The GDP, which in 2020 contracted for the first time in 11 years, is expected to grow by 6.5% in 2021, and keep growing (albeit at a slower pace) in the proceeding two years. In 2021, the U.S. should recover about 60% of the 9.42 million jobs it lost last year, and pick up another 5.1 million jobs over the following two years. Consequently, the unemployment rate is expected to recede to 4% by the end of 2023, close to where it was pre-pandemic.

This economy and jobs picture, coupled with positive predictions about inflation, interest rates, and capitalization rates, sets the stage for the Urban Land Institute’s Real Estate Economic Forecast, released on May 19, which sees a sector poised to rebound, led by returns from single-family, hotel, and industrial assets. The biggest red flag is the office sector, whose national vacancy rates are expected to rise by a higher-than-usual three-year average, but to also recover starting in 2023.

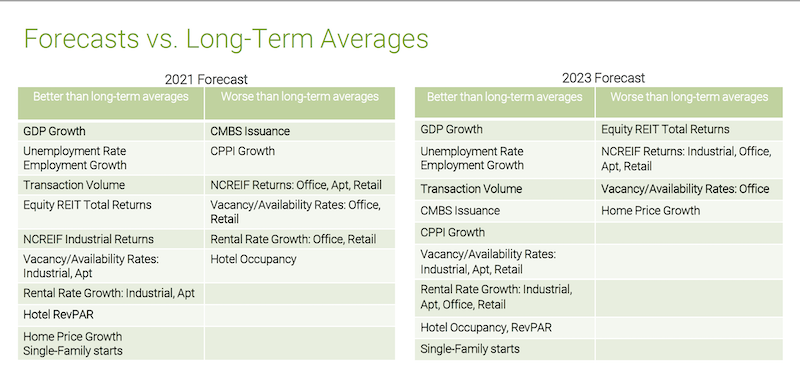

The forecasts for 27 economic and real estate indicators, published in this report, ULI’s 19th, are derived from a survey this spring of 42 economists and analysts from 39 real estate organizations.

Commercial real estate should benefit from a strong economy through 2023. Graphic: ULI

Among the report’s notable findings are these:

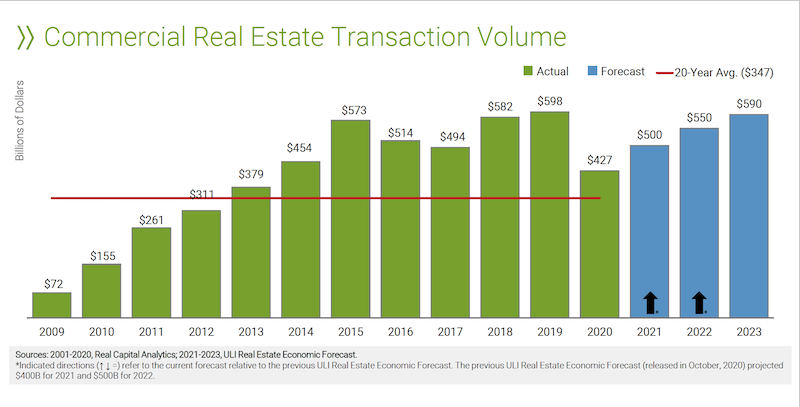

• Commercial real estate transaction volume should recover quickly. It is expected to hit $500 billion this year and $550 billion next year. (The latest peak was $598 billion in 2019.) Commercial mortgage-backed securities issuance is projected at $70 billion this year, and to rise to $90 billion in 2023, exceeding the 20-year $82 billion average.

Transaction volume from real estate is expected to approach pre-pandemic levels again by 2023. Chart: ULI

• Price growth, as measured by the RCA Commercial Property Price Index, should remain below the 2020 level during all three proceeding years. The good news is that ULI is forecasting 5% increases in each of the next two years.

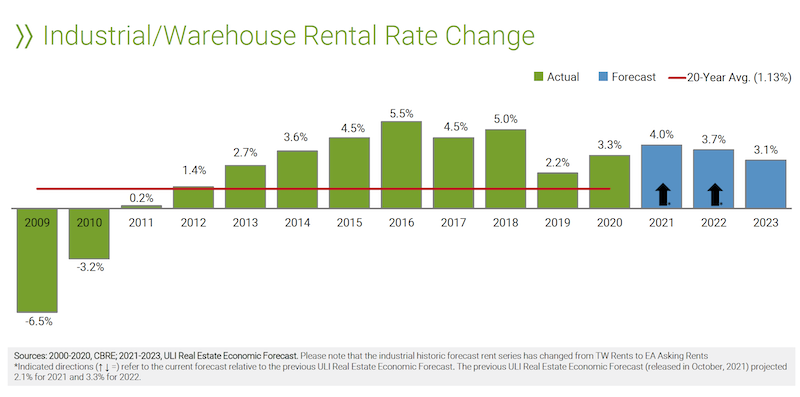

• Rent growth will be similarly volatile. Industrial rents will lead the pack with an average of 3.6% growth between 2021-2023. Multifamily rents will also rise, but office and retail rents are expected to stay in the negative column for a while.

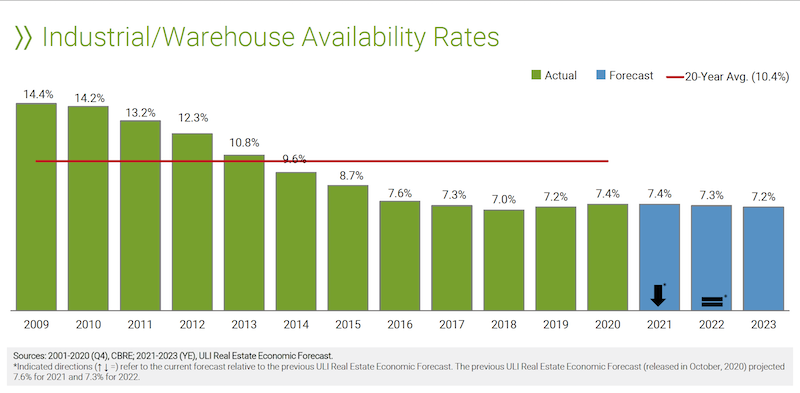

As demand for industrial space increases, so will its rental rates. Charts: ULI

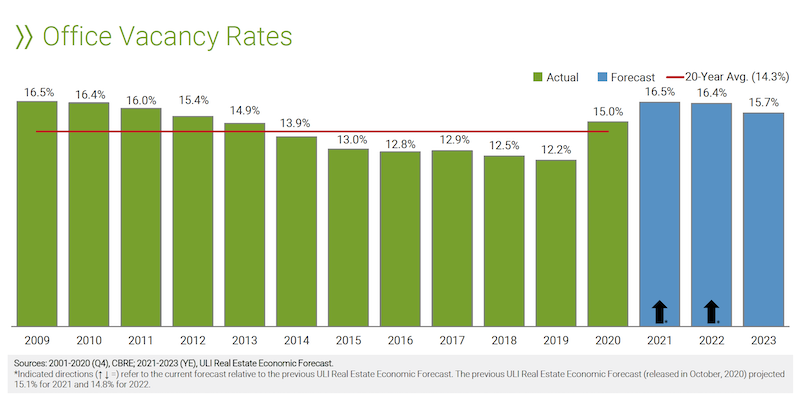

• The report looks at potential vacancy rates for five property types. Availability of warehouses and apartments is expected to remain below their 20-year averages over the next three years. Offices, on the other hand, will see vacancy rates rise to a three-year average of 16.2%, substantively above the sector’s 14.3% 20-year average. Retail vacancy rates, somewhat surprisingly, are projected to average 9.8%, below the sector’s 9.9% 20-year average.

The office sector will have high vacancy rates for at least the next two years. Chart: ULI

• Last year, housing starts exceeded their 20-year average for the first time since the 2008-10 financial crisis. They are expected to hit 1.1 million units this year, and 1.2 million in 2022 and 2023.

• Real estate returns, as measured by the National Council of Real Estate Investment Fiduciaries, are forecast at 4.5%, 5.9%, and 6.5%, respectively, for 2021-2023. Industrial should lead all property types, but even office and retail are projected to generate positive returns.

Related Stories

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

K-12 Schools | Aug 26, 2024

Windows in K-12 classrooms provide opportunities, not distractions

On a knee-jerk level, a window seems like a built-in distraction, guaranteed to promote wandering minds in any classroom or workspace. Yet, a steady stream of studies has found the opposite to be true.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

Data Centers | Aug 8, 2024

Global edge data center market to cross $300 billion by 2026, says JLL

Technological megatrends, including IoT and generative AI, will require computing power to be closer to data generation and consumption, fueling growth of edge IT infrastructure, according to a new JLL report.

MFPRO+ Research | Aug 6, 2024

Matrix multifamily report for July shows ‘hopeful signs’

The multifamily market is showing strength in many ways, according to the July 2024 Matrix Multifamily National Report by Yardi Matrix.

MFPRO+ News | Jul 24, 2024

Most popular cities for renters mid-2024

Rental activity in the U.S. continues to grow halfway through 2024. With the work-from-home boom stabilizing, more renters are eying desirable cities to relocate to.

Office Buildings | Jul 22, 2024

U.S. commercial foreclosures increased 48% in June from last year

The commercial building sector continues to be under financial pressure as foreclosures nationwide increased 48% in June compared to June 2023, according to ATTOM, a real estate data analysis firm.

Healthcare Facilities | Jul 16, 2024

Watch on-demand: Key Trends in the Healthcare Facilities Market for 2024-2025

Join the Building Design+Construction editorial team for this on-demand webinar on key trends, innovations, and opportunities in the $65 billion U.S. healthcare buildings market. A panel of healthcare design and construction experts present their latest projects, trends, innovations, opportunities, and data/research on key healthcare facilities sub-sectors. A 2024-2025 U.S. healthcare facilities market outlook is also presented.

Healthcare Facilities | Jul 11, 2024

New download: BD+C's 2024 Healthcare Annual Report

Welcome to Building Design+Construction’s 2024 Healthcare Annual Report. This free 66-page special report is our first-ever “state of the state” update on the $65 billion healthcare construction sector.