The International Code Council conducted a follow up survey of building and fire departments to learn how code officials are coping with the professional challenges brought on by the COVID-19 pandemic. From August 11 through September 3, 2020, more than 800 respondents from all 50 U.S. states and the District of Columbia provided input. Respondents came from states as well as and local jurisdictions that range in size from 700 people to 4 million.

This survey builds on the results of a prior survey, undertaken in April when states were beginning to issue stay-at-home orders, to determine how departments have responded in the interim and how they are keeping up with new building permits and new construction during the pandemic months.

The results underscore the importance of additional federal resources for code departments. Although the U.S. Department of Homeland Security has determined the work of building and fire prevention departments to be essential to the nation’s response to the coronavirus pandemic—and no state has made a contrary determination—about half of survey respondents did not have the capability to remotely carry out critical aspects of their work. That’s an improvement from 6 in 10 in April, but still unacceptable given code departments’ vital role in communities' pandemic response, resilience, economic recovery and long-term success.

With many state and local governments facing severe revenue downturns resulting from the coronavirus pandemic, more than 4 in 10 respondents reported budget cuts this year, while a little less than half are expecting budget cuts next year. Only 1 in 10 respondents were able to access the $150 billion Coronavirus Relief Fund (CRF) that the federal Coronavirus Aid, Relief, and Economic Security Act (CARES Act, H.R. 748), provided to aid state, local, tribal, and territorial governments in response to this public health emergency.

Nearly all departments surveyed are performing inspections (98% now versus 93% in April) while nearly half still have key staff working remotely (47% now versus 66% in April). The results show small improvements in e-permitting (28% lacking that capability now versus 30% in April) and plan review capabilities (39% lacking that capability now versus 41% in April), with greater improvements in access to code materials (16% lacking access now versus 25% in April) and remote virtual inspections (50% lacking that capability now versus 61% in April). Local laws and departmental practices can restrict the use of virtual capabilities. Of the respondents that did not have e-permitting capability, or that had software that did not address all aspects of e-permitting, a little less than half pointed to policies that prohibit implementation of a more comprehensive solution with just less than 4 in 10 pointing to a requirement for submittal of hard copy plans.

“The results of this survey show how, in less five months, the Code Council’s governmental members have worked to ensure their departments can continue to protect public safety and spur economic activity in a virtual work environment,” said Code Council Chief Executive Officer Dominic Sims, CBO. “But too many departments have outstanding needs. It’s critical that sufficient resources to support building and fire prevention departments are provided by state and local governments through existing CARES Act funds and by the federal government through any subsequent economic stimulus package.”

In the coming weeks, the Code Council will produce a more detailed report on the survey’s findings, summarizing recommended best practices for remote work and policy considerations to facilitate the implementation of virtual solutions.

Related Stories

Senior Living Design | May 9, 2017

Designing for a future of limited mobility

There is an accessibility challenge facing the U.S. An estimated 1 in 5 people will be aged 65 or older by 2040.

Industry Research | May 4, 2017

How your AEC firm can go from the shortlist to winning new business

Here are four key lessons to help you close more business.

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.

Market Data | May 2, 2017

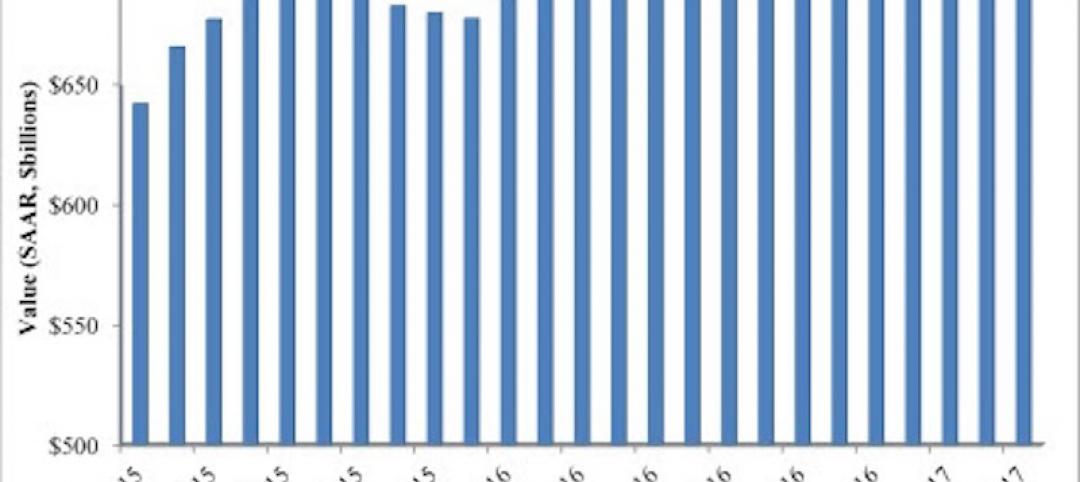

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

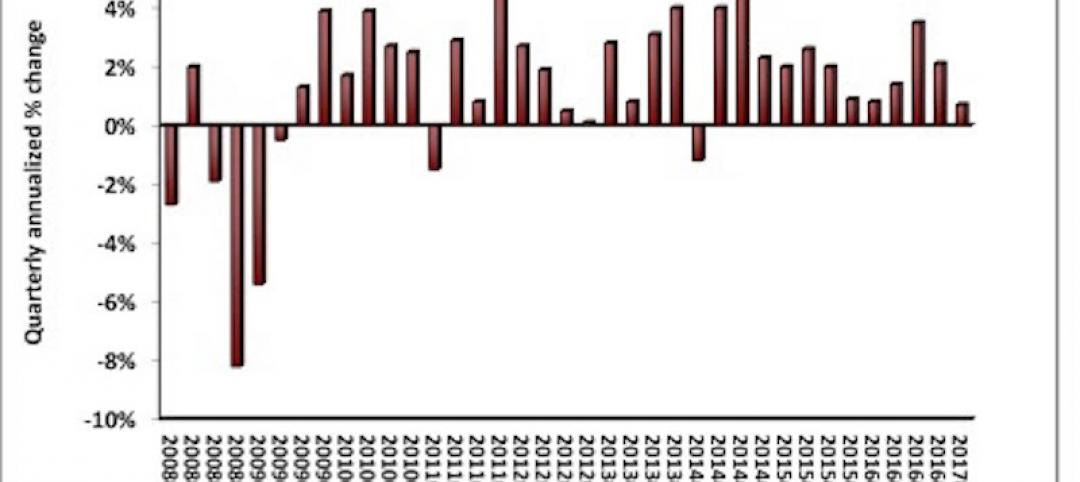

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

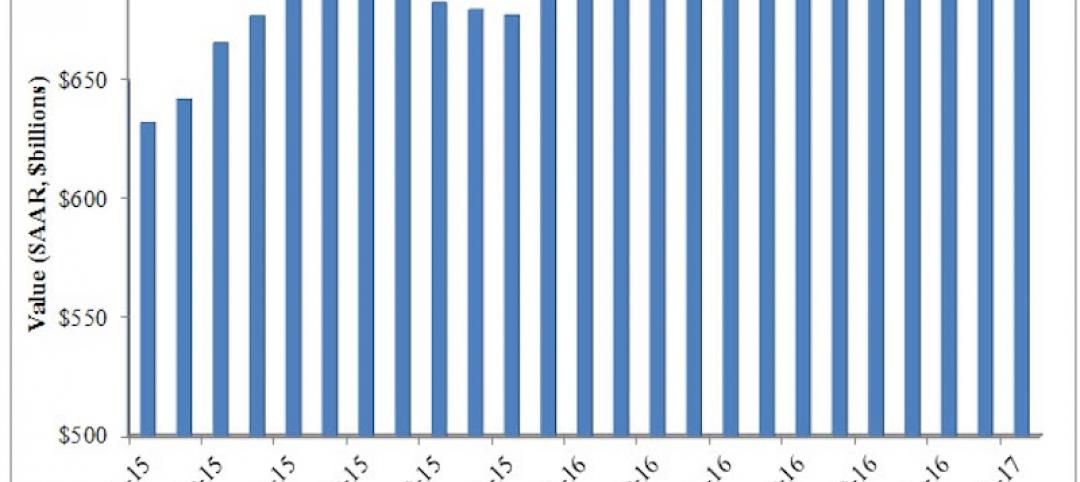

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.