Health systems and hospitals acquiring or developing real estate is not new. For years, healthcare providers have been repositioning their portfolio in an effort to minimize cost and reduce risk, particularly in the wake of the Affordable Care Act. The difference in today’s trends is not the size or use of the real estate, but where it is located and the theory behind it’s placement.

NEW TRENDS

In urban and even suburban markets, real estate today is about the "live, work, play" notion. Within residential projects, close proximity to mass transit and other amenities, like groceries or retail stores, makes for a successful development.

According to The Center for Transit Oriented Development, the number of households looking to rent or buy housing within a half mile of fixed-guideway transit stops is expected to reach 14.6M by 2025. Ancillary development of retail and services to support this population will continue to follow.

Healthcare organizations are also evaluating these developments in order to identify a market response, especially in heavily populated urban areas.

Placed next to restaurants and apartment complexes with proximity to public transportation and other quick mart stores such as CVS and Walgreens, healthcare organizations can provide convenient care to the neighborhood in ways the community had not been previously served. The products being put in place within this environment can range from prompt care clinics to larger ambulatory care facilities.

Some recent market examples feature ambulatory care center developments which include services like primary and preventative care, radiology, rehabilitation services, urgent care, and specialists in cardiology, orthopaedics, sports medicine, and women’s health. These centers are increasingly being placed above a walk-up anchor tenant such as a retail pharmacy or other health related retail operation. Together they create a destination that becomes the preferred one-stop shop for healthcare in the community.

This retail and mixed-use model can position a healthcare organization to capture large portions of an area’s growing population, providing a new market for care delivery. Essentially, with this type of development, healthcare has transitioned into another mixed-use retail shop.

Another example of the "live, work, play" strategy is the development of residential townhomes and apartments within close proximity of healthcare campuses. The award-winning Whitehall Community in Bryn Mawr, Pa., fits this product description. The development was the result of a partnership with Main Line Health and created a "village" within walking distance to not only the hospital’s clinical services, but the town’s shops and restaurants. Different than other national developers’ recent projects, the target for these townhomes wasn’t Millennials. Instead, Main Line Health created four-story, luxury homes that feature an elevator option for the community’s aging Baby Boomers wanting an urban feel but convenient access to healthcare.

FINDING THE OPPORTUNITY

Establishing a presence in urban areas, be it through new development or occupying vacant retail space, allows for multiple competitive advantages for regional, super regional and national systems. First, systems are able to capture a market otherwise taken by their competitors, increasing visibility and volumes. With costly emergency room visits, the new patients seek quick, convenient, and competent care at a lower cost than what a traditional ER delivers.

Second, occupying vacant space on Main Street, or in a busy neighborhood, provides the system with speed-to-market and the ability to capture that market share quicker and at a less costly rate. Systems may opt to buy the storefront, or rent, both in less time than new construction would take.

Historically, the retail and banking industries have utilized advanced predictive analytic techniques incorporating market demographic and psychographic datasets for guidance in planning their retail and customer oriented store and branch networks. By combining these proven techniques with rigorous healthcare and patient center datasets and real-time local market intelligence, healthcare organizations can identify optimal opportunities for growth of the business. Utilizing portfolio analytics tools provides the rationalization for service locations as well as predicts the financial impact and overall feasibility of investment decisions.

Healthcare organizations traditionally have not chosen to push the envelope when it comes to real estate development, but the business of healthcare today requires a different approach. In order to identify opportunities and develop an appropriate deal structure, healthcare organizations must have the appropriate tools and expertise to balance the risk. This is being accomplished by a combination of adding expertise in-house and partnering with outside real estate professionals.

CONCLUSION

Health systems desire the cost savings of preventative care and creating more healthy communities. By concentrating efforts at the core of neighborhoods in more urban and populated areas, systems can serve exponentially higher numbers of patients. Branding is a crucial element of this urban-centric outpatient strategy. Without maintaining consistency with the other hospitals, medical office buildings, and even the other outpatient centers, the perception of the system’s presence is lost - visibility is key.

Those hospitals, systems and health care providers taking a proactive, creative approach to real estate acquisition and development will continue to advance the industry in light of reform. We continue to look to these innovators for the pulse of today’s healthcare.

About the Authors

Eric Fisher is Managing Director with Trammell Crow Company. Patrick Duke is Managing Director with CBRE Healthcare.

Related Stories

MFPRO+ News | Jul 22, 2024

6 multifamily WAFX 2024 Prize winners

Over 30 projects tackling global challenges such as climate change, public health, and social inequality have been named winners of the World Architecture Festival’s WAFX Awards.

Office Buildings | Jul 22, 2024

U.S. commercial foreclosures increased 48% in June from last year

The commercial building sector continues to be under financial pressure as foreclosures nationwide increased 48% in June compared to June 2023, according to ATTOM, a real estate data analysis firm.

Codes and Standards | Jul 22, 2024

Tennessee developers can now hire their own building safety inspectors

A new law in Tennessee allows developers to hire their own building inspectors to check for environmental, safety, and construction violations. The law is intended to streamline the building process, particularly in rapidly growing communities.

Codes and Standards | Jul 22, 2024

New FEMA rules include climate change impacts

FEMA’s new rules governing rebuilding after disasters will take into account the impacts of climate change on future flood risk. For decades, the agency has followed a 100-year floodplain standard—an area that has a 1% chance of flooding in a given year.

Construction Costs | Jul 18, 2024

Data center construction costs for 2024

Gordian’s data features more than 100 building models, including computer data centers. These localized models allow architects, engineers, and other preconstruction professionals to quickly and accurately create conceptual estimates for future builds. This table shows a five-year view of costs per square foot for one-story computer data centers.

Sustainability | Jul 18, 2024

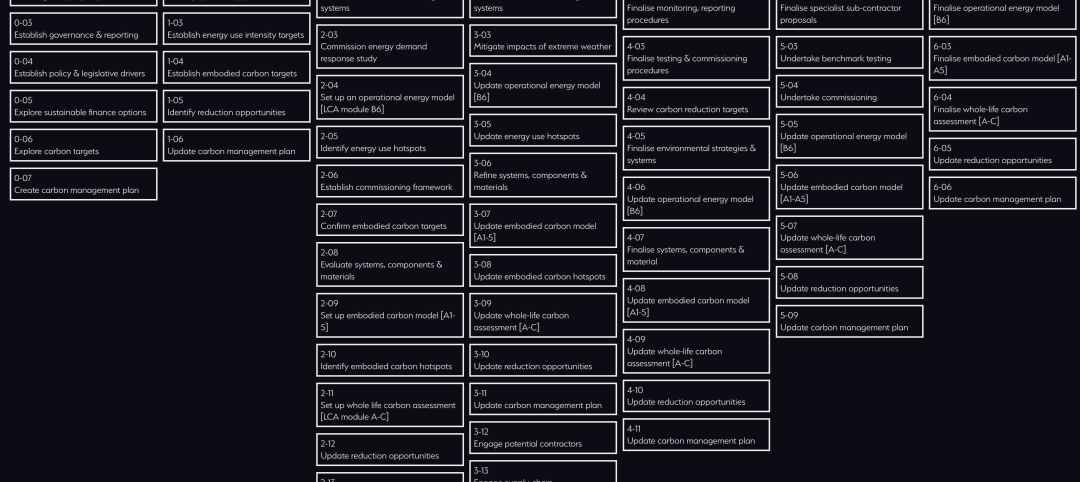

Grimshaw launches free online tool to help accelerate decarbonization of buildings

Minoro, an online platform to help accelerate the decarbonization of buildings, was recently launched by architecture firm Grimshaw, in collaboration with more than 20 supporting organizations including World Business Council for Sustainable Development (WBCSD), RIBA, Architecture 2030, the World Green Building Council (WorldGBC) and several national Green Building Councils from across the globe.

University Buildings | Jul 17, 2024

University of Louisville Student Success Building will be new heart of engineering program

A new Student Success Building will serve as the heart of the newly designed University of Louisville’s J.B. Speed School of Engineering. The 115,000-sf structure will greatly increase lab space and consolidate student services to one location.

Healthcare Facilities | Jul 16, 2024

Watch on-demand: Key Trends in the Healthcare Facilities Market for 2024-2025

Join the Building Design+Construction editorial team for this on-demand webinar on key trends, innovations, and opportunities in the $65 billion U.S. healthcare buildings market. A panel of healthcare design and construction experts present their latest projects, trends, innovations, opportunities, and data/research on key healthcare facilities sub-sectors. A 2024-2025 U.S. healthcare facilities market outlook is also presented.

K-12 Schools | Jul 15, 2024

A Cleveland suburb opens a $31.7 million new middle school and renovated high school

Accommodating 1,283 students in grades 6-12, the Warrensville, Ohio school complex features flexible learning environments and offers programs ranging from culinary arts and firefighting training to e-sports.

MFPRO+ News | Jul 15, 2024

More permits for ADUs than single-family homes issued in San Diego

Popularity of granny flats growing in California