In the third quarter of 2021, analysts at Lodging Econometrics (LE) report that the top five markets with the largest total hotel construction pipelines by projects are: Dallas with 147 projects/17,711 rooms, Atlanta with 139 projects/18,659 rooms, Los Angeles with 133 projects/22,145 rooms, New York City with 130 projects/22,417 rooms, and Houston, with 90 projects/9,225 rooms. These top five markets account for 13% of the projects and 15% of rooms in the total U.S. pipeline.

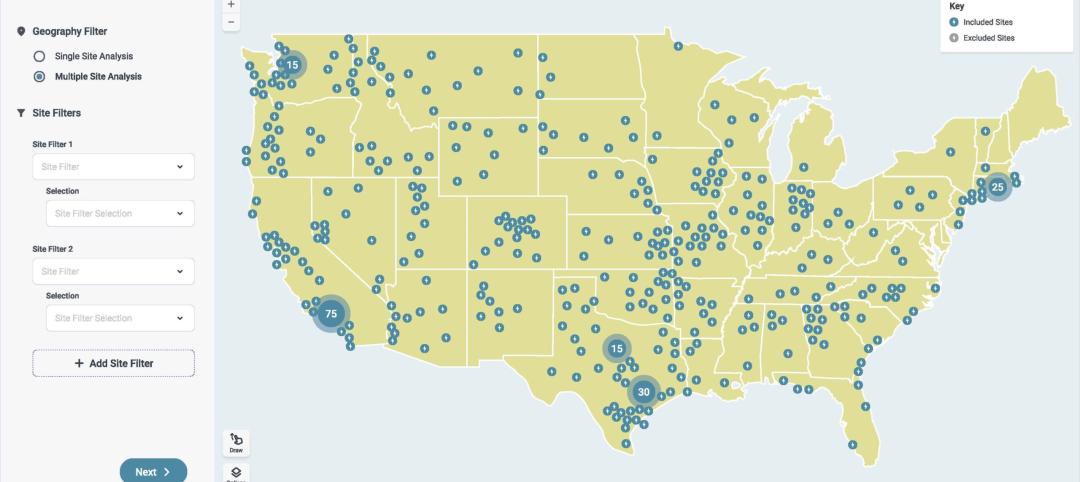

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline. There are currently nine markets in the United States that have 20 or more projects under construction in their pipelines. Markets with the greatest number of projects already in the ground are New York with 95 projects/16,516 rooms, Atlanta with 33 projects/5,311 rooms, Dallas with 31 projects/4,399 rooms, Los Angeles with 30 projects/4,954 rooms, and Austin with 28 projects/3,577 rooms. Atlanta has the greatest number of projects scheduled to start construction in the next 12 months, with 54 projects/7,529 rooms. Dallas follows with 48 projects/5,643 rooms, and then Los Angeles with 47 projects/7,343 rooms, Phoenix with 44 projects/4,834 rooms, and Houston with 42 projects/3,748 rooms. The top five markets with the greatest number of projects in the early planning stage at the end of the third quarter are Dallas with 68 projects/7,669 rooms, Los Angeles with 56 projects/9,848 rooms, Atlanta with 52 projects/5,819, Orlando with 41 projects/7,754 rooms, and Washington D.C. with 40 projects/7,310 rooms.

The increased demand for building materials and shortages in supply, in the wake of the COVID-19 pandemic, has led to higher prices and continues to be major hurdles for contractors, developers, and investors. Nevertheless, in the third quarter, Dallas has the highest number of new projects announced into the pipeline with 18 projects/1,756 rooms. Atlanta follows with 17 projects/1,777 rooms, Phoenix with 10 projects/1,819 rooms, and then Houston with 9 projects/946 rooms.

The renovation and conversion pipeline shows no sign of decline. Presently, there are 1,253 hotels/176,305 rooms under renovation or conversion across the U.S., and twenty-four of the top 50 markets in the U.S. currently have 10 or more hotels undergoing renovation or conversion activity at the end of Q3‘21.

In the first three quarters of 2021, the U.S. opened 665 new hotels with 85,306 rooms. The markets with the highest number of new openings throughout the first three quarters are New York City with 21 hotels/3,554 rooms, Atlanta with 21 hotels/2,925 rooms, Orlando with 19 hotels/2,908 rooms, Houston with 16 hotels/2,166 rooms and Nashville with 16 hotels/2,116 rooms. In Q3, alone, the top 50 markets in the U.S. saw 98 hotels /15,454 rooms open. The U.S. had 189 hotels/25,995 rooms total open in the third quarter.

In 2021, New York City is forecasted to open 51 new hotels and 7,074 rooms, Atlanta follows with 25 hotels/3,499 rooms, then Nashville with 23 hotels/3,011 rooms, Houston with 23 hotels/2,787 rooms, and Orlando with 21 hotels/3,393 rooms. U.S. supply growth is forecasted to be 2.0% in 2021 and is expected to remain the same into 2022.

Related Stories

Products and Materials | Feb 29, 2024

Top building products for February 2024

BD+C Editors break down February's top 15 building products, from custom-engineered glass bridges to washroom accessories.

Designers | Feb 23, 2024

Coverings releases top 2024 tile trends

In celebration of National Tile Day, Coverings, North America's leading tile and stone exhibition, has announced the top 10 tile trends for 2024.

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Hotel Facilities | Jan 22, 2024

U.S. hotel construction is booming, with a record-high 5,964 projects in the pipeline

The hotel construction pipeline hit record project counts at Q4, with the addition of 260 projects and 21,287 rooms over last quarter, according to Lodging Econometrics.

Sponsored | BD+C University Course | Jan 17, 2024

Waterproofing deep foundations for new construction

This continuing education course, by Walter P Moore's Amos Chan, P.E., BECxP, CxA+BE, covers design considerations for below-grade waterproofing for new construction, the types of below-grade systems available, and specific concerns associated with waterproofing deep foundations.

Giants 400 | Jan 2, 2024

Top 80 Hotel Construction Firms for 2023

Suffolk Construction, STO Building Group, PCL Construction Enterprises, AECOM, and Brasfield & Gorrie top BD+C's ranking of the nation's largest hotel and resort general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Jan 2, 2024

Top 70 Hotel Engineering Firms for 2023

Jacobs, EXP, IMEG, Tetra Tech, and Langan top BD+C's ranking of the nation's largest hotel and resort engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Jan 2, 2024

Top 120 Hotel Architecture Firms for 2023

Gensler, WATG, HKS, DLR Group, and HBG Design top BD+C's ranking of the nation's largest hotel and resort architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Engineers | Nov 27, 2023

Kimley-Horn eliminates the guesswork of electric vehicle charger site selection

Private businesses and governments can now choose their new electric vehicle (EV) charger locations with data-driven precision. Kimley-Horn, the national engineering, planning, and design consulting firm, today launched TREDLite EV, a cloud-based tool that helps organizations develop and optimize their EV charger deployment strategies based on the organization’s unique priorities.