Grumman|Butkus Associates, a firm of energy efficiency consultants and sustainable design engineers, recently released the results of its 2023 Hospital Energy and Water Benchmarking Survey, focusing on healthcare facilities’ resource usage trends and costs for calendar years 2021 and 2022.

For the first time, the report charts and historical data are available at a dedicated website, including pull-down menus for sorting data by facility characteristics (for instance, hospitals with purchased steam or in-house laundry). These tools will make it easier for users to make comparisons between the survey data and patterns in their own facilities.

Users can also choose some aspects of data presentation (for instance, $/therm vs. $/MMBtu in the fossil fuel energy chart).

Hospital Energy and Water Use Trends

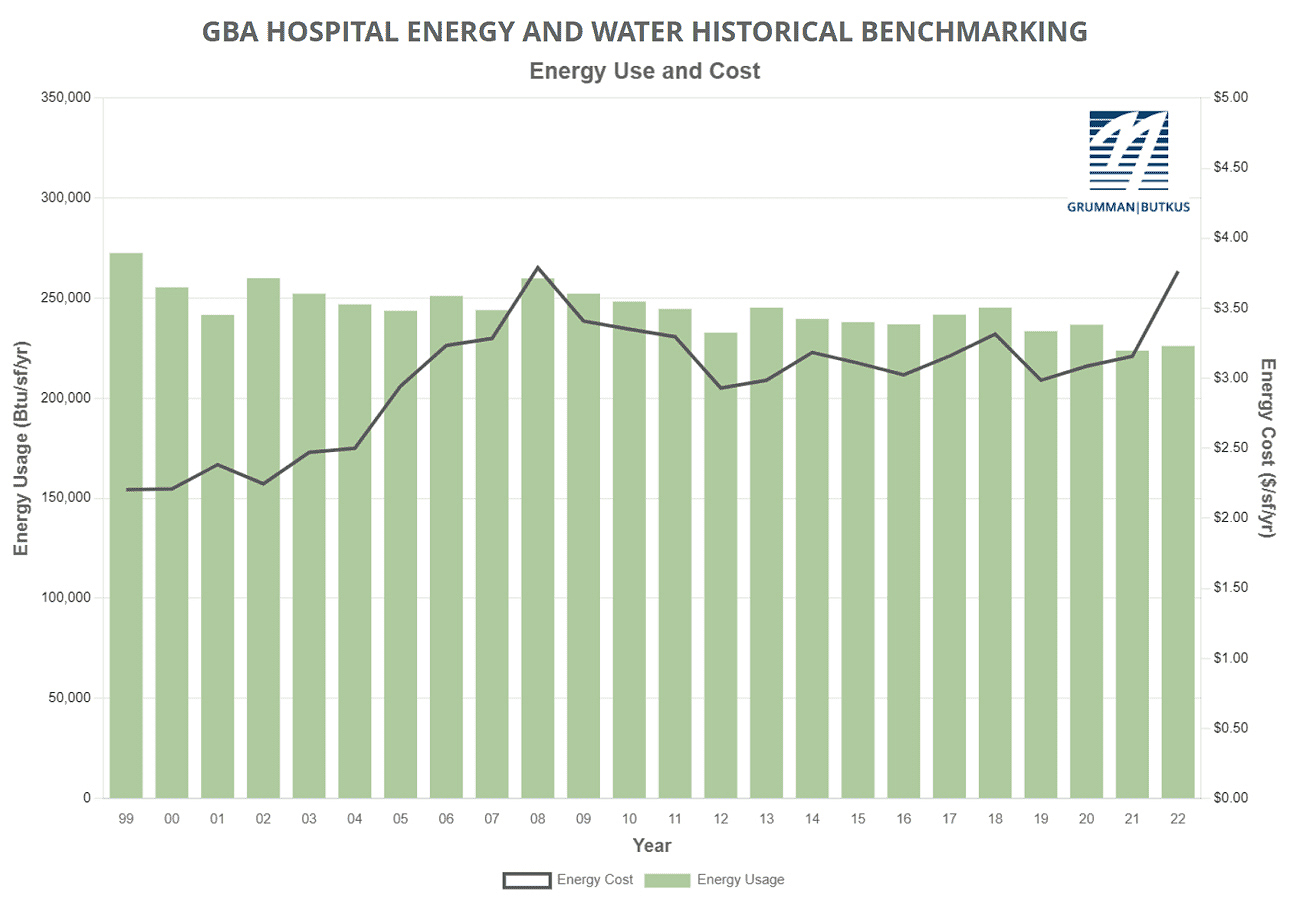

Since GBA initiated the survey nearly 30 years ago, hospitals’ overall fossil fuel use has trended downward, but electricity use isn’t declining as much. The average combined Btu/ft2 (electricity plus gas/steam) for participating facilities was 223,778 in 2021 and 226,081 in 2022, both down from the 236,743 Btu/ft2 reported in CY2020. However, interpretation of year-to-year trends should be tempered by the realization that the respondent pool for 2020-22 would have usage patterns influenced by the COVID-19 pandemic.

Square-foot prices for gas/steam rose ($0.75 in 2021 and $0.98 in 2022, compared with $0.65 in 2020). Square-foot prices for electricity fluctuated ($2.40 in 2021 and $2.78 in 2022, compared with $2.44 in 2020). The overall result is that total reported ft2 costs for energy (gas/steam plus electric) have increased: $3.16 in 2021 and $3.76 in 2022, compared with $3.09 for 2020.

Hospitals’ average carbon footprint has remained fairly steady at 50 to 60 pounds of CO2 equivalent per ft2 per year since GBA began calculating carbon data in 1999. However, Scope 1 and Scope 2 CO2 footprint in 2022 was the lowest it has been since GBA started reporting on carbon emissions (36.96 average CO2 equivalent per ft2 per year). This pattern is likely related to changes in the electric grid, as utilities themselves strive to decarbonize.

Participating facilities displayed a broad range of energy usage patterns. For instance, a few of this year’s survey participants reported fossil fuel consumption of more than 200,000 Btu/sf/year, compared with the general mid-range of facilities (about 130,000 Btu/sf/year) and those that used the least (75,000 Btu/sf/year or less). These variations mean that hospital fossil fuel energy costs may exceed $2.00/sf/year or come in at less than $0.50/sf/year.

Similarly, several hospitals reported consuming more than 40 kWh/sf/year in electrical energy, compared with a mid-range of about 27 kWh/sf/year. A few survey participants squeaked in at less than 20 kWh/sf/year. The wide differences in usage mean that some participants are paying well over $4.00/sf/year for electrical energy, while many are getting by with less than $2.50 and a few with less than $1.75.

“Facilities that have high unit costs for energy should view this as an opportunity,” says GBA-Illinois Chairman Dan Doyle. “For example, a project that would have a five-year payback at an ‘average’ facility may have a payback of just 2.5 or three years at a facility with higher unit costs for energy.”

Hospital water/sewer use has been gradually declining, but was up in both 2021 and 2022, at 42 and 51 gallons per square foot per year, respectively, compared with about 36 gallons per square foot per year in CY2020. The leap between 2021 and 2022 was likely a statistical anomaly caused by different respondent mix between those two years. Costs for water/sewer are undoubtedly rising, however. Respondents reported costs of $0.46/square foot in 2021 and $0.43/square foot in 2022, compared with the $0.27/ft2 that hospitals were spending in 2006, the year GBA began tracking water/sewer use.

“GBA expects the general trend of rising water and sewer costs to continue,” says Doyle. “Price hikes not only reflect increasing costs to extract and treat the water, but also the expense of upgrading or replacing aging infrastructure. In addition, some cash-strapped governmental entities may view water as a revenue sources.”

Since 1995, the GBA survey has provided a free annual benchmarking resource. Hospitals are invited to participate by submitting responses to a short list of questions. Information for this edition was provided by a combined total of 181 hospitals located in Illinois, Wisconsin, New Jersey, Indiana, Michigan, Nevada, and numerous other states coast-to-coast.

Full results and analysis, as well as information about participating in the 2024 survey (2023 data), are available at the firm’s website: grummanbutkus.com/HES.

For additional information, contact Dan Doyle (ddoyle@grummanbutkus.com) or Julie Higginbotham (jhigginbotham@grummanbutkus.com).

Related Stories

Giants 400 | Oct 5, 2023

Top 90 Healthcare Engineering Firms for 2023

Jacobs, WSP, IMEG, BR+A, and Affiliated Engineers head BD+C's ranking of the nation's largest healthcare sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue related to all healthcare buildings work, including hospitals, medical office buildings, and outpatient facilities.

Giants 400 | Oct 5, 2023

Top 175 Healthcare Architecture Firms for 2023

HDR, HKS, CannonDesign, Stantec, and SmithGroup top BD+C's ranking of the nation's largest healthcare sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue related to all healthcare buildings work, including hospitals, medical office buildings, and outpatient facilities.

Adaptive Reuse | Sep 19, 2023

Transforming shopping malls into 21st century neighborhoods

As we reimagine the antiquated shopping mall, Marc Asnis, AICP, Associate, Perkins&Will, details four first steps to consider.

Healthcare Facilities | Sep 13, 2023

Florida’s first freestanding academic medical behavioral health hospital breaks ground in Tampa Bay

Construction kicked off recently on TGH Behavioral Health Hospital, Florida’s first freestanding academic medical behavioral health hospital. The joint venture partnership between Tampa General (a 1,040-bed facility) and Lifepoint Behavioral Health will provide a full range of inpatient and outpatient care in specialized units for pediatrics, adolescents, adults, and geriatrics, and fills a glaring medical need in the area.

Healthcare Facilities | Sep 8, 2023

Modern healthcare interiors: Healing and care from the outside in

CO Architects shares design tips for healthcare interiors, from front desk to patient rooms.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Healthcare Facilities | Aug 21, 2023

Sutter Health’s new surgical care center finishes three months early, $3 million under budget

Sutter Health’s Samaritan Court Ambulatory Care and Surgery Center (Samaritan Court), a three-story, 69,000 sf medical office building, was recently completed three months early and $3 million under budget, according to general contractor Skanska.

Healthcare Facilities | Aug 18, 2023

Psychiatric hospital to feature biophilic elements, aim for net-zero energy

A new 521,000 sf, 350-bed behavioral health hospital in Lakewood, Wash., a Tacoma suburb, will serve forensic patients who enter care through the criminal court system, freeing other areas of campus to serve civil patients. The facility at Western State Hospital, to be designed by HOK, will promote a holistic approach to rehabilitation as part of the state’s vision for transforming behavioral health.