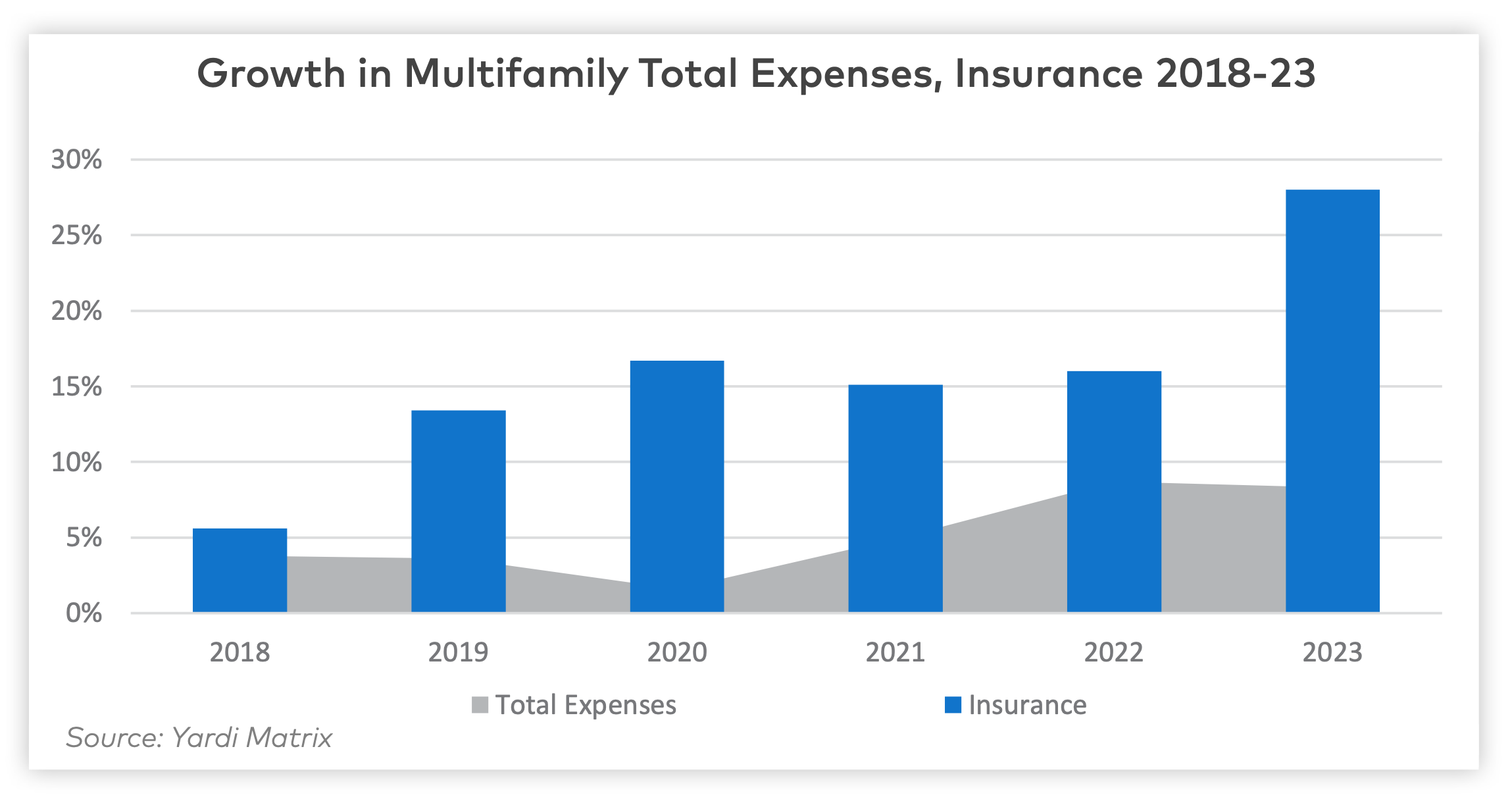

Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.

According to the March 2024 Matrix Research Bulletin for Multifamily Expenses, expense growth for multifamily properties was led by property insurance (up 27.7% YOY), marketing (12.3%), administrative costs (9.6%), and repairs and maintenance (8.8%).

Driven by inflationary pressures, total expenses at multifamily properties have “increased rapidly” in the past two years, peaking at 8.7% in 2022, the report states. This is compared to the average annual expense growth of 4.9% in 2021, 1.6% in 2020, 3.6% in 2019, and 3.8% in 2018.

Multifamily Expenses Rising, Led by Insurance

Insurance costs per unit continue to rise, and have increased 129% nationally since 2018. The current property insurance costs per unit are now at an average of $636.

While property insurance makes up just 7% of total expenses for properties, it's becoming a growing concern especially in the Southeast and other regions prone to severe weather events. In these high-risk areas prone to hurricanes, floods, and fires, obtaining insurance is becoming increasingly difficult.

The study showed that multifamily properties were still profitable in 2023, despite rising expenses. This is because income growth outpaced expenses. On average, gross income per unit increased by $1,056 nationally, while expenses only grew by $593, resulting in a $463 increase in net operating income (NOI).

Yardi Matrix forecasts that asking rents will increase by 1.8% during 2024, and we can expect renewal rent growth will continue to decelerate.

Related Stories

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Industry Research | Apr 25, 2023

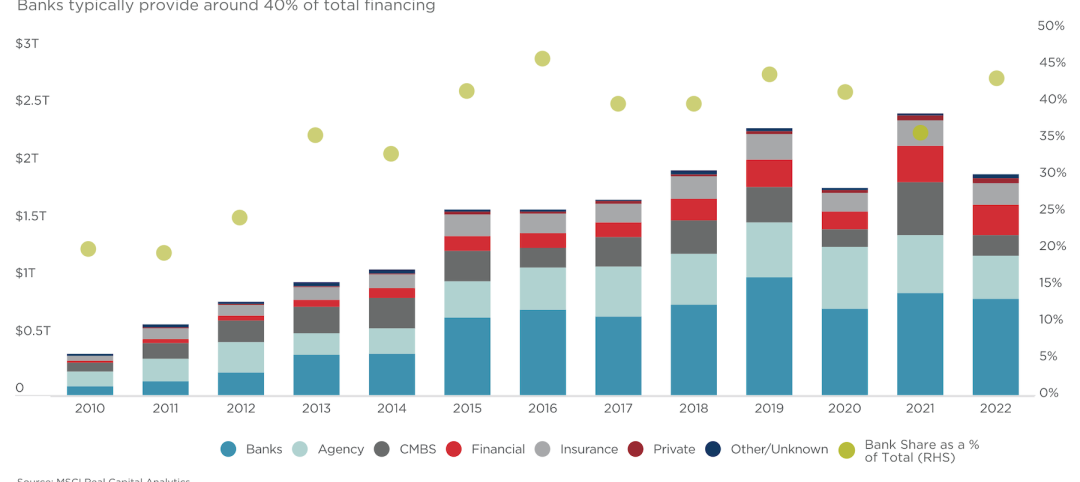

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Self-Storage Facilities | Apr 25, 2023

1 in 5 Americans rent self-storage units, study finds

StorageCafe’s survey of nearly 18,000 people reveals that 21% of Americans are currently using self-storage. The self-storage sector, though not the most glamorous, is essential for those with practical needs for extra space.

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Market Data | Apr 11, 2023

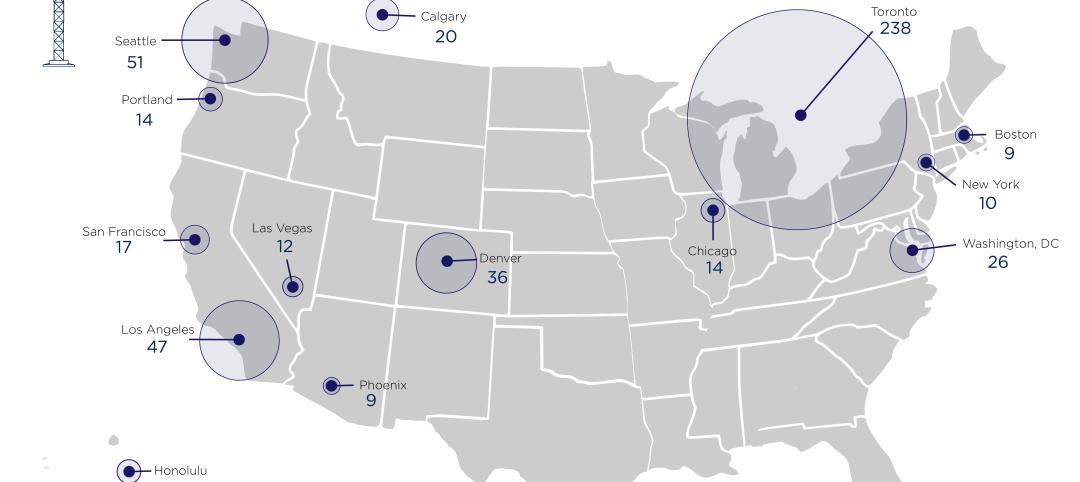

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Multifamily Housing | Apr 4, 2023

Acing your multifamily housing amenities for the modern renter

Eighty-seven percent of residents consider amenities when signing or renewing a lease. Here are three essential amenity areas to focus on, according to market research and trends.