Rising rents and occupancies boosted values across virtually every commercial property sector in 2015, fueling speculation about how hot is too hot when it comes to commercial real estate. While some analysts predict a more modest 2016, the fundamentals of the market remain strong going into the new year, according to some of Chicago’s leading commercial real estate experts, who recently weighed in on the top trends that will drive leasing and development activity in 2016.

1) Off-Price Retail Awakens the Force with Shoppers: Faced with growing competition from online retailers and a broader shift in consumer spending, traditional department stores and apparel retailers are seeking new opportunities in off-price apparel and home products. “While off-price retail is nothing new—it’s the same model TJX and Nordstrom Rack have been using for decades—it became much more popular during the recession, when cost-conscious consumers were looking for discounted luxury items,” said Tim Blum, EVP of Retail Development for HSA Commercial Real Estate.

Macy’s Backstage, Off/Aisle by Kohl's and Find @ Lord & Taylor are just the latest off-price offshoots to enter the market as retailers look for additional revenue sources to offset declining foot traffic at their full-line stores. Indeed, the off-price apparel and footwear market reached almost $45 billion in revenue in 2015, up more than 40% from 2009, according to RBC Capital Markets.

The Mayfair Collection, HSA Commercial’s new retail development in Wauwatosa, Wis., is home to several off-price chains, including T.J. Maxx, Saks Fifth Avenue OFF 5TH and Nordstrom Rack, which now has more locations in the U.S. and Canada than Nordstrom’s full-price stores. And earlier this year, one of the newest off-price concepts, J. Crew Mercantile, chose the Mayfair for its second U.S. location. “As the economy improved, many consumer shopping habits stayed the same, and we’re now seeing that reflected in the tenant mix of retail centers across the country,” said Blum.

2) Class B Becoming Option A for Renters: Rising rents and developers’ continued focus on luxury developments have nudged many renters to seek older Class B communities that offer similar services and amenities as Class A properties, but at a more affordable price. “Nationally, effective rents at B communities are estimated to be nearly 30% below those of A, making them especially appealing to millennials and other cost-conscious renters,” said David Schwartz, Co-founder and CEO of Waterton.

Underscoring the demand for older units is the Class B vacancy rate, which began trending below that of A communities in the first half of 2014, noted Schwartz. While this shift can be partially attributed to the new Class A supply that’s come online, Stephen Rappin, President of Evergreen Real Estate Services, said it’s being driven more by the relative affordability of B communities, along with a lack of new construction in this market segment and increasing demand from younger, more price-sensitive households. “A substantial portion of the rental demand is from millennials moving out of their parents’ house and renting for the first time,” Rappin said. “They may be able to afford Class A rents in a few years, but for now it is out of reach.”

RMK Management Corp. also has seen millennial renters increase at many of its Class B communities. “The reasons for selecting an older property vary, but cost is often the deciding factor,” said Diana Pittro, executive vice president of RMK Management. “By leasing an apartment in an older building, renters can live in neighborhoods they might not otherwise be able to afford. And because many Class B properties are newly renovated, they include features similar to those of newly constructed Class A buildings.”

3) Let’s Get Physical: From indoor climbing gyms and spinning studios to ping-pong clubs and ballet/barre facilities, 2015 saw a rise in new fitness concepts. With land constraints only increasing in urban areas, 2016 should see even more creative exercise options that don’t require acres of space. “Because of their density, many urban neighborhoods lack fitness options beyond a standard gym,” said Mike De Rouin, President of FitzGerald Associates Architects, which recently designed newly built rock-climbing gym First Ascent in Chicago’s Avondale neighborhood and has also worked on adapting several existing buildings in the Chicago area into Blue Paddle Swim Clubs. “Some of these new health concepts are ideal for renovating and reusing vacant big-box retail spaces with flexible floor plans and plenty of parking."

From indoor climbing gyms and spinning studios to ping pong clubs and ballet/barre facilities, 2015 saw a rise in new fitness concepts. Architecture and design firm FitzGerald Associates Architects has seen an uptick in both ground-up development, including its newly designed First Ascent rock-climbing gym in Avondale, and adaptive reuse projects to accommodate new fitness concepts.

From indoor climbing gyms and spinning studios to ping pong clubs and ballet/barre facilities, 2015 saw a rise in new fitness concepts. Architecture and design firm FitzGerald Associates Architects has seen an uptick in both ground-up development, including its newly designed First Ascent rock-climbing gym in Avondale, and adaptive reuse projects to accommodate new fitness concepts.

Also contributing to the proliferation of alternative fitness concepts: their diverse customer base. “A rock-climbing wall appeals to people of all ages, including families who might rent the facility for a party, and baby boomers looking for a new fitness regimen,” said Craig Pryde, Principal at KTGY Architecture + Planning’s Chicago/Midwest office. KTGY recently designed Vertical Endeavors in Glendale Heights, Ill., and expects the fitness market to further expand in 2016. “What’s unique about alternative exercise facilities is that they can operate next door to a traditional health club because they offer different experiences,” said Pryde.

The impact of these new fitness concepts is having a ripple effect in the retail sector. “We’re seeing a growing number of ‘athleisure’ clothing brands coming into retail centers,” said Bill Di Santo, President of national commercial contractor Englewood Construction, which has completed projects for fitness apparel brands Lululemon and Ivivva and has also noted increased construction activity from Athleta and Nike. “These stores are a great addition to the tenant mix because they appeal not only to exercise enthusiasts, but also those who’ve simply embraced the athletic-casual fashiontrend—particularly as office environments have become more casual in their dress codes.”

4) Commercial Tenants Will Get WELL Soon: With more than 69,000 LEED®-certified projects around the world, the green building movement is well underway. But in 2016, certification will be as much about people as the physical environment itself thanks to the WELL Building Standard®, the first benchmarking program to evaluate properties based solely on their ability to promote the health and well-being of their occupants.

“LEED certification is building-focused, while WELL certification is people-focused, so they’re designed to complement each other even though they were created by different entities,” said Allan Skodowski, Director of LEED and Sustainability Services for Transwestern and former chair of the U.S. Green Building Council. “In an office building, WELL encompasses everything from optimal temperature, lighting and noise levels to corporate policies that promote work-life balance.”

While still in its infancy, the program is expected to roll out in a similar fashion to LEED, with office buildings among the first to adopt. “Buildings that have already achieved LEED certification will likely view WELL as the next step in the process rather than viewing it as an either/or decision,” said John Gledhill, a SVP at Transwestern who helps corporate clients match sustainability goals with their real estate objectives.

5) Foreign Investors at Home in the U.S.: The U.S. real estate market will continue to be boosted by foreign investors in 2016, thanks in part to the combination of a strong U.S. dollar and the devaluation of currency in other non-U.S. markets. In fact, as of early December, investors from outside the U.S. had already spent $3.27 billion on Chicago-area real estate, well above the current full-year record of $2.18 billion set in 2013, according to Real Capital Analytics. ”Much of that overseas money, especially Chinese capital, is finding its way from the coasts to Chicago,” said Steven Maher, Managing Broker for Kinzie Real Estate Group.

While China’s interest in U.S. real estate investment is a hot topic, foreign investors from Canada, Norway and Singapore also have shown a high level of activity in the U.S. but have historically flown under the radar, according to Sperry Van Ness | Chicago Commercial. “In our experience, Canadian investors seem to be the most active,” said Michael Thanasouras, Managing Director of SVN. “Not only have we seen a wide variety of private and institutional investors looking at Chicago properties, but a substantial number of deals have closed, particularly in the retail and office asset classes.”

6) Going the Extra Mile for ‘Last-Mile’: With estimated retail e-commerce sales climbing to $87.5 billion in the third quarter—up 15.1% from third-quarter 2014, according to the U.S. Department of Commerce—online retailers are racing to secure urban warehouse space to fulfill a higher volume of orders in a shorter amount of time. “The ‘last mile,’ or final leg of delivery, has become increasingly important as more people shop online,” said John Coleman, EVP and Chicago Industrial Lead at Transwestern. “Delivery times are now measured in minutes and hours rather than days and weeks, which is fueling demand for last-mile warehouses that can facilitate same-day and even next-hour delivery.

Look for E-commerce and short-term delivery services like Amazon Prime Now to have a strong impact on operations in the multifamily sector in 2016. To increase its efficiencies from an operational standpoint, 1000 South Clark in Chicago’s South Loop will feature a state-of-the-art package locker system accessible to both residents and delivery carriers.

Look for E-commerce and short-term delivery services like Amazon Prime Now to have a strong impact on operations in the multifamily sector in 2016. To increase its efficiencies from an operational standpoint, 1000 South Clark in Chicago’s South Loop will feature a state-of-the-art package locker system accessible to both residents and delivery carriers.

“In some cases, these warehouses serve dual purposes: they reduce delivery times for goods that are shipped directly to the customer and accelerate restocking at brick-and-mortar locations fulfilling local orders with store inventory,” Coleman continued.

E-commerce and short-term delivery services like Amazon Prime Now are also impacting operations in the multifamily sector. “At our newest community, 1000 South Clark, we’re installing a state-of-the-art locker system that can be used by building staff and carriers, increasing our efficiencies from an operational standpoint,” said Yale Dieckmann, EVP and Chief Investment Officer of JDL Development.

7) The Retailization of Healthcare: As the healthcare industry continues to adjust to changes brought about by the Affordable Care Act and evolving patient preferences, health systems are taking a page from the retail handbook as they look for ways to deliver the most convenient and cost-effective care to patients. “This convergence between retail and healthcare is evident not just in terms of real estate, but also day-to-day operations as providers think more like retailers with regard to everything from pricing to the overall customer experience,” said John Wilson, President of HSA PrimeCare.

In order to increase patient satisfaction and reduce the cost of their services, health systems are moving more operations off campus to retail centers that are closer to the patient. “Convenience is key, especially when it comes to primary- and urgent-care services, as patients are looking for providers with clinics no more than a 5- or 10-minute drive away,” said Wilson. “In many cases, these clinics are located on end caps or outlots to shopping centers to maximize accessibility for patients.”

The benefits afforded by retail centers, including ample parking and, in many cases, proximity to residential neighborhoods, extend beyond location to visibility. “Being connected with retail areas isn’t simply a matter of access, as healthcare providers also gain brand recognition with traffic from retail customers,” said Pryde of KTGY Architecture + Planning. He adds that some providers are backfilling vacancies left behind by big-box retailers that either downsized or went out of business during the recession. “Structurally, these facilities are ideal for medical office building conversions, as they typically don’t require much demolition, and have plenty of power and height for equipment and expansion,” said Pryde.

8) Everything Old is New Again: As labor and construction costs continue to climb, many developers and owners are forgoing ground-up development, electing instead to adapt and reuse existing commercial buildings, particularly in urban areas where vacant land is in short supply.

According to Pat FitzGerald, Managing Principal of FitzGerald Associates Architects, during a time of limited financing, adaptive reuse is not only more cost-effective than ground-up development, but typically faster. “Adapting and reusing an existing building with an already non-conforming status may also allow a larger building than current zoning permits, and often results in projects with more character than new construction,” says FitzGerald.

VeriGreen Development, an affiliate of Evergreen Real Estate Services, often elects to adapt and reuse existing commercial buildings as a way to secure historic tax credits. “It brings additional resources to the table while garnering support from local stakeholders invested in the preservation of historic buildings that have fallen on hard times,” said Stephen Rappin, who also serves as President of VeriGreen, which is currently converting the former St. Charles Hospital in Aurora, Ill., into mixed-income senior housing.

Related Stories

Mass Timber | Jun 2, 2023

First-of-its-kind shake test concludes mass timber’s seismic resilience

Last month, a 10-story mass timber structure underwent a seismic shake test on the largest shake table in the world.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Industry Research | Apr 25, 2023

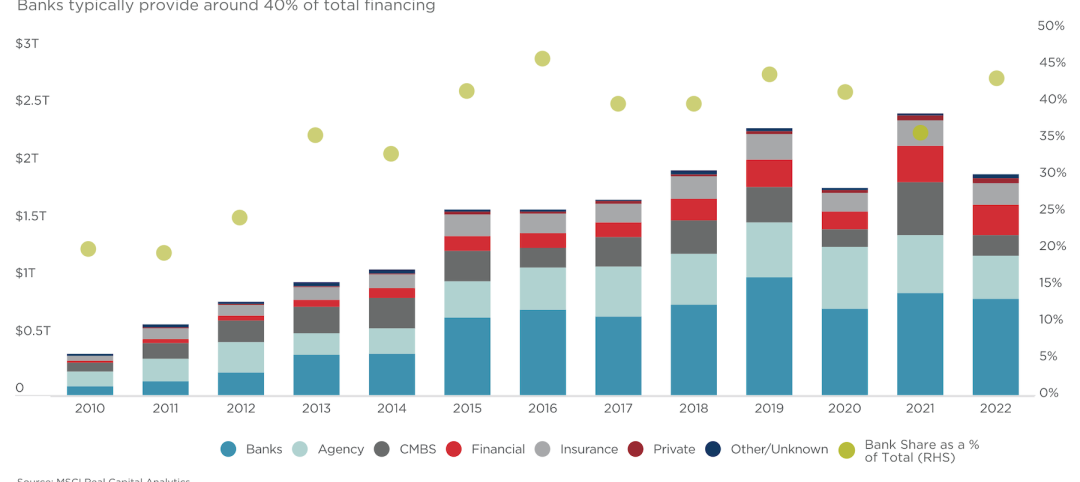

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Self-Storage Facilities | Apr 25, 2023

1 in 5 Americans rent self-storage units, study finds

StorageCafe’s survey of nearly 18,000 people reveals that 21% of Americans are currently using self-storage. The self-storage sector, though not the most glamorous, is essential for those with practical needs for extra space.

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

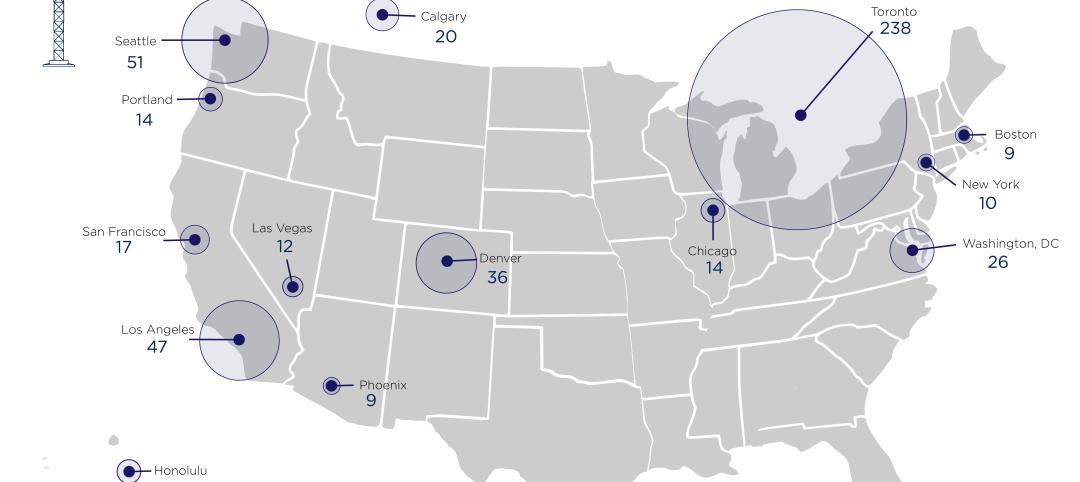

Market Data | Apr 11, 2023

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.