Leopardo Companies, a construction firm serving Chicago and the Midwest, has released its 2017 Construction Economics Report and Outlook, an in-depth analysis of factors that impact development, renovation and build-out costs in commercial facilities, including the office, industrial/manufacturing, retail, multifamily, healthcare and lodging sectors.

Nationally, year-over- year construction spending increased by 4.2 percent in December 2016, as total volume reached an estimated $1.182 trillion. The pace of growth, however, was less than in 2015, when volume increased by 8.7 percent. The slowdown in growth was due to firms pulling back on capital expenditures and speculative development amid concerns about the global economy, political uncertainty, volatility in energy prices, rising construction labor costs and a cautious environment for construction financing.

Chicago and suburban areas experienced construction gains in the office, industrial, healthcare and multifamily sectors, while volume was flat in the retail and homebuilding sectors. The Chicagoland market also saw a 1.4 percent drop in construction employment, compared to a national average increase of 2.2 percent. The loss of construction jobs exacerbates the challenge of rising labor costs in the sector, which will continue into 2017 and beyond.

“We expect to see the construction market resume its healthy pace of growth this year, after a slight slowdown in the second half of 2016 due in part to the uncertainty of the presidential election,” said Leopardo Vice President Mark Yanik. “Although it’s too soon to know the impact of the Trump administration on demand for commercial real estate, some early signs are potentially favorable to our industry, such as plans to withdraw from the Trans-Pacific Partnership, renegotiate the North American Free Trade Agreement, and ease banking regulations.”

Key findings in the report include:

Office construction spending grew 20.9 percent during 2016, driven by growth of the technology sector. Office space will continue to be in high demand in cities like Chicago that are well-suited to millennials’ desire for live-work- play neighborhoods. However, companies that are concerned about high labor cost are increasingly interested in lower-cost markets like Salt Lake City, Denver and San Antonio.

Construction spending in the U.S. manufacturing sector contracted 4.3 percent in 2016 after a record-setting 33.3 percent growth rate in 2015. In the Chicago area, however, industrial/manufacturing construction reached an all-time high last year, as record levels of net absorption reduced occupancies and increased rental rates across the region.

U.S. healthcare construction spending grew 1.7 percent to $41.4 billion by the end of 2016, down 5.4 percent from the previous year. Rising healthcare costs have prompted a shift from hospitals to outpatient facilities, driving demand for medical office buildings and helping to backfill vacancies in retail strip centers. This trend extends to the Chicago area, where new regional clinics are under way to be closer to patient populations.

Download the full 2017 Construction Economics Report and Outlook for free.

Related Stories

Contractors | Feb 14, 2023

The average U.S. contractor has nine months worth of construction work in the pipeline

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

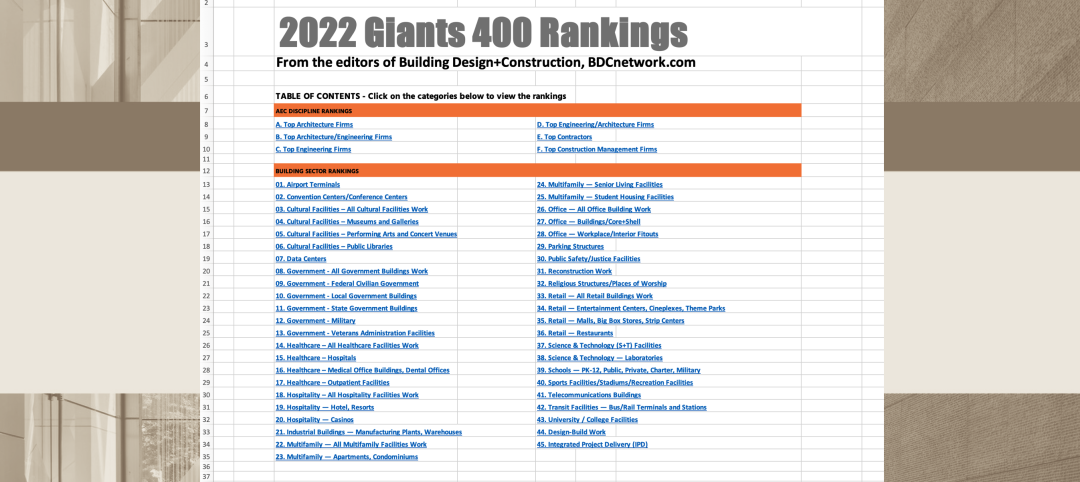

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Multifamily Housing | Feb 7, 2023

Multifamily housing rents flat in January, developers remain optimistic

Multifamily rents were flat in January 2023 as a strong jobs report indicated that fears of a significant economic recession may be overblown. U.S. asking rents averaged $1,701, unchanged from the prior month, according to the latest Yardi Matrix National Multifamily Report.

Market Data | Feb 6, 2023

Nonresidential construction spending dips 0.5% in December 2022

National nonresidential construction spending decreased by 0.5% in December, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $943.5 billion for the month.

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

Market Data | Jan 10, 2023

Construction backlogs at highest level since Q2 2019, says ABC

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.