Starts of buildings with five or more housing units rose from December 2018 through December 2019 by 74.6% to a seasonally adjusted annual rate of 536,000, according to preliminary Census Bureau estimates. At the end of that period, the number of multifamily housing units under construction was up 7.3% to 177,000.

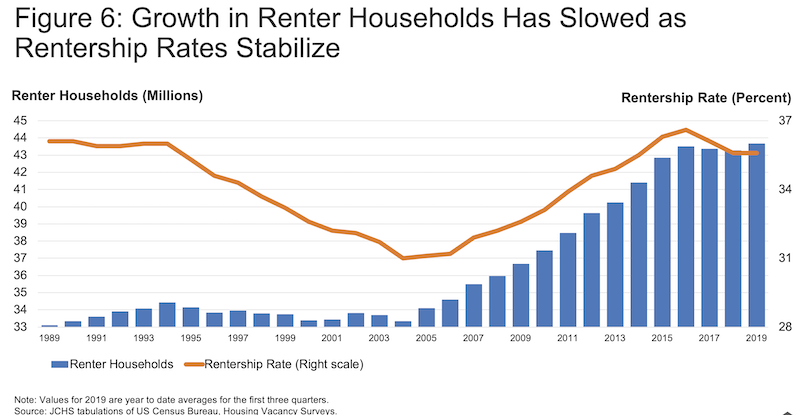

However, the seemingly endless demand for multifamily housing could finally be abating. After more than a decade-long runup, renter household growth appears to have plateaued. By the Housing Vacancy Survey’s count, the number of renters fell by a total of 222,000 between 2016 and 2018, but then more than made up for this lost ground with a gain of 350,000 through the first three quarters of 2019.

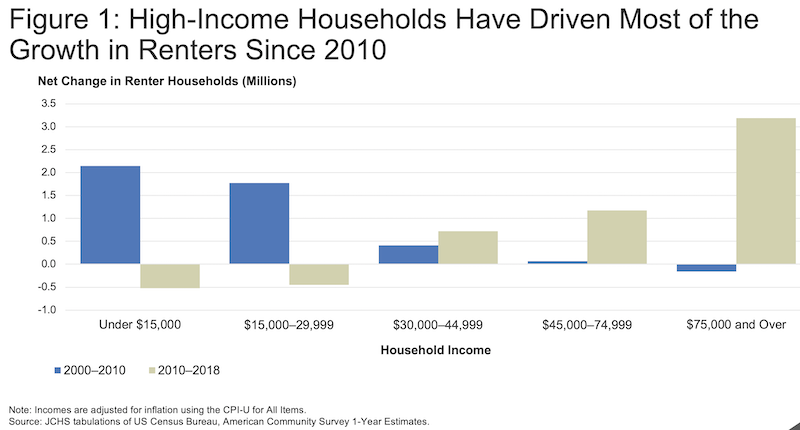

The National Association of Home Builders recently projected that multifamily housing starts would increase by only 1% in 2020. And what’s getting built in most markets is targeting higher-income renters, whose numbers increased by 545,000 in 2016–2018 alone. In fact, households with real incomes of at least $75,000 accounted for over three-quarters of the growth in renters (3.2 million) from 2010 to 2018,

Those are some of the findings in “America’s Rental Housing 2020,” the annual report released today by the Joint Center for Housing Studies of Harvard University. The John D. and Catherine T. MacArthur Foundation and the Joint Center’s Policy Advisory Board provided the funding for the report.

The report provides a rearview mirror perspective on the country’s rental landscape, where renting has become far more common and acceptable among the age groups and family types traditionally more likely to own their housing. For example, from the homeownership peak in 2004 to 2018, the number of married couples with children who owned homes fell by 2.7 million, while the number renting rose by 680,000.

Charts: Joint Center for Housing Studies at Harvard University

The increase in renting among high-income, older, and larger households reflects fundamental shifts in the composition of demand.

The American Dream of owning a house isn’t waning, necessarily. Public opinion surveys indicate that most renters are satisfied with their current housing situations, but still desire to eventually own homes. However, these same surveys also point to affordability as a major barrier to homeownership. Consistent with this finding, nearly all of the net growth in homeowners from 2010 to 2018 was among households with incomes of $150,000 or more.

“Rising rents are making it increasingly difficult for households to save for a downpayment and become homeowners,” says Whitney Airgood-Obrycki, a Research Associate at the Joint Center and lead author of the new report. “Young, college-educated households with high incomes are really driving current rental demand."

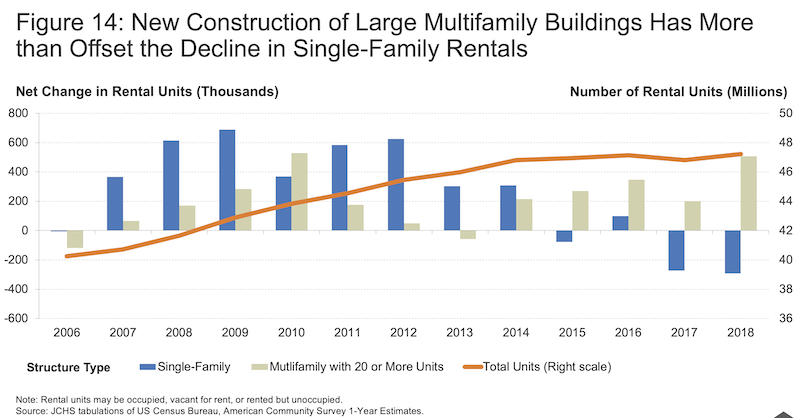

New rental construction remains near its highest levels in three decades. The share of newly completed apartments in structures with 50 or more units increased steadily from 11 percent in the 1990s, to 27 percent in the 2000s, to 61 percent in 2018.

Nearly all new multifamily units are built as rentals, with a growing share in larger buildings intended for the high end of the market. So it’s not surprising that rents continue to escalate.

The Joint Center estimates that the median asking rent for unfurnished units completed between July 2018 and June 2019 was $1,620—some 37% higher, in real terms, than the median for units completed in 2000. About one in five newly built apartments had an asking rent of at least $2,450, while only 12% had asking rents below $1,050.

Rents have been trending upward for a while. Between 2012 and 2017, the number of units renting for $1,000 or more in real terms shot up by five million, while the number of low-cost units renting for under $600 fell by 3.1 million. The supply of units with rents in the $600–$999 range also declined, but by a more modest 450,000. This marks a sharp departure from the preceding five-year period, when the number of units in all three rent segments grew by 1.2 to 1.8 million.

Low-cost rental units accounted for only 25% of the national rental stock in 2017, compared to 33% in 2012, with decreases in all 50 states and Washington, DC.

Contributing to rent escalation has been supply. Even as overall rental demand ebbs and new supply comes online, tight conditions prevail across the country. The Census Bureau reports that the national rental vacancy rate edged down again in mid-2019 to 6.8%—the lowest level since the mid-1980s.

According to RealPage, vacancy rates for units in professionally managed properties were down in 118 of the 150 markets tracked, with year-over-year declines averaging 0.7 percentage point in the third quarter of 2019.

With vacancy rates so low, rent gains continue to outrun general inflation. The Consumer Price Index for rent of primary residence was up 3.7% year-over-year in the third quarter of 2019, far outpacing the 1.1% increase in prices for all non-housing items over the same period. This brought the number of consecutive quarters of real rent growth to 29, the second-longest streak in records dating back to the 1940s.

RealPage reports that apartment rents in 142 of 150 metros rose from the third quarter of 2018 to the third quarter of 2019.

Thanks to strong growth in the number of high-income renters, the share of renters with cost burdens—i.e., those paying more than 30% of their household incomes for rent—fell more noticeably from a peak of 50.7% in 2011 to 47.4% in 2017, followed by a modest 0.1 percentage point increase in 2018. That year, there were six million more cost-burdened renters than in 2001 and the cost-burdened share was nearly 7 percentage points higher.

Meanwhile, 10.9 million renters—or one in four—spent more than half their incomes on housing in 2018.

Even as the overall share of cost-burdened renters has receded somewhat, the share of middle-income renters paying more than 30% of income for housing has steadily risen. While the improving economy has increased the share of middle-income renters, earnings growth has not caught up with the rise in rents.

Housing expense is also a burden that a sizable number of people simply can’t bear. After falling for six straight years, the number of people experiencing homelessness nationwide turned upward in 2016–2018, to 552,830. Much of this reversal reflects an 18,110 jump in the number of homeless individuals living outside or in places not intended for human habitation, with particularly large increases in the high-cost states of California, Oregon, and Washington.

Climate change is also playing havoc on the country’s housing landscape. The Joint Center estimates that 10.5 million renter households—one quarter of the total—live in zip codes with at least $1 million in home and business losses in 2008–2018 due to natural disasters.

As the nation’s rental affordability crisis evolves, efforts to address these challenges must evolve as well, the Joint Center states. However, the federal response has not kept up with need. HUD budget outlays for rental assistance programs grew from $37.4 billion in 2013 to $40.3 billion in 2018 in real terms, an average annual increase of just 1.5%. The shortfall in federal spending leaves about 75% of the 17.6 million eligible households without rental assistance.

State and local programs have attempted to fill these gaps in assistance by targeting low-income households without access to federal support. Chief among their efforts has been the issuance of $4.8 billion in tax-exempt bonds for multifamily housing in 2017–2018. Local governments have also passed reforms that mandate or incentivize new construction of affordable units, and 510 jurisdictions nationwide now have inclusionary zoning.

Related Stories

| Aug 11, 2010

Triangular tower targets travelers

Chicago-based Goettsch Partners is designing a new mixed-use high-rise for the Chinese city of Dalian, located on the Yellow Sea coast. Developed by Hong Kong-based China Resources Land Limited, the tower will have almost 1.1 million sf, which includes a 377-room Grand Hyatt hotel, 84 apartments, three restaurants, banquet space, and a spa and fitness center.

| Aug 11, 2010

Brooklyn's tallest building reaches 514 feet

With the Brooklyner now topped off, the 514-foot-high apartment tower is Brooklyn's tallest building. Designed by New York-based Gerner Kronick + Valcarcel Architects and developed by The Clarett Group, the soaring 51-story tower is constructed of cast-in-place concrete and clad with window walls and decorative metal panels.

| Aug 11, 2010

RMJM unveils design details for $1B green development in Turkey

RMJM has unveiled the design for the $1 billion Varyap Meridian development it is master planning in Istanbul, Turkey's Atasehir district, a new residential and business district. Set on a highly visible site that features panoramic views stretching from the Bosporus Strait in the west to the Sea of Marmara to the south, the 372,000-square-meter development includes a 60-story tower, 1,500 resi...

| Aug 11, 2010

'Feebate' program to reward green buildings in Portland, Ore.

Officials in Portland, Ore., have proposed a green building incentive program that would be the first of its kind in the U.S. Under the program, new commercial buildings, 20,000 sf or larger, that meet Oregon's state building code would be assessed a fee by the city of up to $3.46/sf. The fee would be waived for buildings that achieve LEED Silver certification from the U.

| Aug 11, 2010

Colonnade fixes setback problem in Brooklyn condo project

The New York firm Scarano Architects was brought in by the developers of Olive Park condominiums in the Williamsburg section of Brooklyn to bring the facility up to code after frame out was completed. The architects designed colonnades along the building's perimeter to create the 15-foot setback required by the New York City Planning Commission.

| Aug 11, 2010

U.S. firm designing massive Taiwan project

MulvannyG2 Architecture is designing one of Taipei, Taiwan's largest urban redevelopment projects. The Bellevue, Wash., firm is working with developer The Global Team Group to create Aquapearl, a mixed-use complex that's part of the Taipei government's "Good Looking Taipei 2010" initiative to spur redevelopment of the city's Songjian District.

| Aug 11, 2010

Recycled Pavers Elevate Rooftop Patio

The new three-story building at 3015 16th Street in Minot, N.D., houses the headquarters of building owner Investors Real Estate Trust (IRET), as well as ground-floor retail space and 71 rental apartments. The 215,000-sf mixed-use building occupies most of the small site, while parking takes up the remainder.

| Aug 11, 2010

Housing America's Heroes 7 Trends in the Design of Homes for the Military

Take a stroll through a new residential housing development at many U.S. military posts, and you'd be hard-pressed to tell it apart from a newer middle-class neighborhood in Anywhere, USA. And that's just the way the service branches want it. The Army, Navy, Air Force, and Marines have all embarked on major housing upgrade programs in the past decade, creating a military housing construction boom.

| Aug 11, 2010

Loft Condo Conversion That's Outside the Box

Few people would have taken a look at a century-old cigar box factory with crumbling masonry and rotted wood beams and envisioned stylish loft condos, but Miles Development Partners did just that. And they made that vision a reality at Box Factory Lofts in historic Ybor City, Fla. Once the largest cigar box plant in the world, the Tampa Box Company produced boxes of many shapes and sizes, spec...

| Aug 11, 2010

World's tallest all-wood residential structure opens in London

At nine stories, the Stadthaus apartment complex in East London is the world’s tallest residential structure constructed entirely in timber and one of the tallest all-wood buildings on the planet. The tower’s structural system consists of cross-laminated timber (CLT) panels pieced together to form load-bearing walls and floors. Even the elevator and stair shafts are constructed of prefabricated CLT.