Most contractors expect demand for many types of construction to shrink in 2021 even as the pandemic is prompting many owners to delay or cancel already-planned projects, meaning few firms will hire new workers, according to survey results released today by the Associated General Contractors of America and Sage Construction and Real Estate. The findings are detailed in The Pandemic’s Growing Impacts on the Construction Industry: The 2021 Construction Hiring and Business Outlook Report.

“This is clearly going to be a difficult year for the construction industry,” said Stephen E. Sandherr, the association's chief executive officer. “Demand looks likely to continue shrinking, projects are getting delayed or canceled, productivity is declining, and few firms plan to expand their headcount.”

The percentage of respondents who expect a market segment to contract exceeds the percentage who expect it to expand – known as the net reading – in 13 of the 16 categories of projects included in the survey. Contractors are most pessimistic about the market for retail construction, which has a net reading of negative 64%. They are similarly concerned about the markets for lodging and private office construction, which both have a net reading of negative 58%.

Other construction categories with a high negative net reading include higher education construction, which has a net reading of negative 40%; public buildings, with a net negative of 38%, and K-12 school construction which has a net reading of negative 27%. Among the three market segments with a positive net reading, two – warehouse construction (+4%) and the construction of clinics, testing facilities and medical labs (+11%) – track closely with the few segments of the economy to benefit from the impacts of the coronavirus.

Firms report that many of their already-scheduled projects have either been delayed or canceled. Fifty-nine percent of firms report they had projects scheduled to start in 2020 that have been postponed until 2021. Forty-four percent report they had projects canceled in 2020 that have not been rescheduled. Eighteen percent of firms report that projects scheduled to start between January and June 2021 have been delayed. And 8% report projects scheduled to start in that time frame have been canceled.

Few firms expect the industry will recover to pre-pandemic levels soon. Only one-third of firms report business has already matched or exceeded year-ago levels, while 12% of firms expect demand to return to pre-pandemic levels within the next six months. Fifty-five percent report they either do not expect their firms’ volume of business to return to pre-pandemic levels for more than six months or they are unsure when their businesses will recover.

Only 35% of firms report they plan to add staff this year. Meanwhile, 24% plan to decrease their headcount in 2021 and 41 percent expect to make no changes in staff size. Firms do vary by region in their hiring outlook. In the South, the percentage of firms that expect to add employees – 39 percent – is more than double the percentage that expect to reduce headcount – 17 percent. The outlook among firms in the Northeast is nearly opposite: fewer than one-quarter of respondents expect to increase their headcount in 2021 while 41 percent foresee a reduction.

Despite the low hiring expectations, most contractors report it remains difficult to fill some or all open positions. Fifty-four percent of firms report difficulty finding qualified workers to hire, either to expand headcount or replace departing staff. And 49% expect it will either get harder, or remain as hard, to find qualified workers in 2021.

“The unfortunate fact is too few of the newly unemployed are considering construction careers, despite the high pay and significant opportunities for advancement,” said Ken Simonson, the association's chief economist. “The pandemic is also undermining construction productivity as contractors make significant changes to project staffing to protect workers and communities from the virus.”

Simonson noted that 64% of contractors report their new coronavirus procedures mean projects are taking longer to complete than originally anticipated. And 54% of firms report that the cost of completing projects has been higher than expected.

Officials with Sage noted that firms are being more strategic about information technology as they try to remain competitive in the current environment. Sixty-two percent of contractors indicate they currently have a formal IT plan that supports business objectives, up from 48% last year. An additional 7% plan to create a formal plan in 2021.

“While the past year has been filled with many challenges, technology has played an integral role in keeping people connected and businesses up and running,” said Dustin Anderson, vice president of Sage Construction and Real Estate. “While many firms have had to scale back other investments, technology remains an important part of most business plans as we move into the new year.”

Anderson added that most firms plan to keep their technology investment about the same as last year. When asked whether they planned to increase or decrease investment or stay the same in 15 different types of technologies, the majority of respondents – ranging between 71 and 89% – said their investments would remain the same as last year.

“The outlook for the industry could improve, however, if federal officials are able to boost investments in infrastructure, backfill state and local construction budgets and avoid the temptation to impose costly new regulatory barriers,” Sandherr said “But even as we work to advocate for measures to rebuild demand for construction, we also need to take longer-term steps to continue developing the construction workforce.”

Association officials noted with traffic still below pre-pandemic levels and a large pool of workers available, now is an ideal time to improve highways, repair transit systems, upgrade airports, modernize waterways and otherwise improve other types of public works. They added that one of the lessons from the late 2000s is that boosting federal infrastructure investments without backfilling state and local construction budgets is counterproductive. And that Congress and the incoming administration need to appreciate the risks of imposing burdensome new regulatory measures on an already-crippled economy.

Sandherr said the association is addressing the workforce challenge by crafting a new plan that focuses on continued advocacy, helping chapters and members establish or improve training programs and launching a new, national workforce recruiting effort. This new effort, “Construction is Essential,” will use targeted digital advertising to complement and build on the many existing local and regional construction workforce campaigns already in place.

“Our objective is to make sure contractors end the year on a far better note than many are starting it,” Sandherr said.

The Outlook was based on survey results from more than 1,300 firms from all 50 states and the District of Columbia. Varying numbers responded to each question. Contractors of every size answered over 20 questions about their hiring, workforce, business and information technology plans. Click here for The Pandemic’s Growing Impacts on the Construction Industry: The 2021 Construction Hiring and Business Outlook Report. Click here for the survey results. Click here for a brief video summarizing the findings.

Related Stories

Apartments | Aug 22, 2023

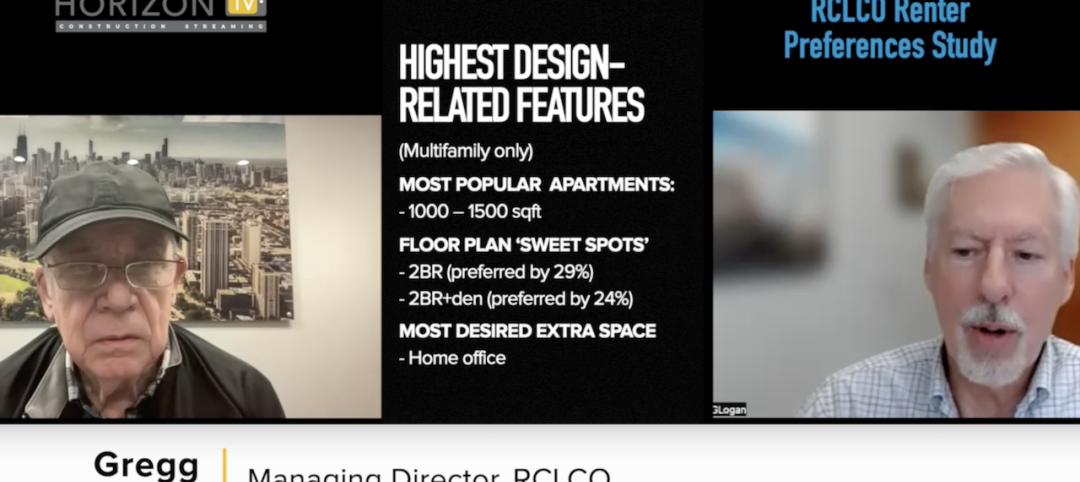

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

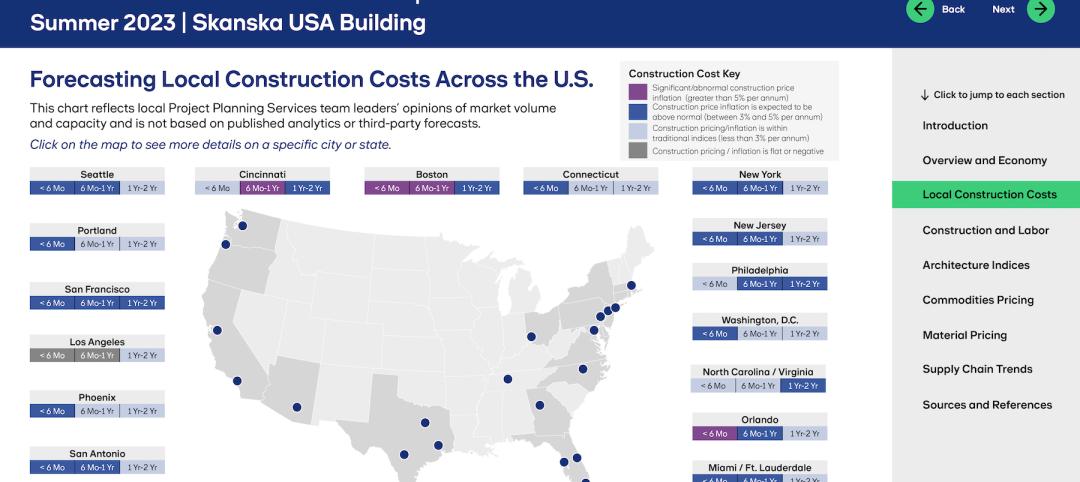

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.