The good news: the cargo and transportation snags that have encumbered building material availability this year showed signs of finally easing in September.

The bad news: the lack of material supply and increasing demand for labor are keeping prices high, to the point where manufacturers aren’t willing to hold price quotes for more than a week, if at all.

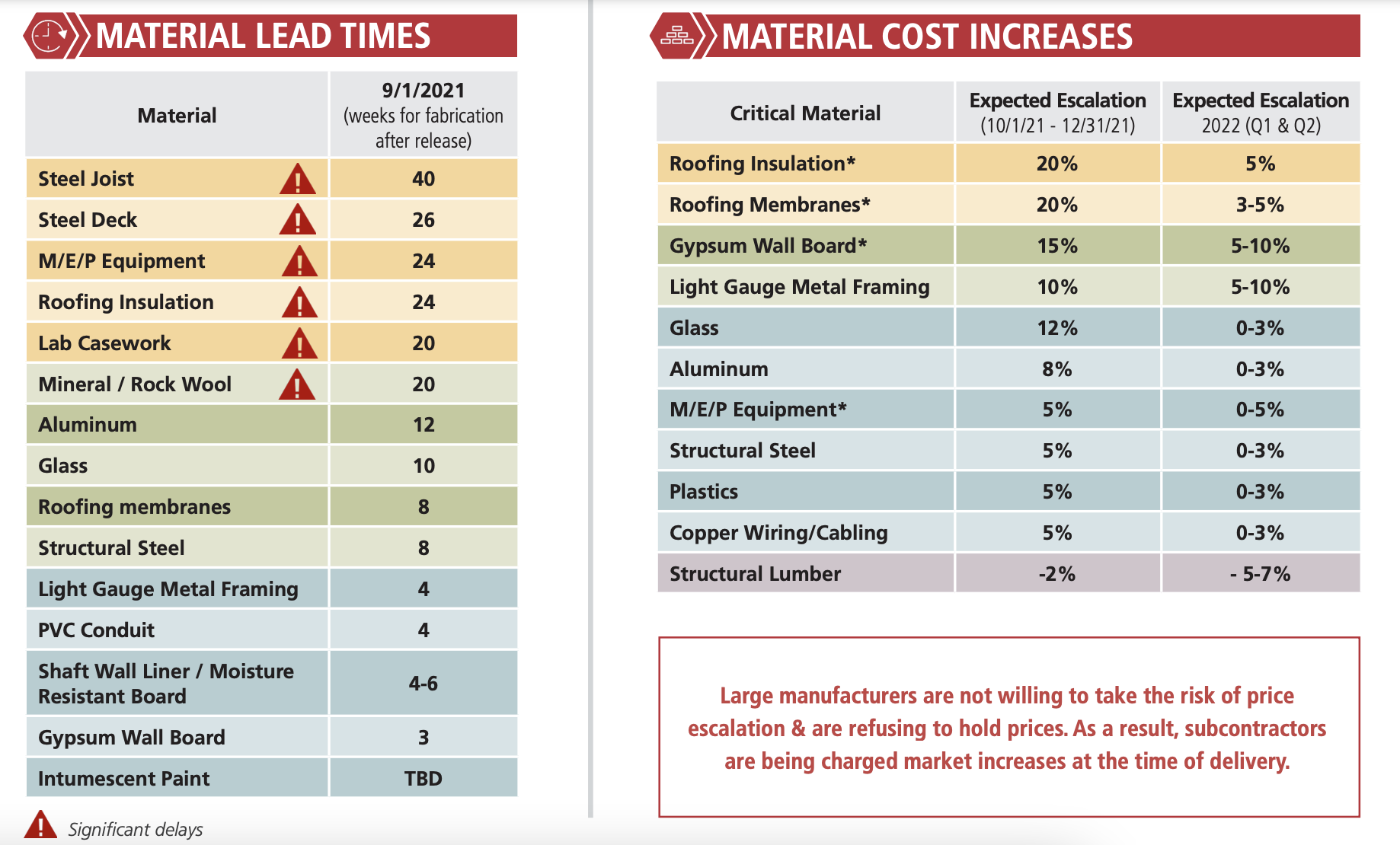

That, in a nutshell, is the state of the construction market, which the general contractor Consigli lays out in its Market Outlook for October 2021. The Outlook, written by the firm’s Director of Purchasing Peter Capone and Vice President of Preconstruction Jared Lachapelle, sends up red alerts about the availability of six product categories—steel joist, steel deck, MEP equipment, roofing insulation, lab casework, and mineral/rock wool—whose lead times for fabrication after release, as of Sept. 1, ranged from 20 to 40 weeks, with steel joists having the longest wait time.

The Outlook reports a 12 percent average price escalation for the 15 building materials tracked, and anticipates another 3 percent bump through the final quarter of this year. Roofing insulation, roofing membranes, gypsum wallboard, light-gauge metal framing, and glass exceed the overall averages.

As a result of large manufacturers not willing to take risks on escalating prices. “subcontractors are being changed market increases at the time of delivery,” states the report.

MANAGING RISK TAKES DISCIPLINE

Consigli’s strategies for risk management include:

•lock in prices with subs that are willing to share risk

•buy in bulk quantities whenever possible

•consider alternative supply sources

•implement stringent quality assurance and control measures

•focus on weekly materials delivery verification

•pre-purchase and warehouse materials

•identify peak manpower needs

•utilize prefabrication that takes labor off site

•partner with trades through design-assist

Consigli thinks labor shortages could get worse in the second half of next year. The severity will depend, in part, on vaccination mandates at a time when a sizable number of construction workers still refuse to be vaccinated. But even a fully vaccinated workforce might struggle to keep pace with construction demand that the pending $1 trillion infrastructure bill, if passed, would further pressure.

The Outlook notes that some manufacturers are focusing their production capacities on commonly used materials like drywall and MEP equipment, which is limiting—and sometimes halting—the production of specialty products. And AEC firms need to be vigilant about maintaining compatibility and quality when manufacturers source products from alternate vendors.

Consigli sees some light at the end of this supply tunnel. Its Outlook notes that steel prices are starting to level off as production increases. But citing the National Roofing Contractors Association, Consigli also cautions that shortages in roofing materials and insulation (whose lead time right now is 24 weeks) will continue through next year because of raw materials supply issues.

Related Stories

| Aug 11, 2010

PCA partners with MIT on concrete research center

MIT today announced the creation of the Concrete Sustainability Hub, a research center established at MIT in collaboration with the Portland Cement Association (PCA) and Ready Mixed Concrete (RMC) Research & Education Foundation.

| Aug 11, 2010

Study explains the financial value of green commercial buildings

Green building may be booming, especially in the Northwest, but the claims made for high-performance buildings have been slow to gain traction in the financial community. Appraisers, lenders, investors and brokers have found it difficult to confirm the value of high-performance green features and related savings. A new study of office buildings identifies how high-performance green features and systems can increase the value of commercial buildings.

| Aug 11, 2010

Architecture Billings Index drops to lowest level since June

Another stall in the recovery for the construction industry as the Architecture Billings Index (ABI) dropped to its lowest level since June. The American Institute of Architects (AIA) reported the August ABI rating was 41.7, down slightly from 43.1 in July. This score indicates a decline in demand for design services (any score above 50 indicates an increase in billings).

| Aug 11, 2010

Construction employment declined in 333 of 352 metro areas in June

Construction employment declined in all but 19 communities nationwide this June as compared to June-2008, according to a new analysis of metropolitan-area employment data released today by the Associated General Contractors of America. The analysis shows that few places in America have been spared the widespread downturn in construction employment over the past year.

| Aug 11, 2010

Jacobs, Hensel Phelps among the nation's 50 largest design-build contractors

A ranking of the Top 50 Design-Build Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Balfour Beatty agrees to acquire Parsons Brinckerhoff for $626 million

Balfour Beatty, the international engineering, construction, investment and services group, has agreed to acquire Parsons Brinckerhoff for $626 million. Balfour Beatty executives believe the merger will be a major step forward in accomplishing a number of Balfour Beatty’s objectives, including establishing a global professional services business of scale, creating a leading position in U.S. civil infrastructure, particularly in the transportation sector, and enhancing its global reach.

| Aug 11, 2010

Construction unemployment rises to 17.1% as another 64,000 construction workers are laid off in September

The national unemployment rate for the construction industry rose to 17.1 percent as another 64,000 construction workers lost their jobs in September, according to an analysis of new employment data released today. With 80 percent of layoffs occurring in nonresidential construction, Ken Simonson, chief economist for the Associated General Contractors of America, said the decline in nonresidential construction has eclipsed housing’s problems.