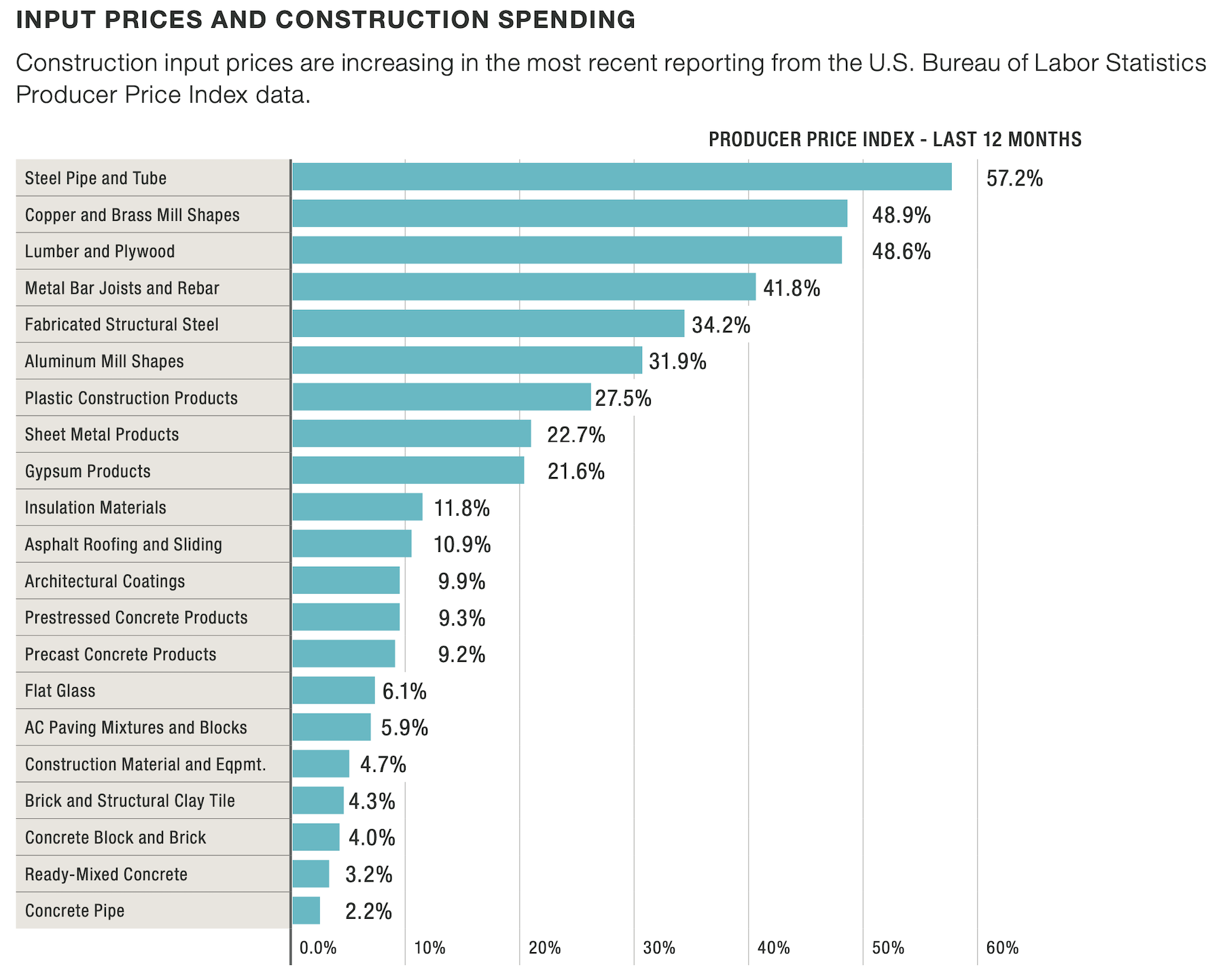

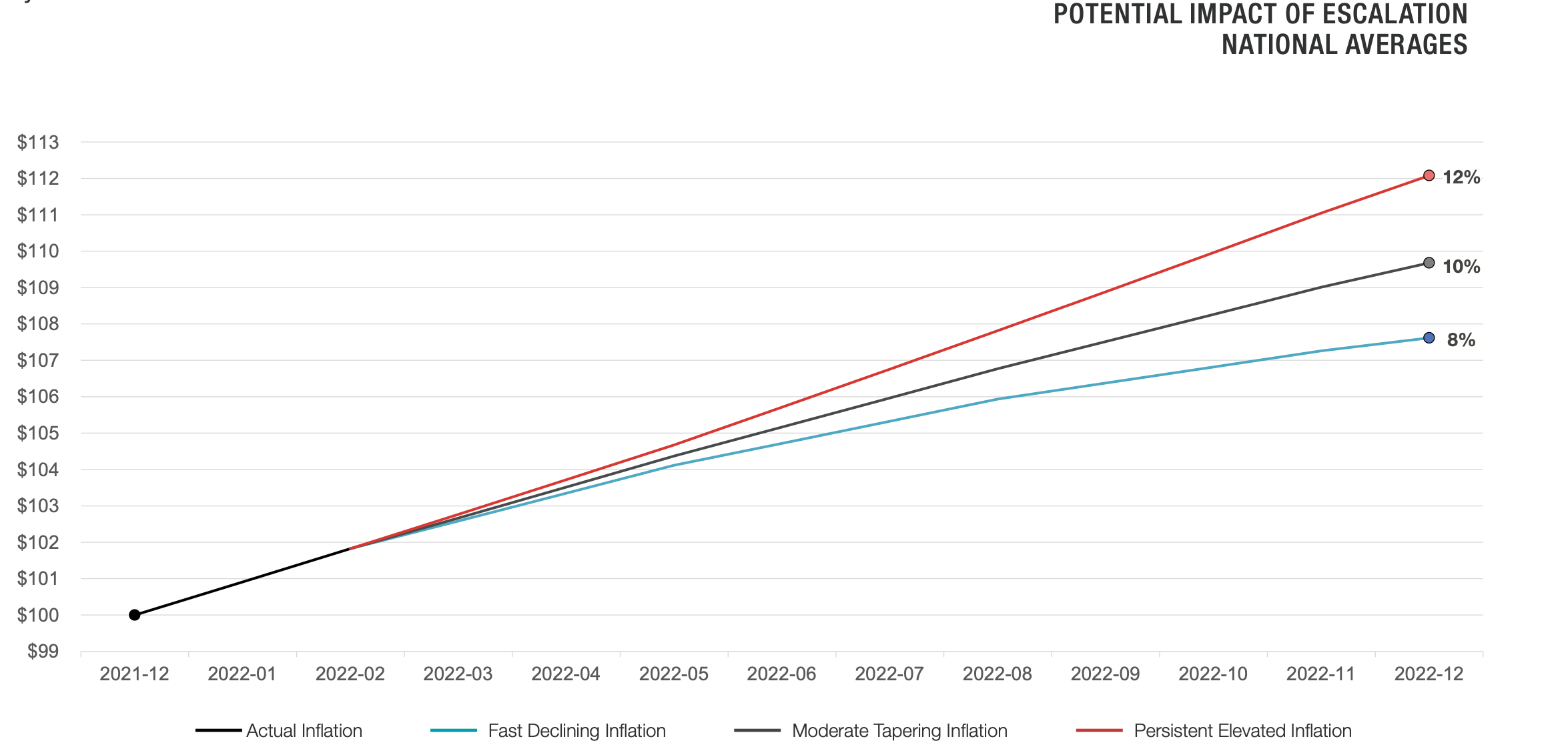

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly. “It’s important to clarify that costs are not decreasing; a more accurate description is that [they are] getting expensive less quickly,” stated Dallas-based architecture and construction firm The Beck Group, in its Summer 2022 Biannual Cost Report, which Beck released this week.

Covering January through June of this year, the report combines market data from a variety of sources—including AIA, FMI, McKinsey & Company, Autodesk, Cumming, the Urban Land Institute, and Associated General Contractors of America—with insights from the firm’s preconstruction teams in six markets: Atlanta, Austin, Charlotte, Dallas-Fort Worth, Denver, and the state of Florida.

Market conditions remain challenging nearly everywhere. “Schedule-related constraints are a new norm in today’s market,” The Beck Group contends. “Construction firms are in the middle of suppliers who can’t or won’t commit to pricing longer than 10 days and owners with historically prolonged approval processes. This reality conflicts with the past when it was still possible to hold pricing for upwards of 60 days.”

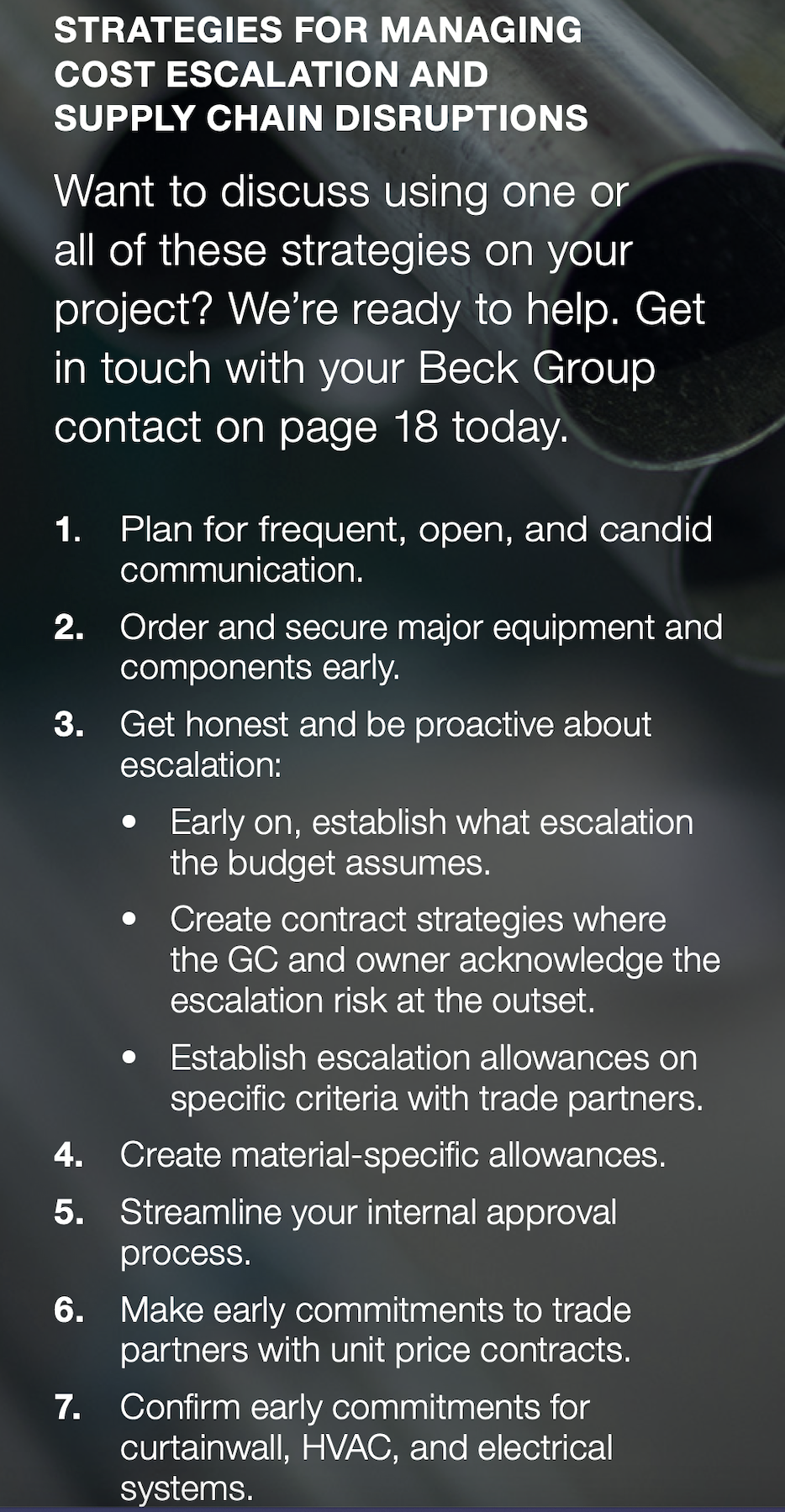

That being said, The Beck Group claims that the industry is on the cusp of a “new era in collaboration to manage costs and schedules.” That is especially true for developers and owners that bring their AEC partners into projects as early as possible. In its report, The Beck Group offers a list of strategies for managing inflation and supply-chain disruptions that mostly revolve around earlier procurement (see box).

Beck itself creates procurement packages for its clients to secure materials and equipment, a service that involves the firm’s design and construction teams.

DENVER AN EXPENSIVE PLACE TO BUILD IN

On the whole, The Beck Group is seeing significant demand and construction activities in the Sun Belt, in line with the “constant migration” of people and businesses to that region. (It points out, for example, that 43 high-rise towers are under development or construction in Austin.) To keep up with that demand, subcontractors in Texas must rely on imported cement (which, ironically, is among the construction materials least affected by current inflation).

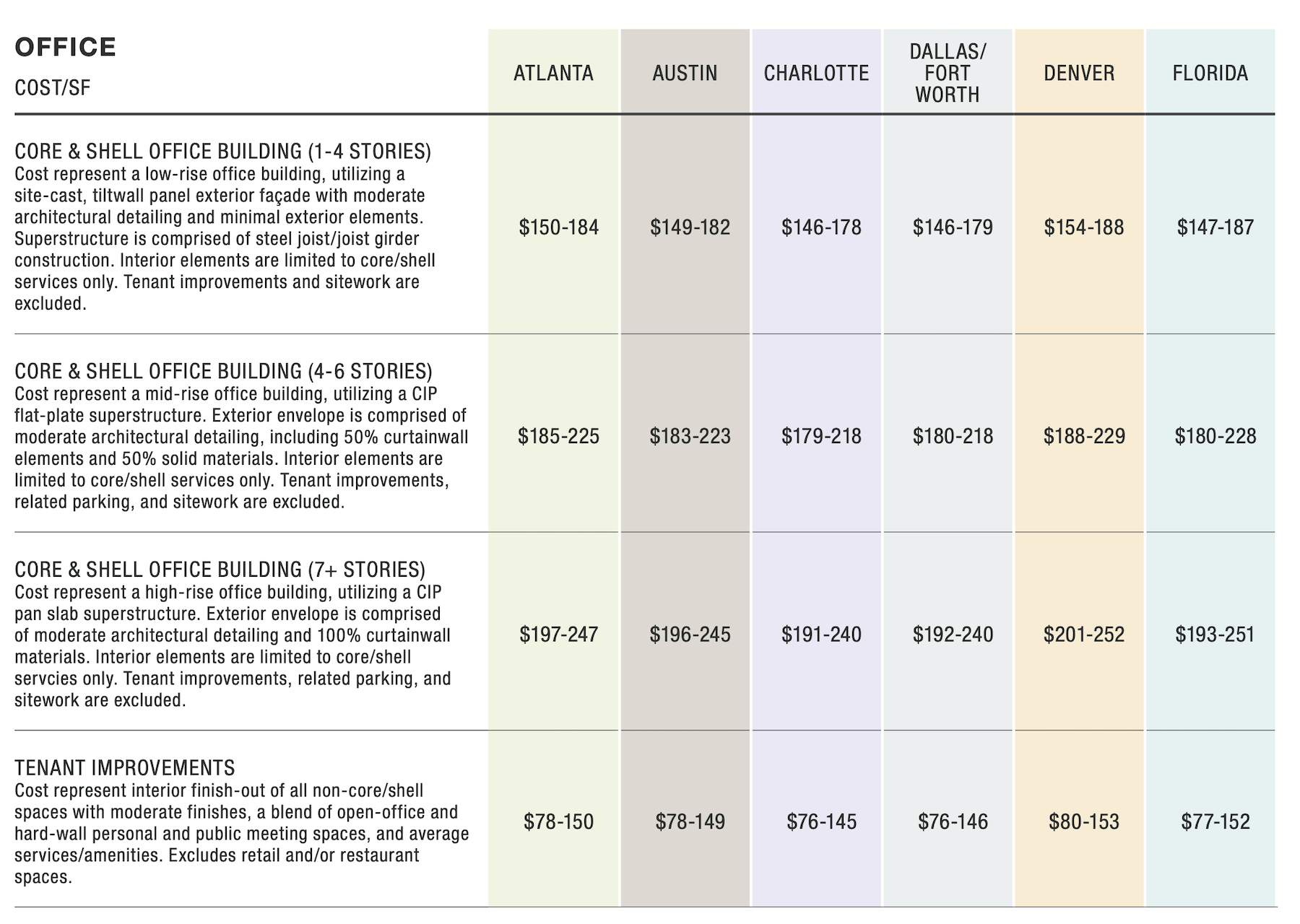

The report takes a deeper dive into the six Sun Belt markets mentioned above, and breaks down project costs by building types—office, healthcare, higher education, faith-based, hospitality, parking, and site work—and their respective sub niches.

The Denver metro is experiencing high demand for multifamily and mixed-use projects. Existing and planned projects are plentiful in the Atlanta market, and subcontractors report substantial backlogs. Building activity in the Florida market remains healthy, bolstered by the state’s economy that is expected to expand by 4 percent between now and 2024. The most significant demand for construction is education, healthcare, and aviation.

Across all building types, it costs more to build or renovate in Denver than in the other five markets, albeit only marginally so in several cases. For example, in healthcare, Denver’s costs per sf for ambulatory surgery centers—ranging from $477 to $583—were around $10 to $25 higher than the other metros. Science and lab buildings cost from $650 to $901 per sf to construct in Denver, versus $631 to $885 in Austin, another S+T hotbed.

The report also compares the cost per key to build or renovate hotels in these six markets, as well as the cost per space for parking and the cost per acre for site development.

CONSTRUCTION EMPLOYMENT STRENGTHENING

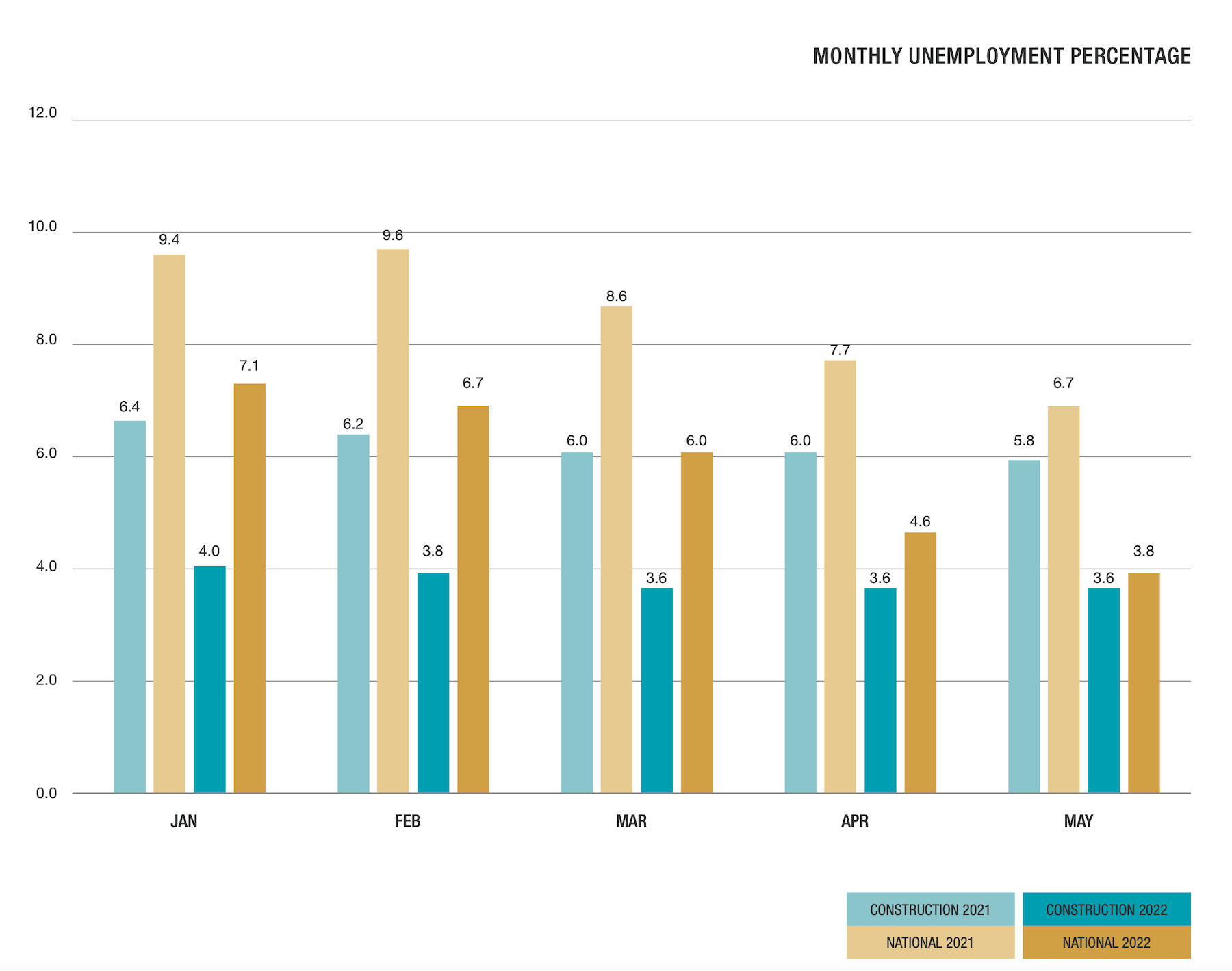

The Beck Group report corroborates what other recent studies have been finding: that the construction employment market, nationally, is improving. Beck predicts this trend to continue as higher wages lure more people into the profession. The employment situation might also explain the slight bump in industry confidence that was evident in the first half of the year.

Related Stories

Construction Costs | May 16, 2024

New download: BD+C's May 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Contractors | May 15, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of April 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Contractors | May 1, 2024

Nonresidential construction spending rises 0.2% in March 2024 to $1.19 trillion

National nonresidential construction spending increased 0.2% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.19 trillion.

AEC Tech | Apr 30, 2024

Lack of organizational readiness is biggest hurdle to artificial intelligence adoption

Managers of companies in the industrial sector, including construction, have bought the hype of artificial intelligence (AI) as a transformative technology, but their organizations are not ready to realize its promise, according to research from IFS, a global cloud enterprise software company. An IFS survey of 1,700 senior decision-makers found that 84% of executives anticipate massive organizational benefits from AI.

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.