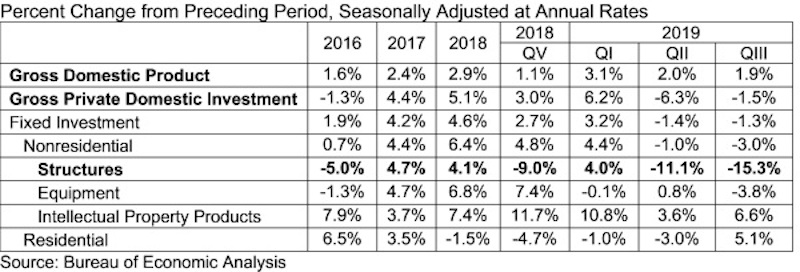

The U.S. economy expanded at an annualized rate of 1.9% in the third quarter of 2019 despite contracting levels of nonresidential investment, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Economic Analysis. Nonresidential fixed investment declined at a 3% annual rate in the third quarter after declining at a 1% rate in the second quarter.

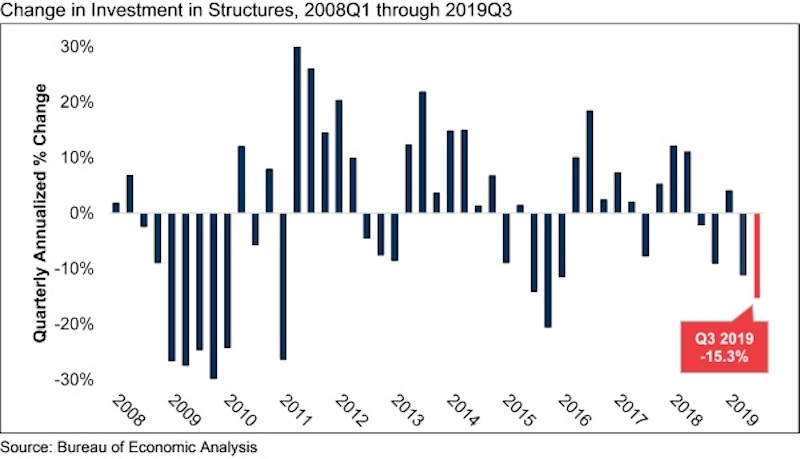

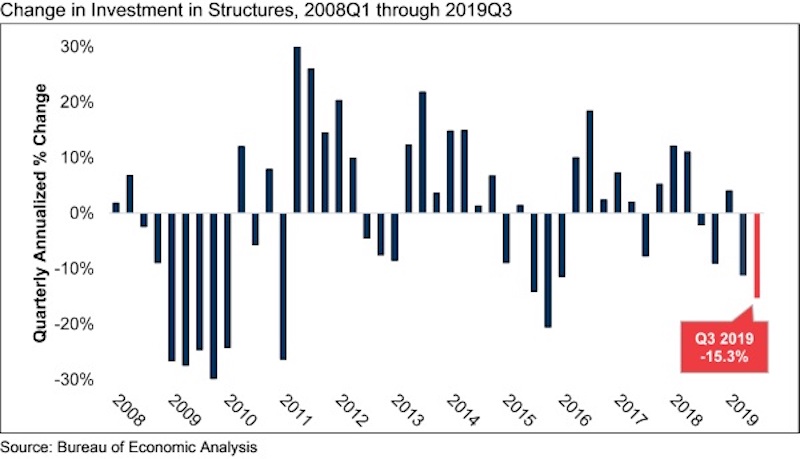

The annual rate for nonresidential fixed investment in structures, a component closely tied to construction, declined 15.3% in the third quarter. Investment in structures has now contracted in four of the previous five quarters, including an 11.1% decline in the second quarter of 2019.

“Today’s report reinforced a number of observations regarding the U.S. economy and the nation’s nonresidential construction sector,” said ABC Chief Economist Anirban Basu. “First, the economy is slowing. While consumer spending and government outlays remain elevated, gross private domestic investment continues to slip, this time by 1.5% on an annualized basis in the third quarter. While this is less than the 6.3% decline registered during the second quarter, the key takeaway is that the current economic expansion is narrowing, increasingly fueled by consumers and public agencies taking on additional debt.

“Second, certain segments of nonresidential construction continue to soften,” said Basu. “Recent data regarding nonresidential construction spending indicate weaker spending in categories such as office and lodging. This was reflected in today’s GDP report, which indicated that spending on structures contracted significantly during the third quarter. For the most part, nonresidential construction spending growth continues to be driven by public construction, including in categories such as water supply and public safety.

“The primary question now is whether the slowdown in economic activity will persist into 2020,” said Basu. “Many factors suggest it will, including a weakening global economy, a U.S. manufacturing sector that is arguably already in recession, vulnerability attributable to massive accumulations of public, corporate and household debt and the uncertain outcomes attached to ongoing trade negotiations. On the other hand, U.S. equity markets have continued to surge higher in the context of better-than-expected corporate earnings and ongoing accommodation by the Federal Reserve. Put it all together and the outlook for the U.S. economy has seldom been more uncertain, especially given next year’s elections.

Related Stories

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Market Data | May 18, 2021

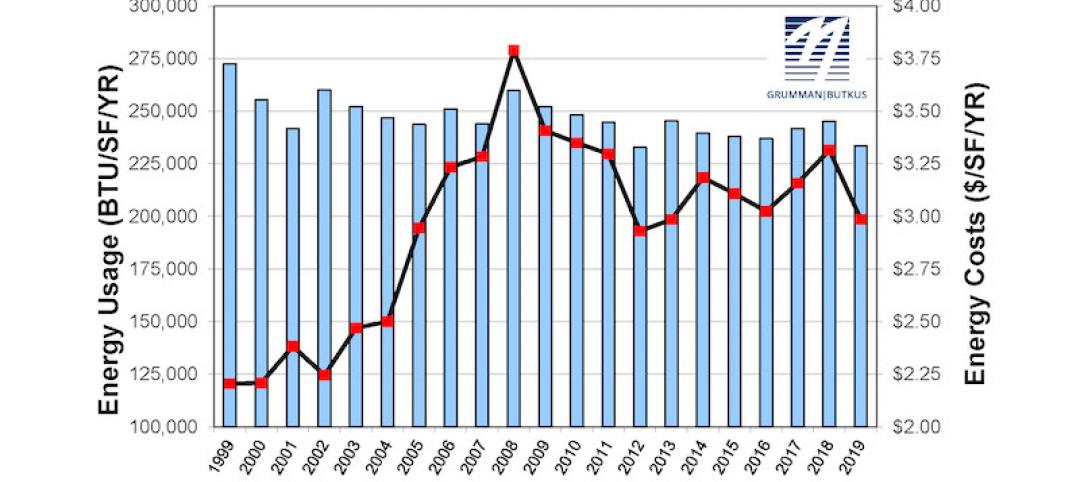

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | May 13, 2021

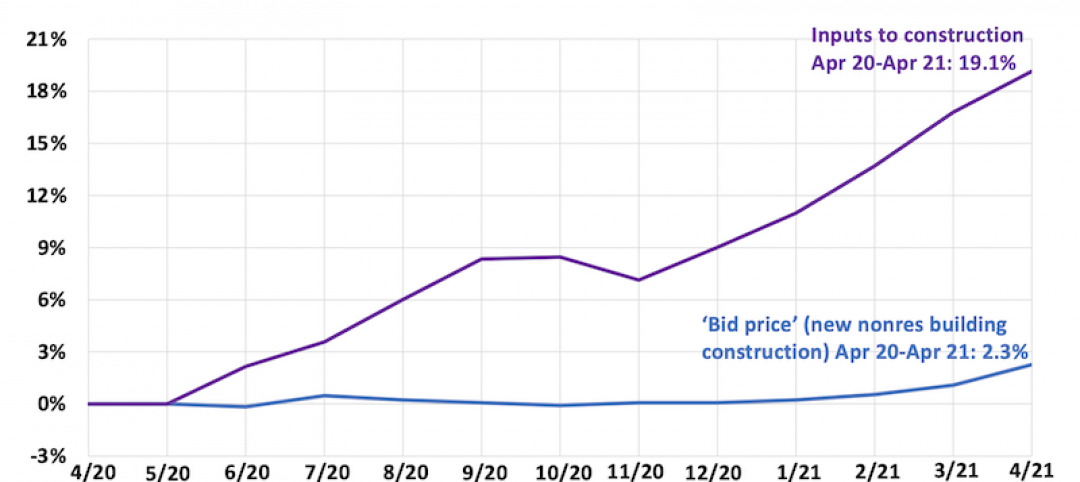

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

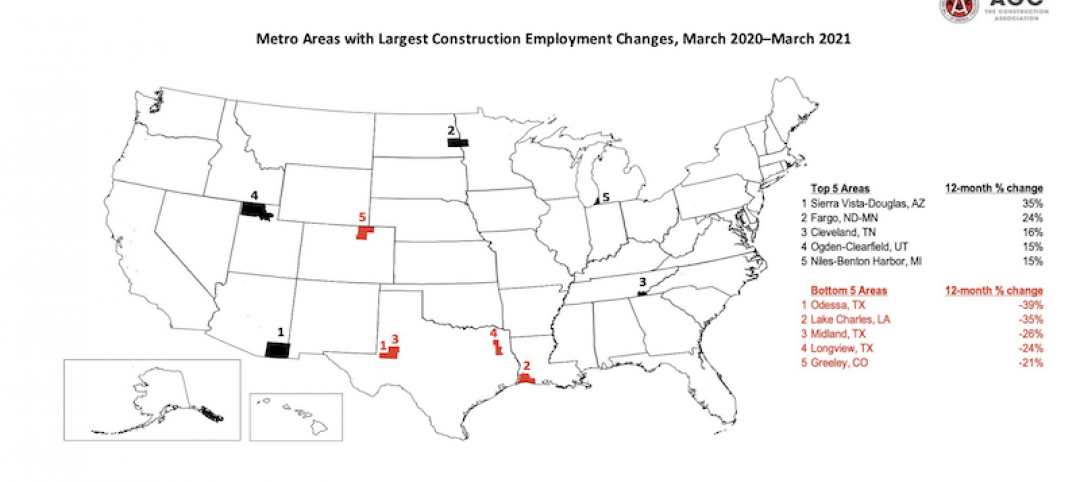

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.