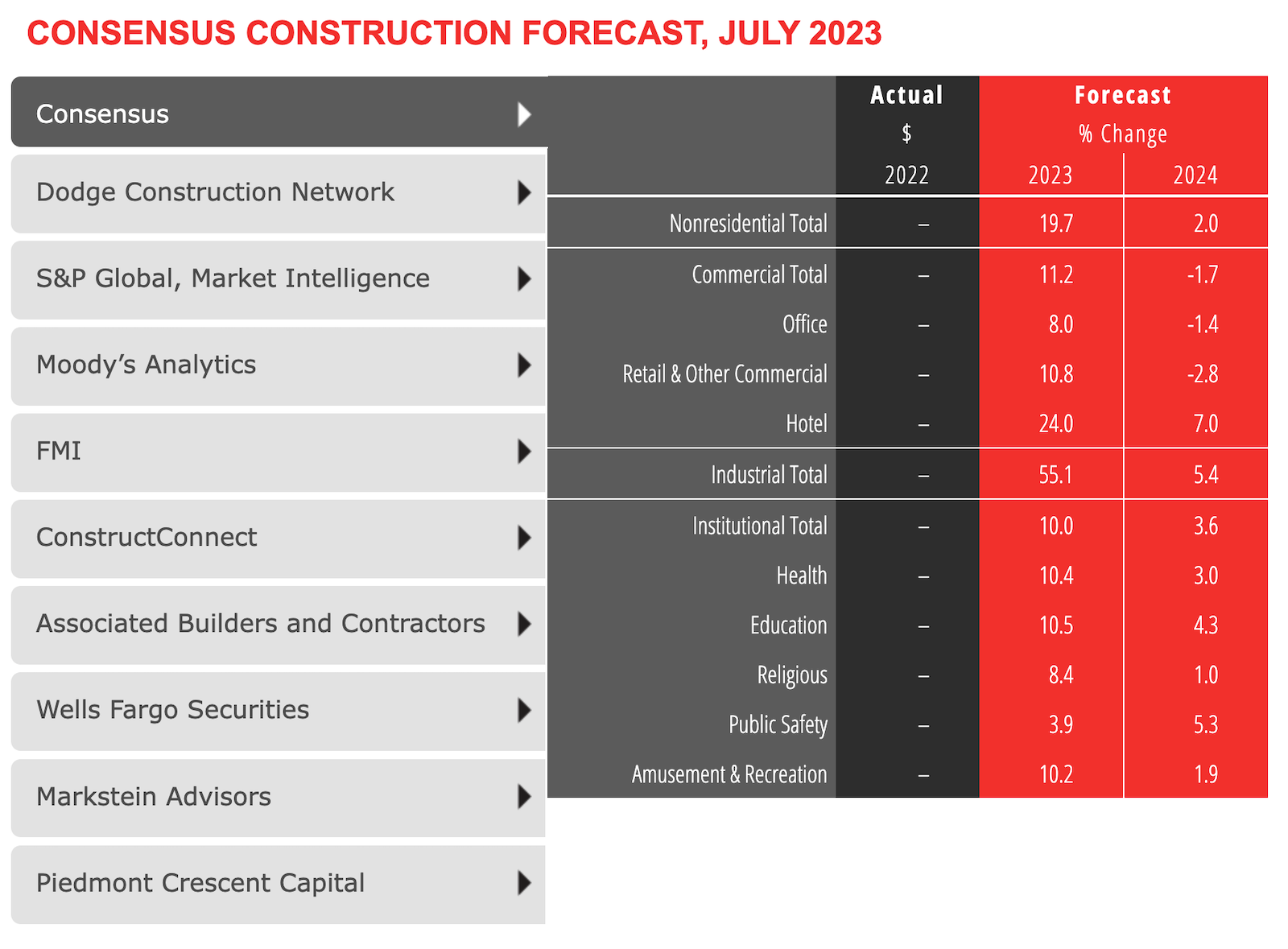

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

The twice-yearly Consensus Construction report aggregates building construction spending forecasts from nine leading economists:

- Richard Branch, Dodge Construction Network

- Scott Hazelton, S&P Global

- Steven Shields, Moody's Analytics

- Brian Strawberry, FMI

- Alex Carrick, ConstructConnect

- Anirban Basu, Associated Builders and Contractors

- Charles Dougherty, Wells Fargo Securities

- Bernard Markstein, Markstein Advisors

- Mark Vitner, Piedmont Crescent Capital

All nine economists are in agreement on a 2024 spending-growth slowdown. Two economists are calling for a contraction in spending (Wells Fargo, -1.0%; Piedmont Crescent Capital, -4.7%). ABC's Anirban Basu is the most bullish on 2024, predicting a 7.7% increase in overall building spending.

"The first half of this year has seen gains in construction spending on nonresidential buildings approaching 20%. However, this scorching growth rate is expected to moderate a bit moving into the third and fourth quarters," wrote AIA Chief Economist Kermit Baker, Hon. AIA, in the report. "Even with the easing in supply chain issues and the improved pricing of many construction materials and products, elevated interest rates, more restrictive lending on the part of banks, nervousness over the direction of the economy, and construction labor constraints are expected to slow the pace of growth."

Bright spots for the remainder of 2023 and 2024 include:

- Healthcare, driven by the aging baby boom population

- Manufacturing/distribution, thanks to the post-Covid reshoring of production resulting from supply chain issues during the pandemic

- Hotels, with leisure travel returning to normal following the pandemic

- Education, as school districts and higher education institutions play catch-up on projects in the wake of Covid.

"There are emerging concerns that outsourcing the manufacturing of high-tech products leaves our economy and national defense more vulnerable," Baker wrote. "The $280 billion in funding provided by the 2022 federal CHIPS and Science Act is designed to advance domestic research and manufacturing of semiconductors in the United States. These funds will boost spending for these facilities for much of the coming decade."

View the full AIA Consensus Construction Forecast Panel report, including an interactive table with market forecasts from all nine economists.

Related Stories

MFPRO+ Research | Oct 15, 2024

Multifamily rents drop in September 2024

The average multifamily rent fell by $3 in September to $1,750, while year-over-year growth was unchanged at 0.9 percent.

Contractors | Oct 1, 2024

Nonresidential construction spending rises slightly in August 2024

National nonresidential construction spending increased 0.1% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.22 trillion.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Student Housing | Sep 17, 2024

Student housing market stays strong in summer 2024

As the summer season winds down, student housing performance remains strong. Preleasing for Yardi 200 schools rose to 89.2% in July 2024, falling just slightly behind the same period last year.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Contractors | Sep 10, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of August 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in August, according to an ABC member survey conducted Aug. 20 to Sept. 5. The reading is down 1.0 months from August 2023.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

Contractors | Aug 21, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of July 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator held steady at 8.4 months in July, according to an ABC member survey conducted July 22 to Aug. 6. The reading is down 0.9 months from July 2023.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

Contractors | Aug 1, 2024

Nonresidential construction spending decreased 0.2% in June

National nonresidential construction spending declined 0.2% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.21 trillion. Nonresidential construction has expanded 5.3% from a year ago.