The deterioration in construction output growth across emerging markets has been worse than previously expected, particularly in the US and the Middle East. Therefore, the forecast for global construction output growth in 2019 has been revised down to 2.7%, which will be the slowest pace of growth in a decade, according to GlobalData, a leading data and analytics company.

GlobalData’s central forecast sees global construction output growth increase to 3.2% in 2020 and then stabilize at 3.4% over the remainder of the forecast period, which runs to 2023. According to the company’s latest report, ‘Global Construction Outlook to 2023 – Q3 2019 Update’, this is partly driven by a projected improvement in the global economy in 2020, which in turn relies on improvements in financial market sentiment and stabilization in some of the larger currently-troubled emerging markets.

Danny Richards, Lead Economist at GlobalData, comments: “Some major advanced economies have struggled to generate growth momentum, including the US, the UK and Australia. In China, where the authorities are stepping up investment in infrastructure to prevent a continued slowdown, growth will remain positive, contributing to a slight acceleration in growth in total output in the emerging markets.”

Richards continues: “Geopolitical risks are intensifying, which could potentially undermine investor confidence and disrupt capital flows in the early part of the forecast period. Risks to the overall forecast stem primarily from a possible escalation in the trade war between the US and China, as well as inflamed tensions between the US and Iran following the recent drone strikes on Saudi Arabia’s largest oil processing center, which were blamed on Iran.

“The emerging markets of South-East Asia will invest heavily in new infrastructure projects, supported by private investment, and this region will be the fastest growing, expanding by 6.4% between 2019 and 2023.”

Information based on GlobalData’s report: ‘Global Construction Outlook to 2023 – Q3 2019 Update.

Related Stories

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.

Market Data | Mar 26, 2024

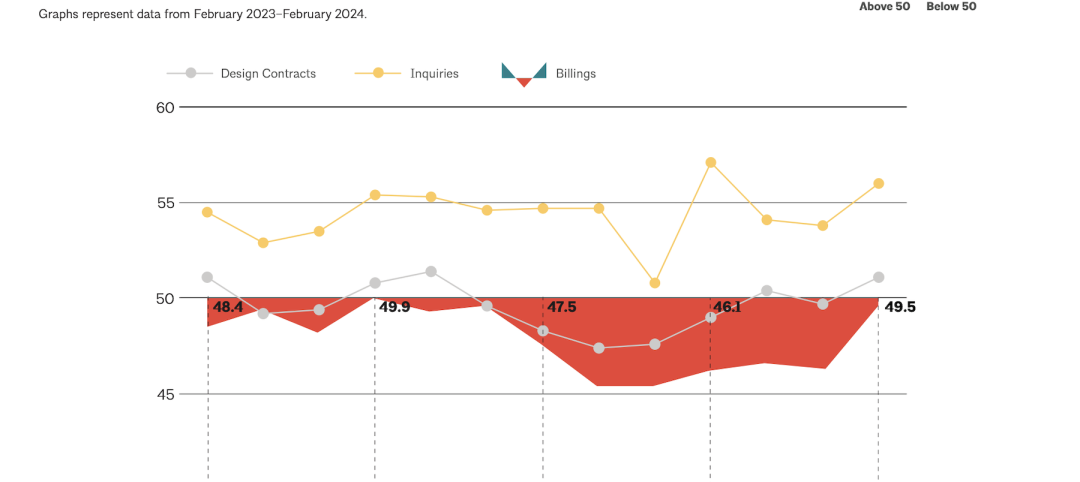

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Contractors | Mar 12, 2024

The average U.S. contractor has 8.1 months worth of construction work in the pipeline, as of February 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Market Data | Mar 6, 2024

Nonresidential construction spending slips 0.4% in January

National nonresidential construction spending decreased 0.4% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.190 trillion.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 2, 2024

Job gains boost Yardi Matrix National Rent Forecast for 2024

Multifamily asking rents broke the five-month streak of sequential average declines in January, rising 0.07 percent, shows a new special report from Yardi Matrix.