Growing materials costs and dwindling talent pools coupled with looming political and economic uncertainty is leaving construction leaders grappling with serious challenges. But where there is greater challenge, comes greater opportunity. According to JLL’s latest report on United States construction activity there is stability ahead with indicators showing a growing backlog of contractor work and seasonal construction spending up 5.7% year-over-year.

But that’s not all. A closer look at the construction industry’s biggest challenges reveals some unexpected opportunities amidst the adversity.

“Many of the biggest industry issues have been consistent over the past year and are nothing new to industry experts,” said Mason Mularoni, Senior Research Analyst, JLL Project and Development Services. “These challenges are leading to a shift in traditional thinking, giving way to more innovation and a greater use of technology. This creates opportunities to generate better project efficiency and save on costs.”

Challenge or opportunity? You decide.

The seemingly interminable labor shortage: Construction unemployment continues to reach historic lows, sitting at 5.3% while hourly wages increase and outpace inflation. This is stretching project budgets and timelines, resulting in a heightened focus on productivity enhancement.

The silver lining? In an industry too often bogged down by contract and paper-passing to get work done efficiently, construction leaders are beginning to rethink the role of technology in day-to-day operations. Unified communications systems save time on paperwork, streamline communications and create better workflows and document sharing between teams. Investing in cloud and mobility solutions helps architects, designers and crew leaders communicate no matter where their works takes them.

Rising costs of materials: Over the last 12 years, materials costs have risen by nearly 30%, with 10% of the change happening in the last five years. With continued construction demand for materials and unknowns surrounding tariffs and international import changes, we can only wait and see when cost increases will slow.

The silver lining? The advent of building information modeling (BIM), artificial intelligence (AI) and modular construction are enabling firms to build more with less material and less waste. BIM technology allows architects and developers to reduce waste in both building and in operations. By knowing exactly how much to plan for, they can save on up-front materials costs. AI is helping firms to optimize materials distribution, while advances in modular construction is also reducing materials waste through recycling, more controlled inventory and enhanced quality control. Such innovations may not come cheap up-front, but they could contribute to cost savings down the line.

Overbuilding anxiety: The U.S. economy has grown steadily, quarter-over-quarter, since the Great Recession—and so has the commercial real estate and development industry. With construction pipelines showing no signs of slowing, many industry leaders are beginning to wonder when the next slowdown might occur.

The silver lining? Planning for different scenarios is an excellent mitigate uncertainty. And the better the analytics at hand, the clearer the outlooks become. Planning tools specific to construction activity are becoming more common, like apps that specifically exist to help project managers track complex data sets like capital planning and change management statistics. By taking long term goals into account, construction firms can begin to make slight changes such as buying materials early for large projects, building a solid pipeline of future work and considering risk carefully when opening a new multi-year development. All of these ideas can help firms move through the upcoming years with confidence and stability.

“Analyzing and tracking challenges like the skilled labor shortage and rising construction costs has allowed us to understand the biggest worries our clients have when it comes to their projects,” said Todd Burns, President, JLL Project and Development Services. “Because of this we are able to offer experience, technology solutions and non-traditional approaches to ease their minds and maximize proficiency.”

Download the latest JLL United States Construction Outlook here.

Related Stories

Market Data | Jan 24, 2020

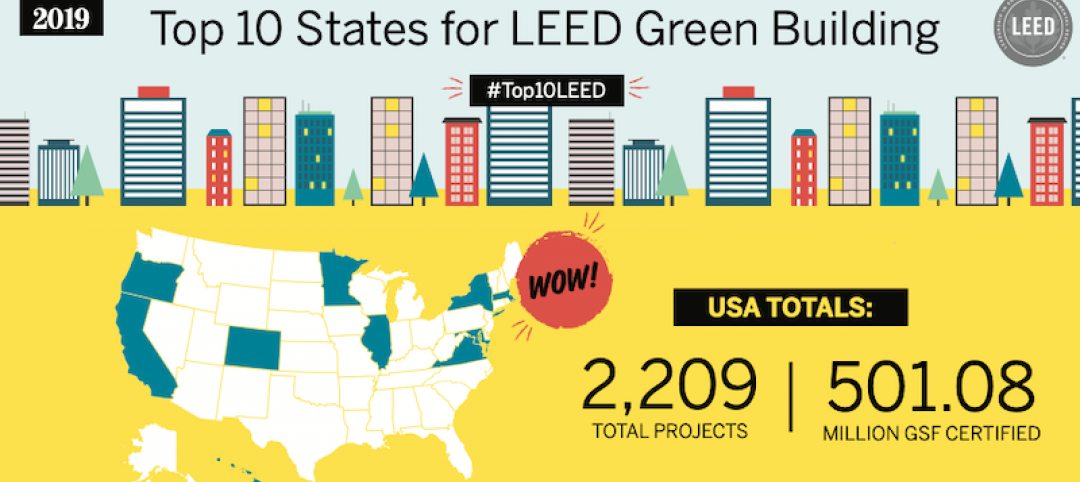

U.S. Green Building Council releases the top 10 states for LEED

Colorado leads the nation, showing how LEED green buildings support climate action and a better quality of life.

Market Data | Jan 23, 2020

Construction contractor confidence surges into 2020, says ABC

Confidence among U.S. construction industry leaders increased in November 2019 with respect to sales, profit margins, and staffing, according to the Associated Builders and Contractors Construction Confidence Index.

Market Data | Jan 22, 2020

Architecture Billings Index ends year on positive note

AIA’s Architecture Billings Index (ABI) score of 52.5 for December reflects an increase in design services provided by U.S. architecture firms.

AEC Tech | Jan 16, 2020

EC firms with a clear ‘digital roadmap’ should excel in 2020

Deloitte, in new report, lays out a risk mitigation strategy that relies on tech.

Market Data | Jan 13, 2020

Construction employment increases by 20,000 in December and 151,000 in 2019

Survey finds optimism about 2020 along with even tighter labor supply as construction unemployment sets record December low.

Market Data | Jan 10, 2020

North America’s office market should enjoy continued expansion in 2020

Brokers and analysts at two major CRE firms observe that tenants are taking longer to make lease decisions.

Market Data | Dec 17, 2019

Architecture Billings Index continues to show modest growth

AIA’s Architecture Billings Index (ABI) score of 51.9 for November reflects an increase in design services provided by U.S. architecture firms.

Market Data | Dec 12, 2019

2019 sets new record for supertall building completion

Overall, the number of completed buildings of at least 200 meters in 2019 declined by 13.7%.

Market Data | Dec 4, 2019

Nonresidential construction spending falls in October

Private nonresidential spending fell 1.2% on a monthly basis and is down 4.3% from October 2018.

Market Data | Nov 25, 2019

Office construction lifts U.S. asking rental rate, but slowing absorption in Q3 raises concerns

12-month net absorption decelerates by one-third from 2018 total.