In the six quarters ended June 30, nearly 95 million square feet of new office space had been delivered in the U.S., and another 25 million sf were under construction for delivery in 2019. With available office space outpacing demand, coupled with a significant flight to quality by companies, landlords are vying for tenants with more generous improvement packages.

Tenant improvement packages, in fact, have helped landlords offset peak rents as well as premium pricing for new construction, whose final price tag continues to be adversely affected by steadily rising materials and labor costs.

Against the backdrop of these dynamics, during what has been the second-longest period of economic expansion in the country’s history, JLL this week released its second annual U.S. and Canada Fit Out Guide and Office Cost Benchmarking Report for 2018, which can be downloaded here.

The guide is based on 2,800 JLL-managed projects for more than 100 clients in 59 markets and 17 industries. Its purpose is to provide a reference for average costs to build out three different office layouts—progressive, moderate, and traditional—within a matrix of high, medium, or base levels of space quality and complexity (see chart).

The guide, based on 2,800 projects, compares the different cost structures for three styles and three quality levels of office fit outs. Image: JLL

This year’s guide adds office layout and space quality components that allow users to evaluate how different layouts, project complexities, and materials selections might affect bottom-line costs. JLL also worked closed with its supply-chain and project managers to provide allowances for furniture, fittings and equipment (FF&E), and AV installation. The latest guide also removed contingencies associated with high-level budgeting.

During a teleconference previewing this report, three JLL executives—Scott Kessling, who heads up its Business Intelligence team; Lauren Harsha, Senior Business Intelligence Analyst; and David Barnett, Senior Analyst-Research—explained how decisions about office-space design and fit-out expenditures are being driven by five factors that are dictating the future of work: human experience, financial performance, digital drive (i.e., harnessing digitalization and rich data to enhance people and enterprise performance), continuous innovation, and operational excellence.

Fit out budgets are also being impacted by labor shortages, and by materials costs that last year rose 3.4% and continue upward in 2018, in some cases—like softwood lumber and steel—by double digits.

To help companies determine which fit out style suits their personalities and strategy, JLL calls out key space considerations for each.

The Progressive style is the favored layout for tech companies and startups. It’s open, with 100% benches and no enclosed offices. It can accommodate between 20% to 50% more employees than the Moderate or Traditional style. A standard plan would have 28 conference rooms and seven open collaborative and multi-use spaces. Project budgets for Progressive fit outs tend to be lighter on hard costs due to minimal dividing walls or enclosed offices. And this style saves on traditional FF&E spending.

A Moderate-style fit might work best for a company transitioning into a more efficient office model. It features a mix of workstations and limited (10%) private offices. It can handle between 20% to 25% more employees than a Traditional-style fit out, and its standard plan would include 20 conference rooms and five collaborative spaces. While more expensive per sf than the Progressive style, a Moderate fit out can capture cost efficiencies by integrating a higher percentage of bench-style desks.

Law firms and financial service providers are among the businesses that favor Traditional-style fit outs, where at least 30% of the space is for enclosed offices, and its floor plan features 8x8-ft cubicles. Traditional will have the highest FF&E costs of the three styles. But JLL also points out that tenant factors are comparatively small within a Traditional model due to lessened need for common areas or multi-use space furniture.

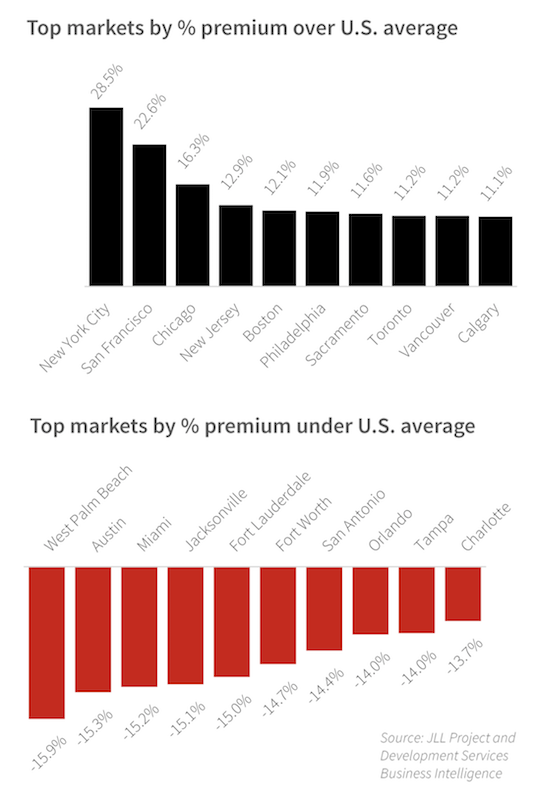

The largest metros are typically the most expensive for office fit outs, but there are still bargains are there, as in Austin, where 3 million sf of new office space is under construction and whose vacancy rate hovers near 11%. Image: JLL

JLL’s report does a deeper dive by offering breakdowns—by 59 metros in the U.S. and Canada, and by fit out style—of hard costs, design and fee costs, FF& costs, and tenant factor costs that are further delineated by base, medium, and high space quality and complexity.

The report then provides more detail on six metros—Austin, Chicago, Los Angeles, New York, San Francisco, and Toronto—that are among the most active places for office construction and redevelopment.

In all six markets, office construction is moving full speed ahead, despite double-digit vacancy rates in four of the six cities. In San Francisco—where 68.8% of new construction is already preleased—absorption rates are expected to rise significantly. In Los Angeles, a big market driver is an expanding digital media sector. And in New York, new supply additions are creating conditions more favorable to renters and are pushing higher-than-ever concessions packages.

Related Stories

Construction Costs | May 16, 2024

New download: BD+C's May 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Contractors | May 15, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of April 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Contractors | May 1, 2024

Nonresidential construction spending rises 0.2% in March 2024 to $1.19 trillion

National nonresidential construction spending increased 0.2% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.19 trillion.

AEC Tech | Apr 30, 2024

Lack of organizational readiness is biggest hurdle to artificial intelligence adoption

Managers of companies in the industrial sector, including construction, have bought the hype of artificial intelligence (AI) as a transformative technology, but their organizations are not ready to realize its promise, according to research from IFS, a global cloud enterprise software company. An IFS survey of 1,700 senior decision-makers found that 84% of executives anticipate massive organizational benefits from AI.

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.