The overall economy, as well as the economy in which they do business, might be down, but contractor panelists who provided these insights still see nonresidential construction on the upswing, according to FMI’s Second Quarter Nonresidential Construction Index (NRCI) Report.

Raleigh, N.C.-based FMI provides management consulting, investment banking, and people development services. Its quarterly index is based on voluntary responses from panelists to a 10-minute survey. The respondents represent a fairly wide cross-section of trades, company sizes, and markets. About 15% of the respondents are national contractors, 56% are Commercial General Building Contractors, and 39% operate businesses that generate between $51 million and $200 million in annual revenue. FMI declined to provide the number of panelists surveyed.

Chart: FMI

Chart: FMI

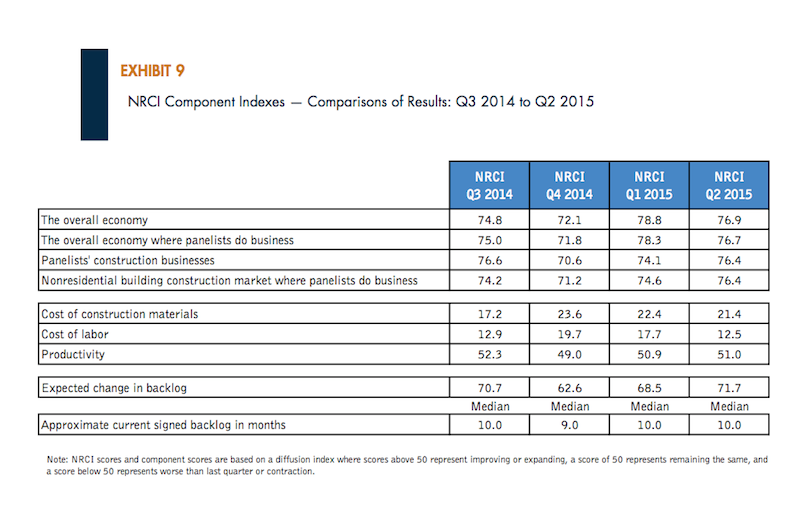

The NRCI for the second quarter was 64.9, virtually unchanged from the first quarter but improved from the 62.8 Index in the second quarter of 2014. FMI states that scores above 50 indicate expansion.

The panelists’ business outlook for specific nonresidential sectors is more ambivalent, however. Indices for healthcare and office construction are up, compared to a year ago, but down (albeit still on the growth side) for education, lodging, and manufacturing.

These scores might reflect the panelists’ perceptions of a still-volatile overall economy, whose second-quarter Index of 76.9 is down from the 78.8 Index in the first quarter. The panelists report that their own markets’ economies are off, too.

On the other hand, the panelists report improving productivity and steady backlogs. Half of the panelists said that their second-quarter backlogs grew faster than the previous quarter.

The indices for costs of materials and labor are down from the previous quarterly and yearly measurements, meaning those costs are rising. The NRCI Index for Construction Materials stood at 21.4, and 58.1% of the panelists said their materials costs increased from the first quarter. The Labor Cost Index was at 12.5, with 75% of the panelists reporting that their labor costs were higher in the second quarter than the first.

Chart: FMI

Chart: FMI

The survey also found that:

• Green construction made up only 28.6 percent of the panelists’ second-quarter backlogs, on average. FMI concludes from this finding that contractors no longer see green as anything special because it has become engrained into the mainstream of their businesses.

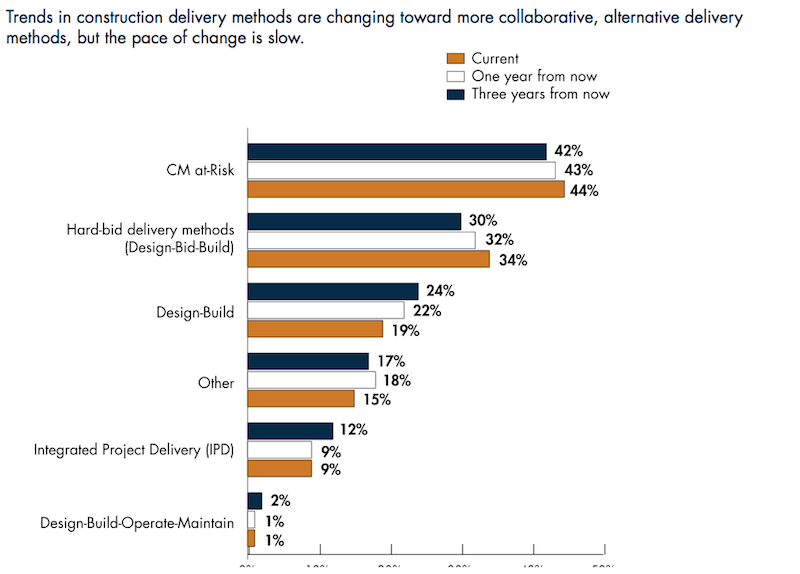

• The expediency of certain delivery methods during the recession is slowly yielding to more collaborative approaches among Building Teams and owners. “CM at-Risk is now allowed by most states, but those building CM at-Risk projects won’t quickly move to IPD [integrated project delivery].” FMI writes. “Design-build and IPD are expected to be growth areas for delivery methods; but IPD in particular, even though it offers many benefits to all parties, is not for everyone at this time. IPD, and even what has been called IPDish, requires more sophisticated owners, designers and contractors in order to realize the full benefits of this delivery approach.”

• Based on the panelists’ responses, FMI notes that other trends in construction—such as prefabrication, modularization, use of robotics, and 3D printing—are also likely to take a longer time to become mainstream like green construction has. “But the ongoing shortages of skilled labor will certainly hasten their coming.”

Related Stories

Adaptive Reuse | Apr 15, 2021

The Weekly Show, Apr 15, 2021: The ins and outs of adaptive reuse, and sensors for real-time construction monitoring

This week on The Weekly show, BD+C editors speak with AEC industry leaders from PBDW Architects and Wohlsen Construction about what makes adaptive reuse projects successful, and sensors for real-time monitoring of concrete construction.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Multifamily Housing | Mar 30, 2021

Bipartisan ‘YIMBY’ bill would provide $1.5B in grants to spur new housing

Resources for local leaders to overcome obstacles such as density-unfriendly or discriminatory zoning.

Office Buildings | Mar 26, 2021

Finding success for downtown office space after COVID-19

Using the right planning tools can spur new uses for Class B and C commercial real estate.

Architects | Mar 25, 2021

The Weekly Show, March 25, 2021: The Just Label for AEC firms, and Perkins Eastman's Well-Platinum design studio

This week on The Weekly show, BD+C editors speak with AEC industry leaders about the Just Label from the International Living Future Institute, and the features and amenities at Perkins Eastman's Well Platinum-certified design studio.

Contractors | Mar 16, 2021

Autodesk U.S. Construction Outlook 2021 report finds commercial bidding activity has surpassed pre-pandemic levels

Despite forecasted drop in non-residential spending for 2021, real-time bidding data from BuildingConnected suggests short-term relief is en route as delayed or rescheduled projects come back online.

Coronavirus | Mar 11, 2021

The Weekly show, March 11, 2021: 5 building products for COVID-related conditions, and AI for MEP design

This week on The Weekly show, BD+C editors speak with AEC industry leaders about building products and systems that support COVID-related conditions, and an AI tool that automates the design of MEP systems.

Laboratories | Mar 10, 2021

8 tips for converting office space to life sciences labs

Creating a successful life sciences facility within the shell of a former office building can be much like that old “square peg round hole” paradigm. Two experts offer important advice.

Contractors | Mar 10, 2021

AGC: House votes in favor of idling workers, stripping their privacy and denying them the opportunity to establish businesses

Democrats' vote in favor of the PRO Act will hurt workers and undermine the economic recovery, top construction industry official says.