Esports is the fastest growing theme in the gaming sector. These organized multiplayer video game competitions have enjoyed spectacular growth over the last decade, with thousands of fans filling stadiums to watch live events and millions following them on streaming platforms. Although eSports currently caters to a niche audience – almost 10% of the global online population of around 4.5 billion – its reach is expanding rapidly.

GlobalData’s latest report, ‘Esports – Thematic Research’, states that the industry has proved largely immune to the COVID-19 pandemic due to its prompt transition into online formats and sudden spike in interest from traditional sports organizations, which pushed eSports further into the mainstream and brought it to the attention of a wider audience.

Rupantar Guha, Senior Analyst of Thematic Research at GlobalData, commented: “Brands from a wide range of industries are investing in eSports to reach a young demographic that is typically resistant to traditional advertising channels. The increasing involvement of non-endemic brands such as Coca-Cola and BMW is helping to legitimize eSports, as well as bringing in significant revenue.”

See Also: Erudite eSports: Colleges build their very own eSports arenas

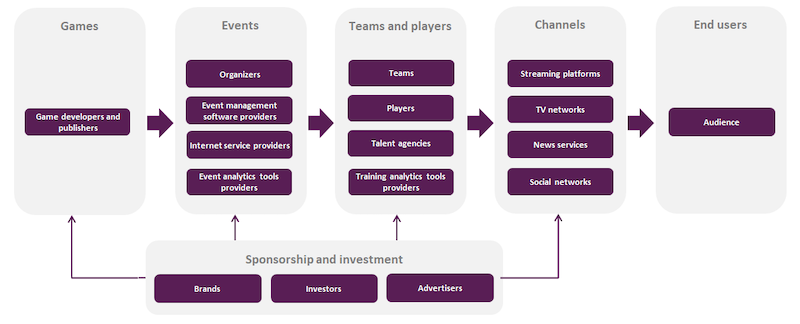

GlobalData splits the eSports value chain into six segments: games, events, teams and players, channels, sponsorship and investment and end users. The report discusses each aspect of the value chain in detail and throws light on how the industry will shape up over the next two to three years.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

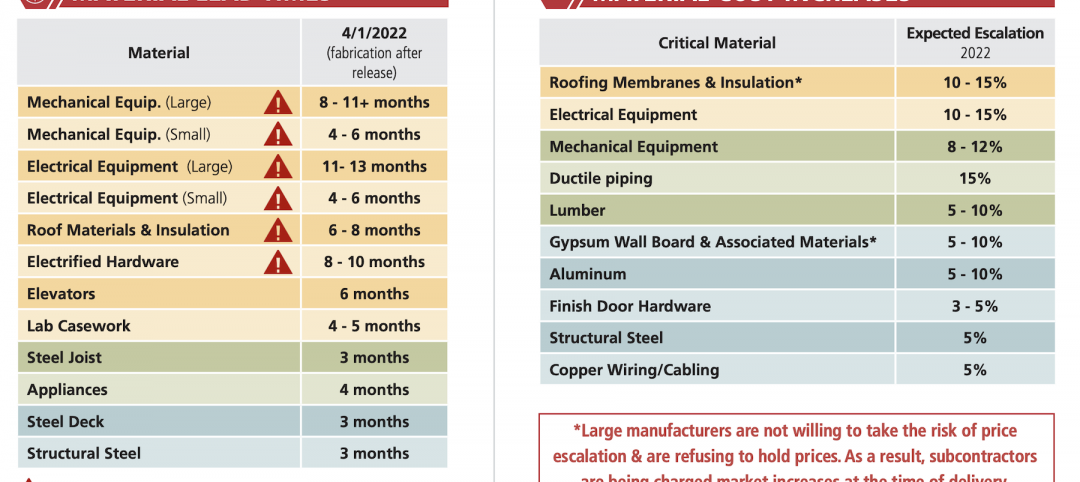

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment