America is no stranger to intercity competition. There are rivalries between cities for the best sports team, snack food, even slogan. But the most cutthroat competition might be one local residents barely ever notice: the bruising, tooth-and-nail fight to host conventions and other big special events.

Over the last 20 years, convention space in the United States has increased by 50%; since 2005, 44 new convention spaces have been planned or constructed in this country alone. That boom hasn't come cheap. In the last ten years, spending on convention centers doubled to $2.4 billion annually, much of it from public coffers.

"It's a very, very, very competitive thing," says Susan S. Gregg, managing editor of Association Conventions and Facilities magazine, one of a large number of trade publications devoted to the convention industry. "All these cities that are so competitive are constantly having to upgrade and expand and improve."

The actual number of conventions hosted in the U.S. has fallen over the last decade

That means finding a way to fund large-scale projects, like convention halls that are big enough to house cars, or airplanes, or hundreds of booths, or whatever else a posse of potential visitors want to see all crowded in one massive room. But it also means attention to smaller details: making sure your center has fast wireless internet is a big one; so are connected hotels ("you can have a great convention center with a lot of space," Gregg says. "But if you don't have the hotel inventory then it's really kind of wasted"). Some convention centers brag about the number of public toilets they have available; others highlight the hot local snack food on offer.

The reason for the bustle is entirely economic: cities believe that convention centers are key to bringing in those coveted tourism dollars. The promise of huge groups of visitors descending, in need of places to sleep, eat, shop, perhaps catch a show, is an alluring one, especially for cities that struggle to get residents downtown.

But there's a problem with this building bonanza, and it's a doozy: There aren't really enough conventions to go around. The actual number of conventions hosted in the U.S. has fallen over the last decade. Attendance at the 200 largest conventions peaked at about 5 million in the mid-1990s and has fallen steadily since then.

As Heywood Sanders wrote in a 2005 Brookings Institution report on convention centers: The overall convention marketplace has shifted dramatically, in a manner that suggests that a recovery or turnaround is unlikely to yield much increased business for any given community. Less business, in turn, means less revenue to cover facilities' expenses, and less money injected into local economies.

Like many other modern contrivances, the idea of the convention center blossomed out of the Industrial Revolution. International trade was growing and dealers needed more ways to share their wares. In 1851, Britain's Crystal Palace (a cacophonous mix of iron and glass, and the belle of the World's Fair ball) heralded in an age of buildings meant for display. Its enormous floor space (the building encompassed 990,000 square feet,) housed 14,000 exhibits.

By the early 20th century, these centers had become an urban badge of honor. According to Barbara Hillier's "Brief History of Convention Centers," cities understood that "they not only brought in much-needed revenue but also created a certain cachet." Still, there were only a handful of players in town. Atlantic City's Convention Hall (created in 1926) hosted the Miss America Pageant, the 1964 Democratic National Convention and the Beatles on their first world tour.

That changed in the 1960s, when cities began to search for new ways to bolster their downtowns. As Hillier writes:

New convention centers popped up like spring daisies across America in the post-Vietnam era with the expansion of the corporate sector, when domestic change brought women into the workplace and state governments took on the rebuilding of civic monuments and public places. In the name of urban renewal, time-worn blocks of housing and retail were razed to make way for the new convention centers, where too often the result was a streetscape of towering, windowless façades, excessive paving, and a scale that overpowered the remaining urban fabric.

A perfect example is Chicago's McCormick Place. McCormick Place is the biggest convention center in the country, in large part because it never stepped off the expansion treadmill. A 1971 fire forced officials to rebuild parts of the building. Just about ten years later, they added a new building. In 1996 and 2006, more space was added.

"There's been a pretty rapid growth of exhibition space," explains McCormick Place's general manager, David R. Causton. "It's highly competitive and we need to be able to get people here."

By all counts, Causton and his team have been wildly successful. McCormick Place's 2.2 million square feet host the greatest fraction of top tradeshows in the country. At its peak, in 1996, it hosted 30 large-scale events (attended by some 1.1 million people). That's more events than are hosted in Las Vegas, New York, or Atlanta.

And as a center, it has a lot of selling points. For one, Chicago is well-located. It's a major city in the center of the country. It's easily accessible by air (another national center of conventions, Atlanta, shares this virtue) and there are a lot of hotels and restaurants nearby. "For conventions, the main concern is to attract as many attendees as possible," Gregg says. "You choose a place that people are going to want to go to, that's appealing to them."

Still, despite all these advantages, Chicago's been struggling to keep up. Between 2001 and 2011, the number delegates attending trade shows and meetings at McCormick place fell about 37 percent, from 1,333,906 to 828,013. Other national venues have seen a similar decline. As the Brookings Institution's Sanders writes, "major commercial centers, Chicago, New York, Atlanta, and New Orleans have all seen significant recent loss in convention activity, even as they expand their convention centers." In Las Vegas and Orlando — the two up-and-comers in the convention space — recent expansions have done little to grow the number of visitors per year.

As a result, spaces like Chicago's McCormick Place are competing for regional and state-level events. "We want to be able to compete with our sister cities as much as on a national stage," Causton says. "We might compete with a regional market on one thing, a national market on the other."

This, in turn, leaves fewer and fewer options for second-tier cities. If Chicago is feeling the burn, what chance does Cincinnati have, or Buffalo?

Washington, D.C., unveiled what's now known as the Walter E. Washington Convention Center to fanfare in 2003, and with good reason. At 2.3 million square feet, the $833.9 million center could hold six football fields or four jumbo jets. It boasted 68 public restrooms, 38 escalators and 31 elevators. It also had more than 4 acres of glass walls, 160 types of lights and 30,293 light bulbs. The center is three times larger than D.C.'s old convention center.

At the time, the District of Columbia was trying to catapult itself into the national convention market. In its first few years, the new convention center received numerous accolades, even scoring a Guinness World Record for hosting the largest sit-down dinner ever (16,206 guests, all attendees of the Alpha Kappa Alpha Sorority’s Centennial Dinner).

Greg O'Dell, president and CEO, certainly talks a good game. When asked how he distinguishes D.C.'s convention center from others, he laughs. "We're the best," he says, firing off statistics and extolling the virtues of being located in a "business destination as well as a city destination" with a "full gambit of services."

But the convention center has not lived up to expectations. Between 2006 and 2008, it missed its booking goals by 13 percent, 24 percent, and 29 percent, respectively. It runs at a loss of about $22 million a year; promised hotel room discounts (meant to lure visitors) have so far not materialized.

Part of the problem is the question of national competition writ small. In 2010, National Harbor in nearby Prince George's County got its own convention center, the glossy Gaylord National Hotel and Convention Center. At 470,000 square feet, it is the largest combined hotel and convention center on the East Coast. That sense of competition has not been lost on O'Dell, even as he paints a rosy picture. "It’s definitely a buyer’s market. There’s more supply in the market," he says. "Customers have a lot more options."

And convention center market over-saturation means that reeling those visitors in has become harder and harder. Christopher Leinberger, a visiting fellow at the Brookings Institution Metropolitan Policy Program and former partner at an international real estate consulting firm, says that too many cities bought into the same dream at the same time.

"So many were saying, 'all you have to do is get one percent of the national market and you'll do just fine,'" he says. "Three hundred cities bought the same logic."

As a result, too many convention centers struggle to provide the economic benefit they initially promised. "You need to look very carefully before building another convention center in this country," Leinberger says. These centers require huge investments, money that could be better used "to bolster the quality of life, the parks, the retailing, the homeless situation. +

Related Stories

MFPRO+ News | Jul 22, 2024

6 multifamily WAFX 2024 Prize winners

Over 30 projects tackling global challenges such as climate change, public health, and social inequality have been named winners of the World Architecture Festival’s WAFX Awards.

Office Buildings | Jul 22, 2024

U.S. commercial foreclosures increased 48% in June from last year

The commercial building sector continues to be under financial pressure as foreclosures nationwide increased 48% in June compared to June 2023, according to ATTOM, a real estate data analysis firm.

Codes and Standards | Jul 22, 2024

Tennessee developers can now hire their own building safety inspectors

A new law in Tennessee allows developers to hire their own building inspectors to check for environmental, safety, and construction violations. The law is intended to streamline the building process, particularly in rapidly growing communities.

Codes and Standards | Jul 22, 2024

New FEMA rules include climate change impacts

FEMA’s new rules governing rebuilding after disasters will take into account the impacts of climate change on future flood risk. For decades, the agency has followed a 100-year floodplain standard—an area that has a 1% chance of flooding in a given year.

Construction Costs | Jul 18, 2024

Data center construction costs for 2024

Gordian’s data features more than 100 building models, including computer data centers. These localized models allow architects, engineers, and other preconstruction professionals to quickly and accurately create conceptual estimates for future builds. This table shows a five-year view of costs per square foot for one-story computer data centers.

Sustainability | Jul 18, 2024

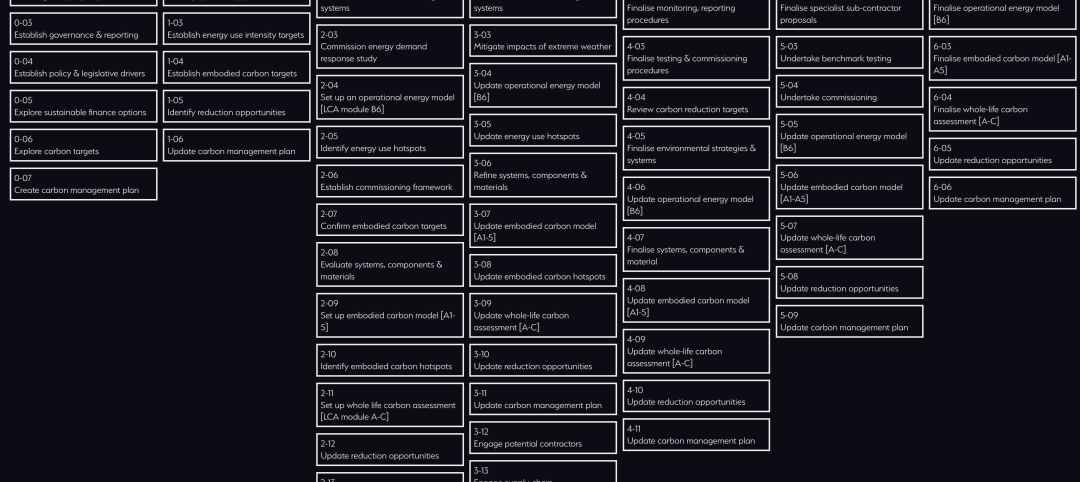

Grimshaw launches free online tool to help accelerate decarbonization of buildings

Minoro, an online platform to help accelerate the decarbonization of buildings, was recently launched by architecture firm Grimshaw, in collaboration with more than 20 supporting organizations including World Business Council for Sustainable Development (WBCSD), RIBA, Architecture 2030, the World Green Building Council (WorldGBC) and several national Green Building Councils from across the globe.

University Buildings | Jul 17, 2024

University of Louisville Student Success Building will be new heart of engineering program

A new Student Success Building will serve as the heart of the newly designed University of Louisville’s J.B. Speed School of Engineering. The 115,000-sf structure will greatly increase lab space and consolidate student services to one location.

Healthcare Facilities | Jul 16, 2024

Watch on-demand: Key Trends in the Healthcare Facilities Market for 2024-2025

Join the Building Design+Construction editorial team for this on-demand webinar on key trends, innovations, and opportunities in the $65 billion U.S. healthcare buildings market. A panel of healthcare design and construction experts present their latest projects, trends, innovations, opportunities, and data/research on key healthcare facilities sub-sectors. A 2024-2025 U.S. healthcare facilities market outlook is also presented.

K-12 Schools | Jul 15, 2024

A Cleveland suburb opens a $31.7 million new middle school and renovated high school

Accommodating 1,283 students in grades 6-12, the Warrensville, Ohio school complex features flexible learning environments and offers programs ranging from culinary arts and firefighting training to e-sports.

MFPRO+ News | Jul 15, 2024

More permits for ADUs than single-family homes issued in San Diego

Popularity of granny flats growing in California