The GDP, which in 2020 contracted for the first time in 11 years, is expected to grow by 6.5% in 2021, and keep growing (albeit at a slower pace) in the proceeding two years. In 2021, the U.S. should recover about 60% of the 9.42 million jobs it lost last year, and pick up another 5.1 million jobs over the following two years. Consequently, the unemployment rate is expected to recede to 4% by the end of 2023, close to where it was pre-pandemic.

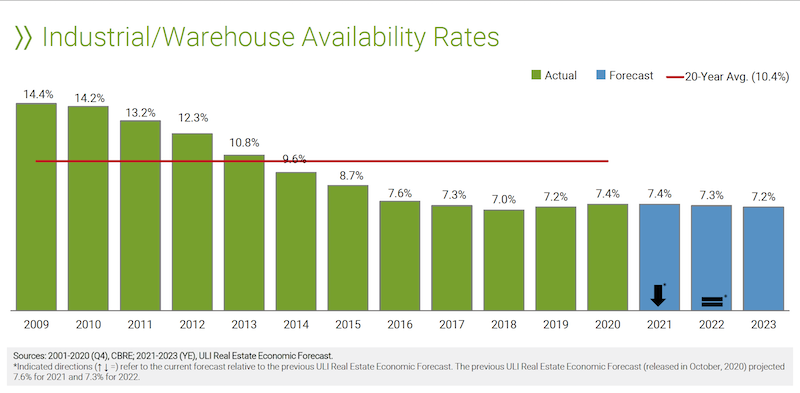

This economy and jobs picture, coupled with positive predictions about inflation, interest rates, and capitalization rates, sets the stage for the Urban Land Institute’s Real Estate Economic Forecast, released on May 19, which sees a sector poised to rebound, led by returns from single-family, hotel, and industrial assets. The biggest red flag is the office sector, whose national vacancy rates are expected to rise by a higher-than-usual three-year average, but to also recover starting in 2023.

The forecasts for 27 economic and real estate indicators, published in this report, ULI’s 19th, are derived from a survey this spring of 42 economists and analysts from 39 real estate organizations.

Commercial real estate should benefit from a strong economy through 2023. Graphic: ULI

Among the report’s notable findings are these:

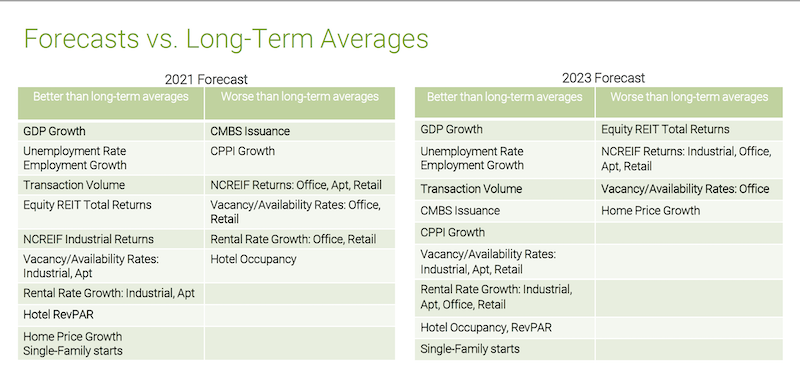

• Commercial real estate transaction volume should recover quickly. It is expected to hit $500 billion this year and $550 billion next year. (The latest peak was $598 billion in 2019.) Commercial mortgage-backed securities issuance is projected at $70 billion this year, and to rise to $90 billion in 2023, exceeding the 20-year $82 billion average.

Transaction volume from real estate is expected to approach pre-pandemic levels again by 2023. Chart: ULI

• Price growth, as measured by the RCA Commercial Property Price Index, should remain below the 2020 level during all three proceeding years. The good news is that ULI is forecasting 5% increases in each of the next two years.

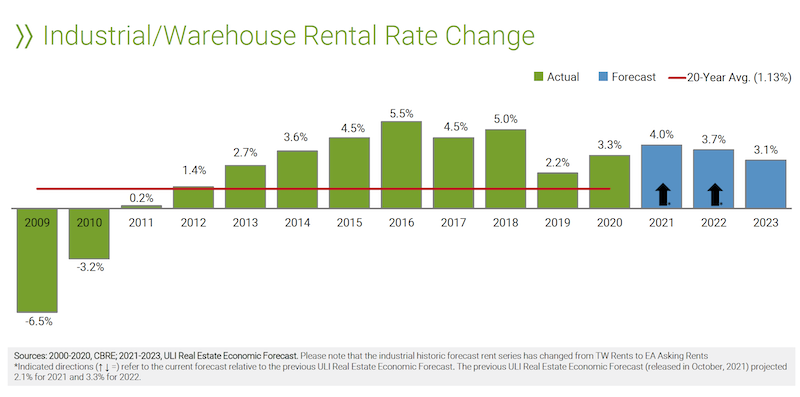

• Rent growth will be similarly volatile. Industrial rents will lead the pack with an average of 3.6% growth between 2021-2023. Multifamily rents will also rise, but office and retail rents are expected to stay in the negative column for a while.

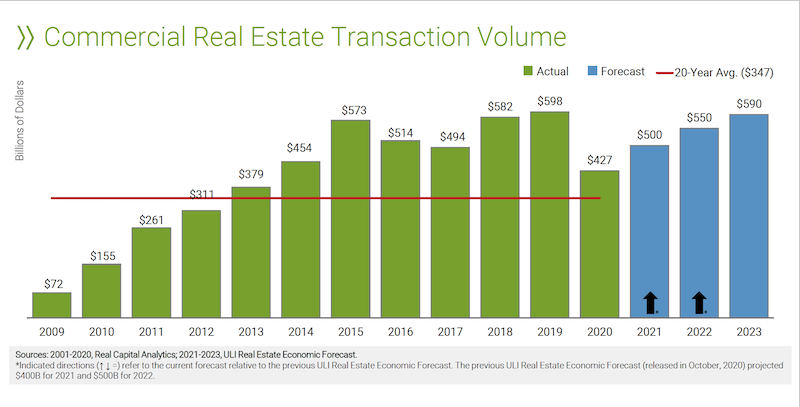

As demand for industrial space increases, so will its rental rates. Charts: ULI

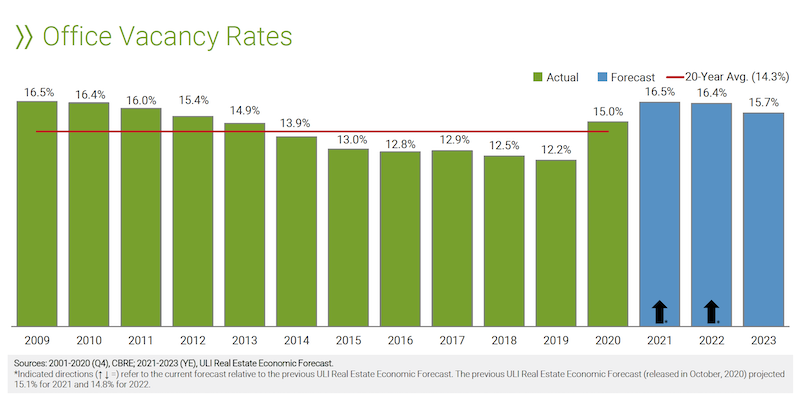

• The report looks at potential vacancy rates for five property types. Availability of warehouses and apartments is expected to remain below their 20-year averages over the next three years. Offices, on the other hand, will see vacancy rates rise to a three-year average of 16.2%, substantively above the sector’s 14.3% 20-year average. Retail vacancy rates, somewhat surprisingly, are projected to average 9.8%, below the sector’s 9.9% 20-year average.

The office sector will have high vacancy rates for at least the next two years. Chart: ULI

• Last year, housing starts exceeded their 20-year average for the first time since the 2008-10 financial crisis. They are expected to hit 1.1 million units this year, and 1.2 million in 2022 and 2023.

• Real estate returns, as measured by the National Council of Real Estate Investment Fiduciaries, are forecast at 4.5%, 5.9%, and 6.5%, respectively, for 2021-2023. Industrial should lead all property types, but even office and retail are projected to generate positive returns.

Related Stories

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Industry Research | Mar 17, 2022

Construction input prices rise 2.6% in February, says ABC

Construction input prices increased 2.6% in February compared to the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today

Museums | Mar 16, 2022

Unpacking the secrets to good museum storage

Museum leaders should focus as much design attention on the archives as the galleries themselves, according to a new white paper by Erin Flynn and Bruce Davis, architects and museum experts with the firm Cooper Robertson.

Codes and Standards | Mar 10, 2022

HOK offers guidance for reducing operational and embodied carbon in labs

Global design firm HOK has released research providing lab owners and developers guidance for reducing operational and embodied carbon to meet net zero goals.

Industry Research | Mar 9, 2022

Survey reveals five ways COVID-19 changed Americans’ impressions of public restrooms and facilities

Upon entering the third year of the pandemic, Americans are not only more sensitive to germs in public restrooms, they now hold higher standards for the cleanliness, condition and technology used in these shared spaces, according to the annual Healthy Handwashing Survey™ from Bradley Corporation conducted in January.

Codes and Standards | Mar 7, 2022

Late payments in the construction industry rose in 2021

Last year was a tough one for contractors when it comes to getting paid on time.

Multifamily Housing | Mar 4, 2022

221,000 renters identify what they want in multifamily housing, post-Covid-19

Fresh data from the 2022 NMHC/Grace Hill Renter Preferences Survey shows how remote work is impacting renters' wants and needs in apartment developments.

Codes and Standards | Mar 4, 2022

Construction industry faces a 650,000 worker shortfall in 2022

The U.S. construction industry must hire an additional 650,000 workers in 2022 to meet the expected demand for labor, according to a model developed by Associated Builders and Contractors.