In the third quarter of 2018, analysts at Lodging Econometrics (LE) report that the top five markets with the largest total hotel construction pipelines are: New York City with 170 projects/29,630 rooms; Dallas with 157 projects/18,954 rooms; Houston with 150 projects/16,473 rooms; Los Angeles with 141 projects/24,129 rooms; and Nashville with 115 projects/15,179 rooms.

Projects already under construction and those scheduled to start construction in the next 12 months, combined, have a total of 3,782 projects/213,798 rooms and are at cyclical highs. Markets with the greatest number of projects already in the ground and those scheduled to start construction in the next 12 months are New York with 145 projects/24,675 rooms, Dallas with 112 projects/13,854 rooms, Houston with 103 projects/11,562 rooms, Los Angeles with 92 projects/14,249 rooms, and Nashville with 88 projects/12,322 rooms.

In the third quarter, Los Angeles has the highest number of new projects announced into the pipeline with 22 projects/6,457 rooms. Detroit follows Los Angeles with 18 projects/1,937 rooms, Dallas with 14 projects/1,529 rooms, New York City with 12 projects/1,857 rooms, and then Atlanta with 12 projects/1,354 rooms.

Reflecting the strong cyclical highs in the pipeline, LE’s forecast for new hotel openings will continue to rise in 2018-2020. In 2018, New York City tops the list with 29 new hotels expected to open/5,351 rooms, Dallas with 29 projects/3,187 rooms, Houston with 27 projects/3,259 rooms, Nashville with 22 projects/3,018 rooms, and Los Angeles with 12 projects/2,152 rooms. In the 2019 forecast, New York continues to lead with the highest number of new hotels expected to open with 59 projects/8,964 rooms followed by Houston with 31 projects/3,098 rooms and Dallas with 30 projects/3,379 rooms. In 2020, Dallas is forecast to take the lead for new hotel openings with 41 projects/4,809 rooms expected to open, followed by New York with 36 projects/5,978 rooms, and Los Angeles with 33 projects/4,292 rooms expected to open.

With the exception of New York City and Houston, the other markets mentioned in the opening show that supply growth has begun to surpass demand. The variances in 2018 year-to-date are small but are certain to widen in the next two years, given the strength of these pipeline in the markets.

All in all, 10 of the top 25 markets show supply growth minimally exceeding demand growth in 2018.

Related Stories

Market Data | Jun 12, 2019

Construction input prices see slight increase in May

Among the 11 subcategories, six saw prices fall last month, with the largest decreases in natural gas.

Market Data | Jun 3, 2019

Nonresidential construction spending up 6.4% year over year in April

Among the 16 sectors tracked by the U.S. Census Bureau, nine experienced an increase in monthly spending, led by water supply and highway and street.

Market Data | Jun 3, 2019

4.1% annual growth in office asking rents above five-year compound annual growth rate

Market has experienced no change in office vacancy rates in three quarters.

Market Data | May 30, 2019

Construction employment increases in 250 out of 358 metros from April 2018 to April 2019

Demand for work is outpacing the supply of workers.

Market Data | May 24, 2019

Construction contractors confidence remains high in March

More than 70% of contractors expect to increase staffing levels over the next six months.

Market Data | May 22, 2019

Slight rebound for architecture billings in April

AIA’s ABI score for April showed a small increase in design services at 50.5 in April.

Market Data | May 9, 2019

The U.S. hotel construction pipeline continues to grow in the first quarter as the economy shows surprising strength

Projects currently under construction stand at 1,709 projects/227,924 rooms.

Market Data | May 9, 2019

Construction input prices continue to rise

Nonresidential input prices rose 0.9% compared to March and are up 2.8% on an annual basis.

Market Data | May 7, 2019

Construction costs in major metros continued to climb last year

Latest Rider Levett Bucknall report estimates rise at more than double the rate of 2018 Growth Domestic Product.

Market Data | Apr 29, 2019

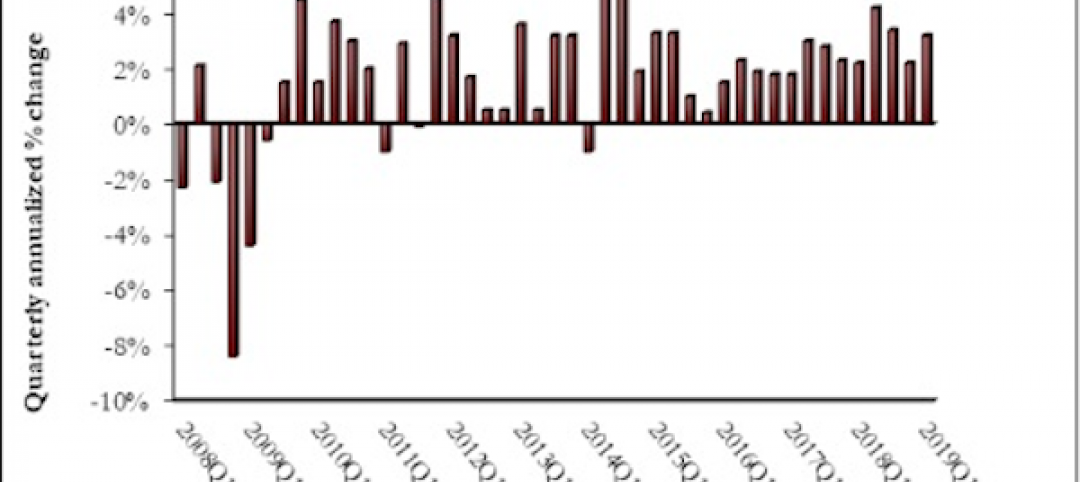

U.S. economic growth crosses 3% threshold to begin the year

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property.