The war in Ukraine, global port congestion, and the persistent spread of COVID variants will conspire to raise prices on equipment and key building products by 7-9 percent this year, according to the general contractor Consigli’s latest market update, which it released a few days ago.

Authors Peter Capone and Jared Lachapelle, Consigli’s director of construction and vice president of preconstruction, respectively, wrote that while the nonresidential construction industry continues to be resilient, it can’t completely alleviate forces that are reducing or delaying the supply of raw materials and finished goods.

Russia’s invasion of Ukraine has reduced the supply of manufacturing materials such as aluminum and copper, and is putting a strain on production and delivery across Europe. Meanwhile shipping congestion “is showing little sign of improvement” worldwide, especially at ports in Asia.

Other factors contributing to rising construction prices include spikes in fuel costs, and wage increases that are jacking up labor costs. “Acquiring workforce, [in] the Northeast in particular, remains an area of concern,” the authors state. Union and non-union subcontractors “are booking up to capacity for 2022,” and are already focused on next year and beyond.

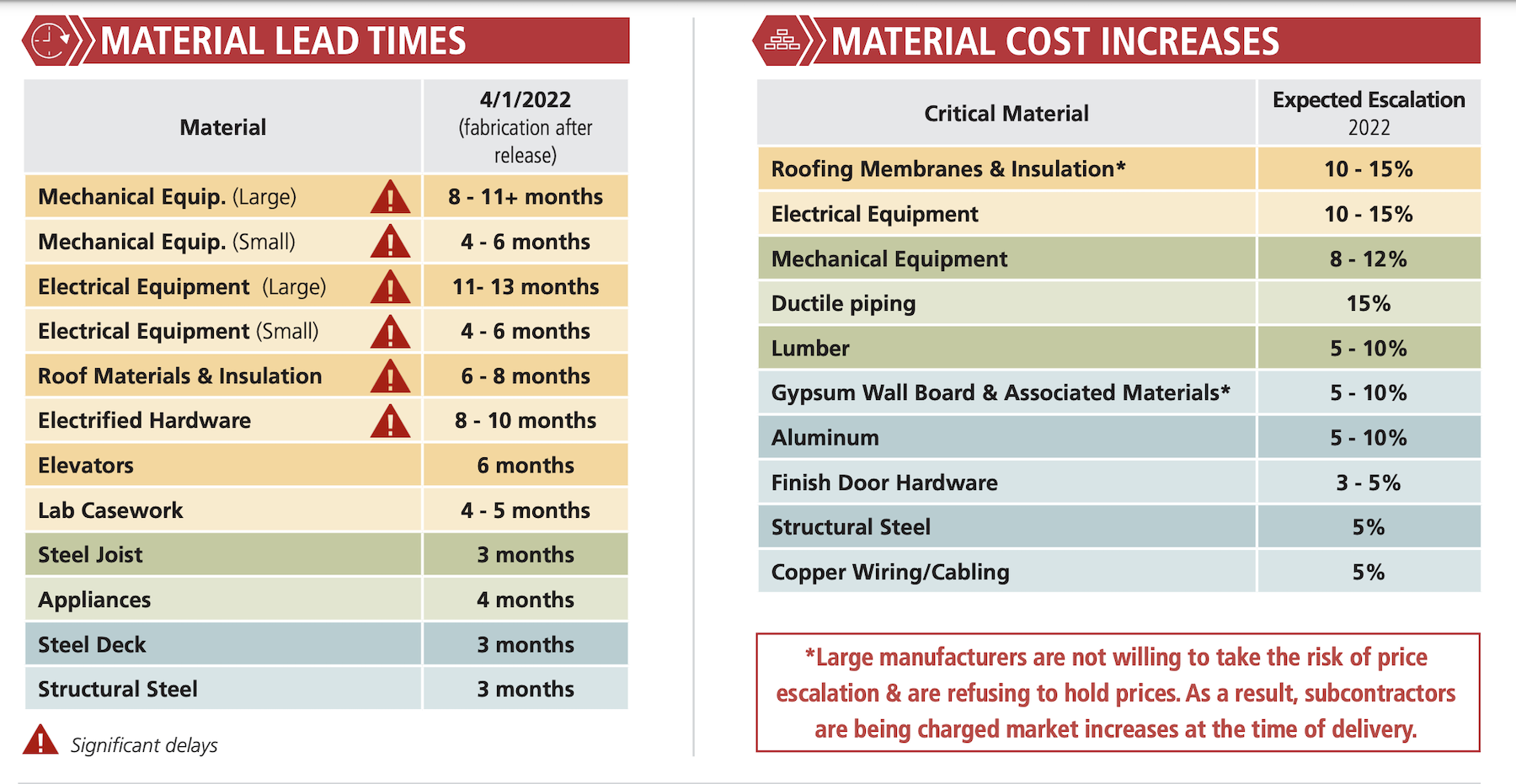

Electrical equipment and hardware, and roofing materials, are stalled in long lead times. As a result, price inflation for these products is expected to be double digit this year.

Consigli is also keeping an eye on a few things that could affect prices, such as contract negotiations with the International Longshoreman Warehouse Union that are scheduled for this July and will impact 22,000 workers at 79 ports.

The federal infrastructure bill, as it rolls out, will place more stress on an already tight labor market. Consigli notes that half of its larger subcontractors have secured 85 percent of their backlog for this year, and are “quickly filling” their projected backlog for 2023.

Related Stories

Market Data | May 18, 2021

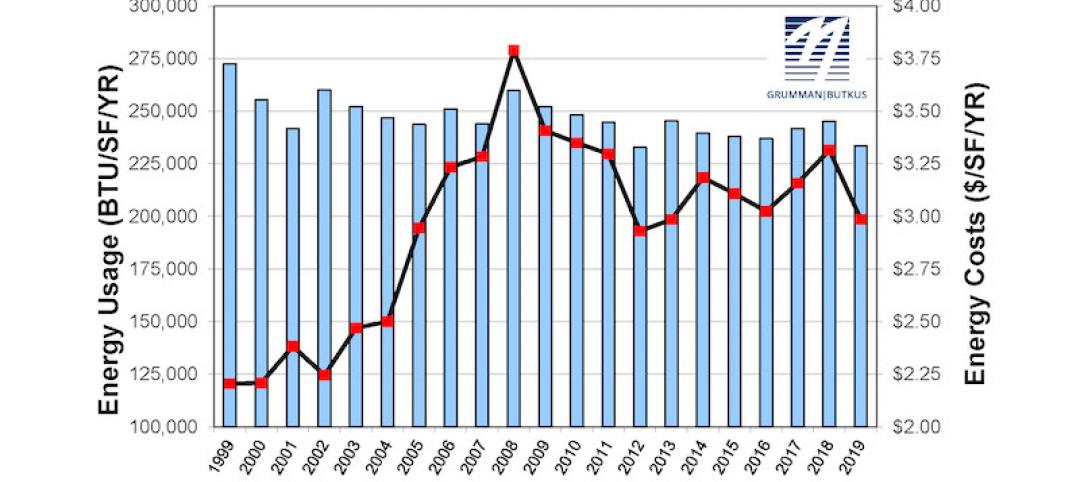

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | May 13, 2021

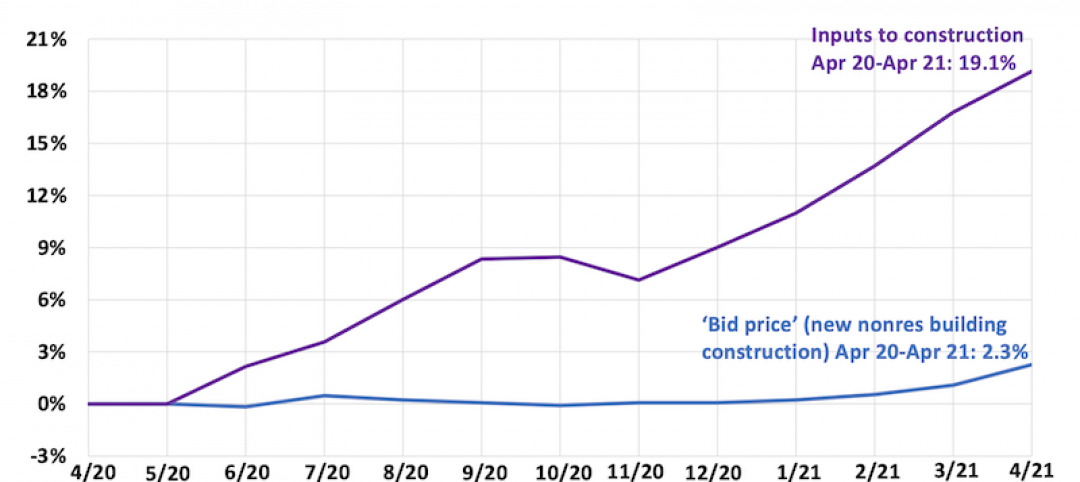

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

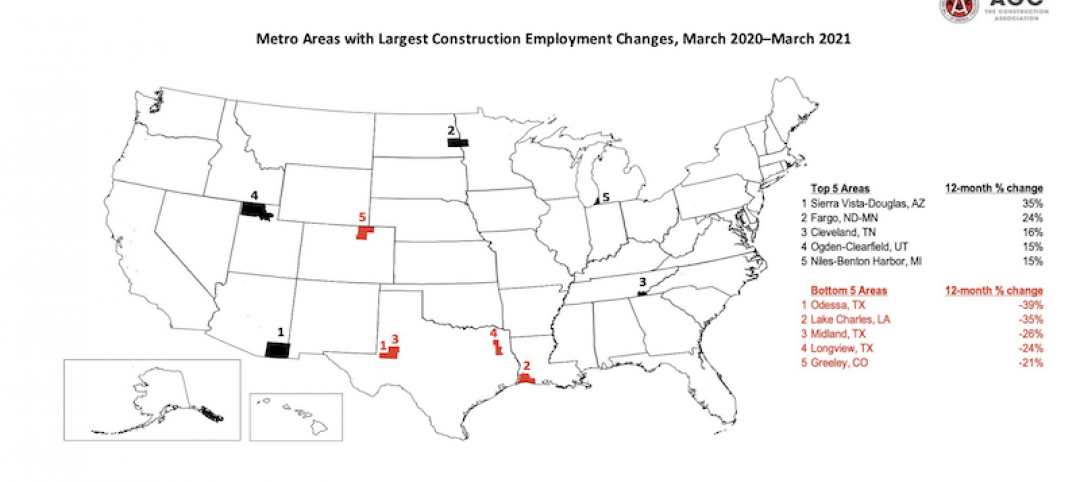

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.