Most construction disputes are settled before they erupt into migraine-inducing litigation. But global asset volatility, currency turbulence, and the loss of economic momentum globally, have made dispute resolution tougher to reach amicably. And, in fact, for the third consecutive year, the length of disputes rose in 2015, according to a new report by Arcadis, the international design and consultancy firm, based on an in-depth review of projects that the firm’s Contract Solutions team handled last year.

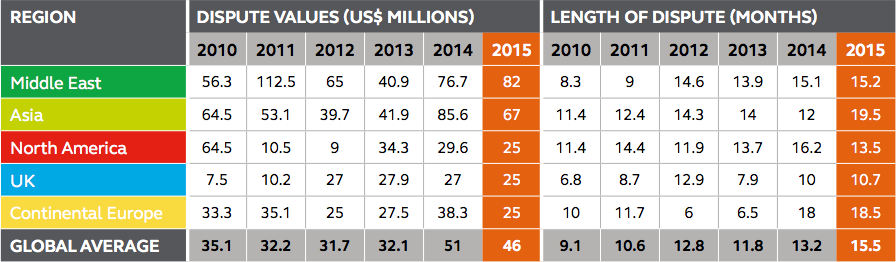

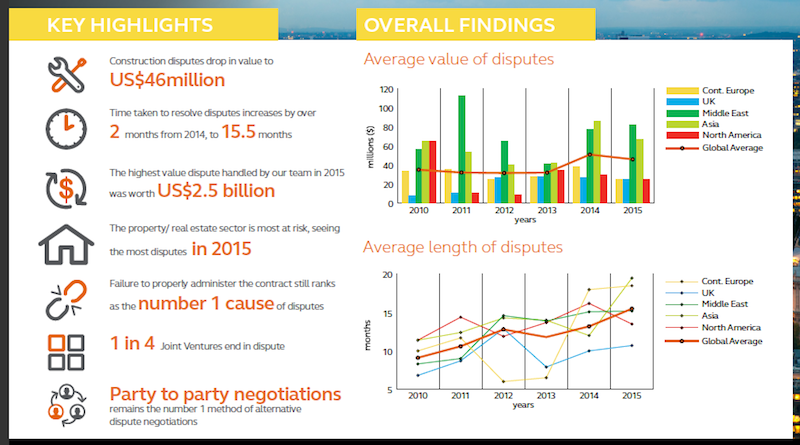

Arcadis, which is active in 70 countries, defines a dispute as a “situation where two parties typically differ in the assertion of a contractual right.” Last year, the value of disputes fell by nearly 11% to an average of $46 million. However, the length of time it took to resolve these conflicts increased to a record average of 15.2 months, compared to 13.2 months in 2014 and 11.8 months in 2013.

The highest value dispute that Arcadis handled last year was worth a whopping $2.5 billion. (The firm did not state where that dispute arose.)

Contractual disputes took longer to mediate for the third consecutive year in 2015. The No. 1 cause for disputes continues to be faulty contract administration. Image: Arcadis “Global Construction Dispute Report 2016.”

Contractual disputes took longer to mediate for the third consecutive year in 2015. The No. 1 cause for disputes continues to be faulty contract administration. Image: Arcadis “Global Construction Dispute Report 2016.”

“The increased length of disputes will have multiple effects for both parties and are likely to, ultimately, have a negative impact on the construction industry,” Arcadis cautions in its report.

The No. 1 cause for disputes was failure to properly administer a contract, followed by a poorly written draft and unsubstantiated claims. The property/real estate sector had the most disputes, followed by the social infrastructure/public sector. Arcadis notes, ruefully, that more than one-quarter of joint ventures end in disputes.

Party-to-party negotiation is still the most common form of resolving disputes. And the best ways to avoid disputes in the first place is to make sure the contract is administered properly, the documents are accurate, and the contract has fair and appropriate risk and balances.

While the number of disputes in North America was up last year, their average values and lengths dipped. The value of disputes last year averaged $25 million, a 15.5% drop from the previous year. And the length of disputes in North America was down by nearly three months, to an average of 13.5 months compared to 16.2 in 2014.

Arcadis notes that the U.S. was the only global region to achieve both a decrease in construction dispute values and length of time to resolve disputes last year. “But there is one downside,” notes Roy Cooper, a Vice President for Arcadis North America. “Even though more disputes are being settled early, the ones that remain grow into complicated, emotional affairs, with large damages at stake. These also take longer to resolve, since U.S. courts hate to try construction cases due to their large volumes of documents and greater complexity.”

In North America, errors and omissions in contracts documents are the most common reasons for disputes.

“We expect that the decline in duration and value will continue into 2016 as the industry [in North America] continues to recognize the importance of addressing disputes early in their lifecycle, and contracts are written with provisions giving strict instruction on how and when to address disputes,” writes Arcadis.

Conversely, the Middle East now surpasses Asia as Dispute Central when it comes to contractual disagreements. The average dispute value in that region jumped by 6.9% last year to $82 million, and the length of disputes rose marginally to an average of 15.2 months.

Disputes drag out even longer in Continental Europe, which averaged 18.5 months last year. “Conflicting party interests” was cited by Arcadis as the No. 1 cause for disputes.

Joint ventures are most vulnerable to contract disputes. And the Middle East far exceeds global averages in the value and lenght of its construction disputes. Image: Arcadis “Global Construction Dispute Report 2016.”

Related Stories

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Architects | Feb 21, 2024

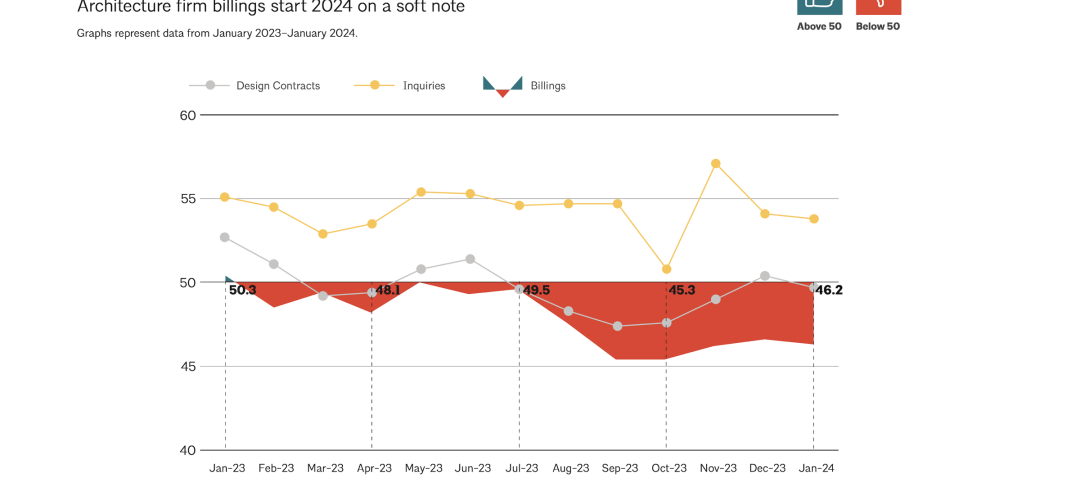

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.