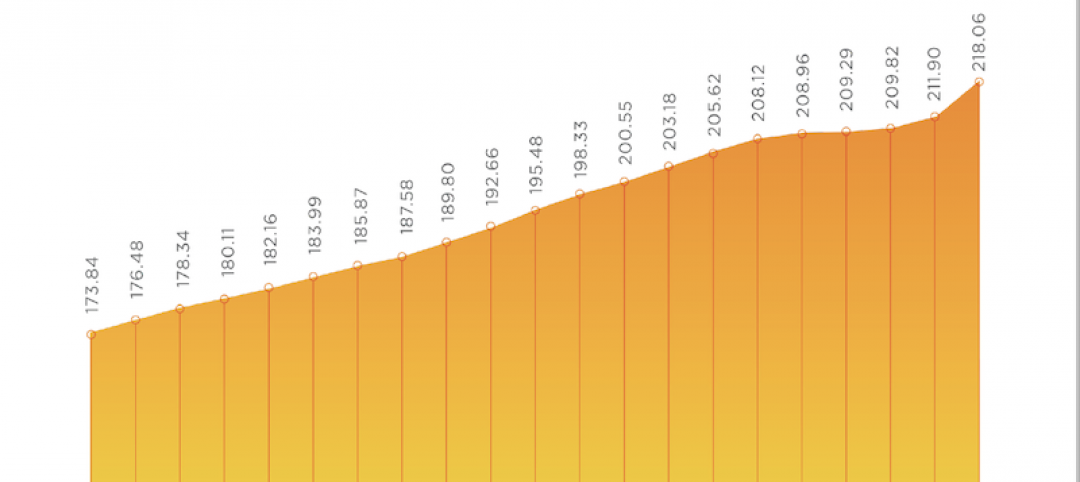

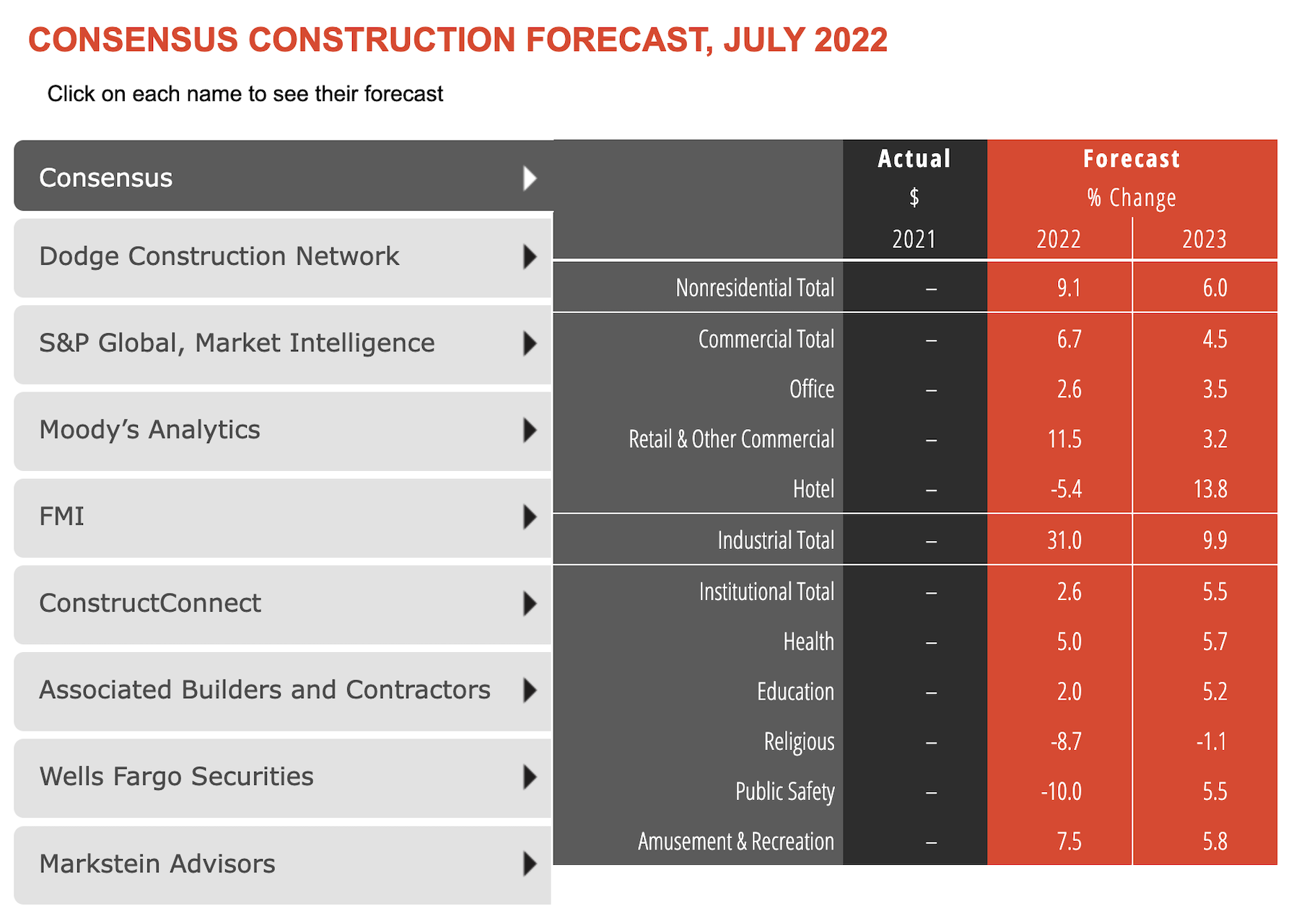

Construction spending on buildings is projected to increase just over nine percent this year and another six percent in 2023, according to a new report from the American Institute of Architects (AIA).

While the outlook for the broader economy has become more uncertain, the prospects for construction spending have improved since the beginning of the year. The outlook from the AIA Consensus Construction Forecast Panel, in its mid-year update, is more optimistic than what was projected at the beginning of the year, largely due to the extremely strong gains in the manufacturing category, as well as surprising strength in retail facilities. The industrial market is expected to pace the building construction upturn this year and next, while the institutional sector is forecast to begin its recovery this year and accelerate moving into 2023.

“The construction industry is not without its own set of challenges,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Supply chain disruptions coupled with general inflation has pushed up inputs to construction by almost 15 percent over the past year. However, challenges to the economy and the construction industry notwithstanding, the outlook for the nonresidential building market appears promising for this year and next.”

Related Stories

Market Data | Jul 15, 2021

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

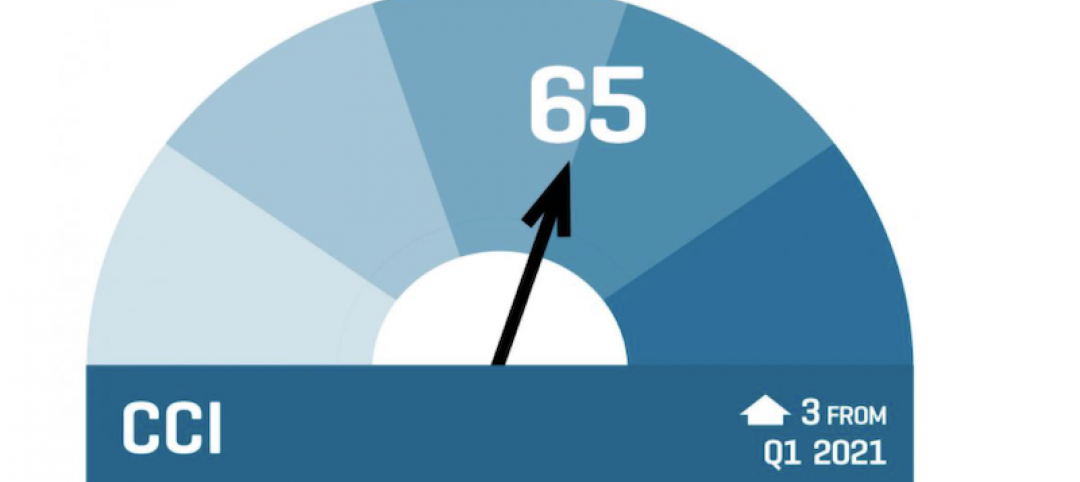

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.

Market Data | Jun 16, 2021

Construction input prices rise 4.6% in May; softwood lumber prices up 154% from a year ago

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span.