Lodging Econometrics (LE) has released its bi-annual Global Construction Pipeline Trend Report, which compiles the construction pipeline counts for every country and market around the world, states that the total global construction pipeline stands at 12,839 projects/2,158,422 rooms which are at all-time highs. The construction pipeline is up an extraordinary 86% by projects over the cyclical low established in 2011 when global counts were at 6,907 projects/1,257,296 rooms.

There are 5,988 projects/1,133,017 rooms currently under construction worldwide. Projects scheduled to start construction in the next 12 months are at 3,945 projects/570,731 rooms, both counts are at record highs. Projects in the early planning stage stand at 2,906 rooms/454,674 projects, just 134 projects short of the record high established in the fourth quarter of 2017.

The top countries by project count are the United States, which has been rising since 2011, with 5,312 projects/634,501 rooms and China with 2,523 projects/556,645 rooms which has been topping out for the last 4.5 years. The U.S. accounts for 41% of projects in the total global construction pipeline while China accounts for 20%, resulting in 61% of projects in the global pipeline being concentrated in just these two countries. Distantly following are Indonesia with 394 projects/66,759 rooms, Germany with 247 projects/47,155 rooms, and the United Kingdom with 247 projects/36,487 rooms.

The cities with the largest pipeline counts are New York with 169 projects/29,365 rooms, Dubai with 163 projects/47,783 rooms, and Dallas with 156 projects/18,908 rooms. Followed by Houston with 150 projects/16,321 rooms, and Shanghai with 121 projects/24,759 rooms. Of the top 10 cities having pipelines with more than 100 projects, 6 are located in the U.S. while 3 are located in China.

The leading 5 franchise companies in the global construction pipeline by project count are Marriott International with 2,324 projects/391,058 rooms, Hilton Worldwide with 2,202 projects/327,723 rooms, InterContinental Hotels Group (IHG) with 1,653 projects/244,038 rooms, AccorHotels with 809 projects/147,647 rooms, and Choice Hotels with 1024 projects/84,350 rooms. Hyatt, at 212 rooms/45,117 projects, is also significant with their portfolio of large luxury and upper upscale projects as well Best Western with 275 projects/29,243 rooms which are concentrated in the middle three chain scales.

The twenty-five-year explosion of hotel brands now totals 610 globally. Marriott leads with 29 labels, followed by Accor with 25, Hilton with 15, IHG and Hyatt with 12 each, and Choice with 11.

Leading pipeline brands for each of these companies are Marriott’s Fairfield Inn with 345 projects/37,224 rooms, Hilton’s Hampton Inn with 604 projects/77,193 rooms, IHG’s Holiday Inn Express with 713 projects/88,689 rooms, AccorHotels ibis Brands with 358 projects/53,387 rooms, and Choice’s Comfort with 322 projects/26,878 rooms.

As a result of record pipeline totals, new hotel openings continue to hit record levels. In 2020, totals could reach a lofty 3,000 new hotel openings, approximately 1,250 of them being in the U.S.

Related Stories

Market Data | Apr 11, 2023

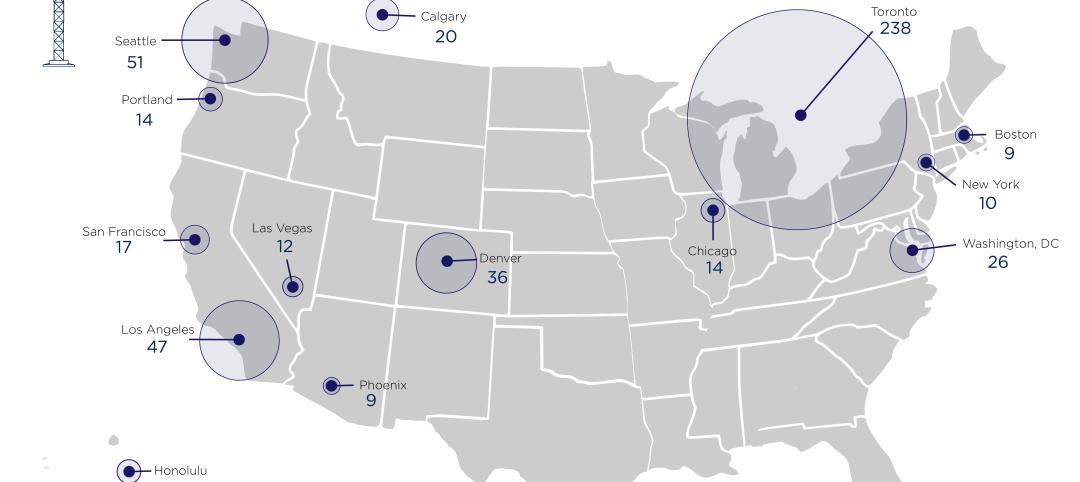

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Contractors | Mar 14, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of February 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

Industry Research | Mar 9, 2023

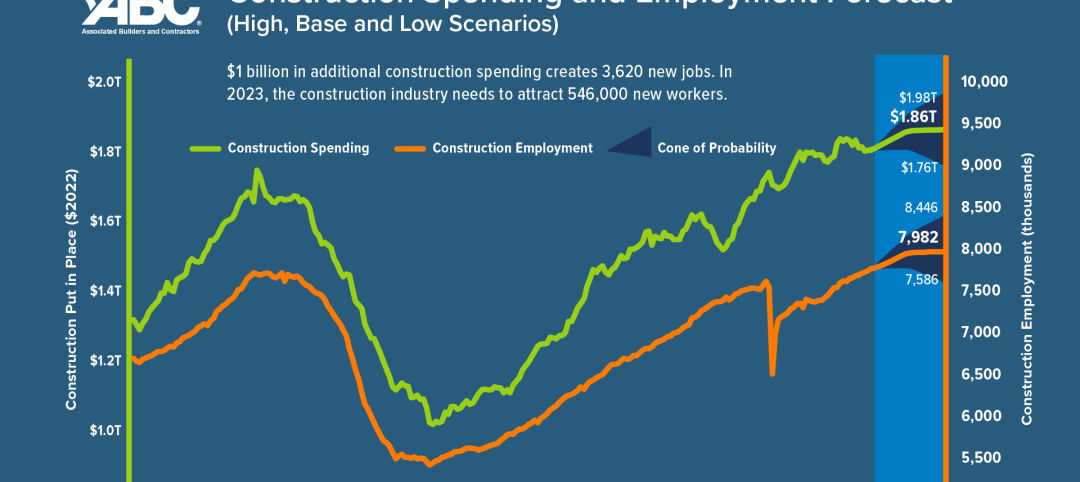

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Market Data | Mar 7, 2023

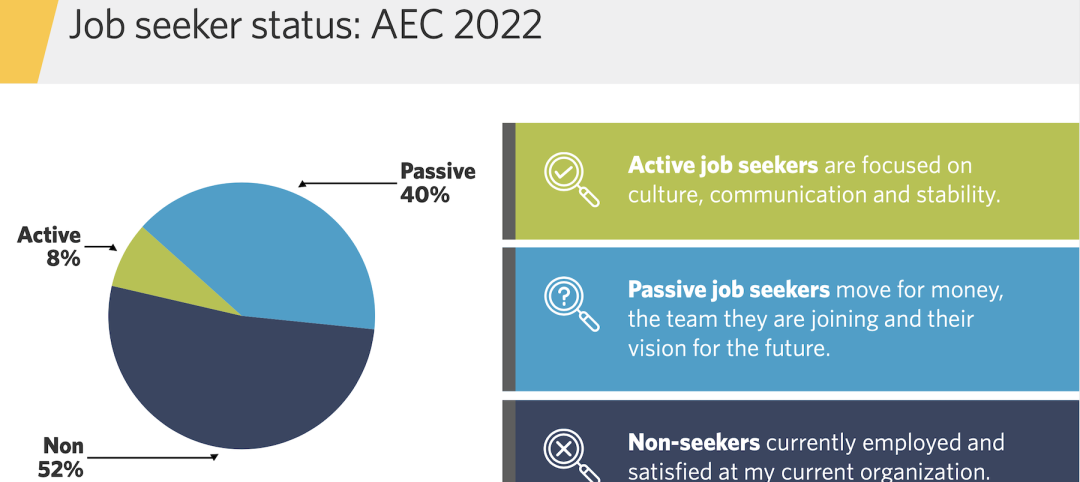

AEC employees are staying with firms that invest in their brand

Hinge Marketing’s latest survey explores workers’ reasons for leaving, and offers strategies to keep them in the fold.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.