Strong construction momentum will easily carry through the first half of 2019, despite project margins facing pressure from all sides. JLL’s Construction Outlook finds robust U.S. economic fundamentals will drive further growth of the sector, which in 2018 recorded a 5.1% increase in total construction value and a 4.5% increase in employment.

Potential risks to the construction sector such as trade war escalation, deteriorating macroeconomic conditions and the worsening labor shortage, are largely balanced by potential boosts that include a large-scale federal infrastructure package, relief from tariffs and the continuation of 3.5% annual GDP growth.

“All forward indicators for construction are still flashing green,” said Todd Burns, President, Project and Development Services, JLL Americas. “However, a year with growth equal to that of 2018 would be considered a success, given concerns of a broader economic slowdown.”

Rising construction costs will sideline select projects

Total building costs, which includes labor, materials and equipment, grew by 3.4% in 2018, outpacing the U.S. inflation rate of 1.9%. The widening spread between cost growth and inflation is pushing borderline projects past the threshold of profitability. Building costs will continue to increase in 2019 but at a slower rate than 2018. This reflects an expected cooldown in material pricing but the surging cost of labor.

Growth in total construction employment has hovered between 3 and 6% over the past six years – a far cry from what’s required for labor supply to catch up with demand. With a tight national employment market, the situation is unlikely to improve anytime soon. Construction wage growth in 2019 will top the 3.4% increase seen last year.

Trade policy a powerful “swing” force

With a direct impact on commodity prices, tariffs represent a uniquely immediate threat to an industry that typically moves slowly. Given the well-established political willingness to impose tariffs and the widening trade deficit with China, a continuation of tariffs in 2019 is expected.

The biggest chance for relief from tariffs are international trade deals that would lift tariffs in exchange for other trade or economic concessions. Such a deal could represent a dramatic positive for construction and is a potential bright spot for the industry.

Construction tech in growth mode, presents opportunity for labor shortage relief

The buzz around construction technology has long eclipsed actual adoption in the industry. The past year, however, saw meaningful gains fueled by large general contracting firms racing to improve productivity and remain competitive. High levels of tech adoption will spread to smaller firms, and elements of construction tech will become the standard across the industry in 2019. Amid intense labor pressures, contractors’ most common reason for making technology investments is to increase labor productivity.

Modular construction is poised to have the biggest long-term impact on the industry. Proponents of the technology envision a future full of dedicated warehouses churning out modular components – from exterior wall segments to entire apartment units – for most new construction.

“Adopting modular construction is not always as simple as it sounds,” said Henry D’Esposito, Senior Research Analyst, Project and Development Services, JLL. “There is often a prolonged period during which the benefits are not fully realized, as firms take time to adjust to the new system. Despite some of the initial challenges, there has been no hesitation among contractors about whether modular will continue to grow.”

Growth of modular construction in 2019 will be centered around increased use by select sectors, including hospitality and healthcare, and an increase in use for one or two select elements within a broader array of projects.

Related Stories

Market Data | Sep 20, 2021

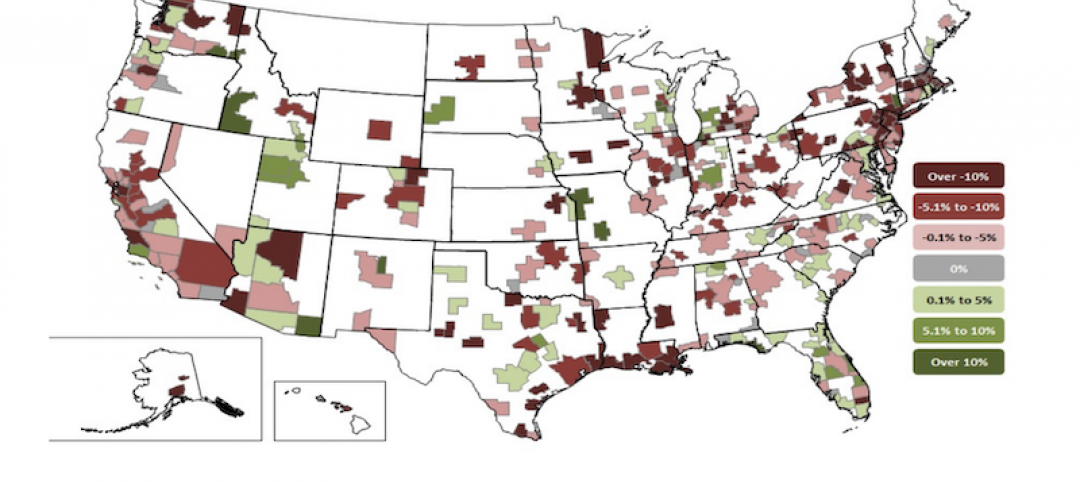

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.

Market Data | Sep 15, 2021

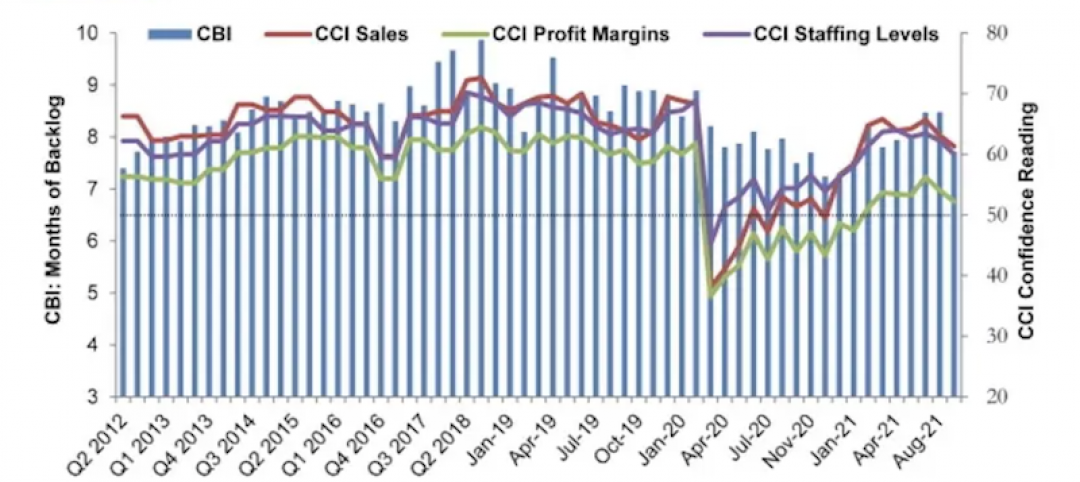

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.

Market Data | Sep 7, 2021

Construction sheds 3,000 jobs in August

Gains are limited to homebuilding as other contractors struggle to fill both craft and salaried positions.

Market Data | Sep 3, 2021

Construction workforce shortages reach pre-pandemic levels

Coronavirus continues to impact projects and disrupt supply chains.

Multifamily Housing | Sep 1, 2021

Top 10 outdoor amenities at multifamily housing developments for 2021

Fire pits, lounge areas, and covered parking are the most common outdoor amenities at multifamily housing developments, according to new research from Multifamily Design+Construction.

Market Data | Sep 1, 2021

Construction spending posts small increase in July

Coronavirus, soaring costs, and supply disruptions threaten to erase further gains.

Market Data | Sep 1, 2021

Bradley Corp. survey finds office workers taking coronavirus precautions

Due to the rise in new strains of the virus, 70% of office workers have implemented a more rigorous handwashing regimen versus 59% of the general population.

Market Data | Aug 31, 2021

Three out of four metro areas add construction jobs from July 2020 to July 2021

COVID, rising costs, and supply chain woes may stall gains.

Market Data | Aug 24, 2021

July construction employment lags pre-pandemic peak in 36 states

Delta variant of coronavirus threatens to hold down further gains.

Market Data | Aug 17, 2021

Demand for design activity continues to expand

The ABI score for July was 54.6.