More than 85% of contractors have been negatively impacted by COVID-19, according to the results of an August reader survey conducted by Construction Executive magazine, which is published by Associated Builders and Contractors. Supply chain disruptions, prolonged municipal permitting processes and delayed inspections due to office closures are all factors contributing to the increased rate of postponement and/or cancellation of construction projects.

While many contractors have not yet seen drastic impacts to their business, as construction was in many areas considered an “essential” service, the long-term implications are concerning. Seventy percent of contractors did not expect the construction industry to stabilize until at least 2021, while an additional 10.4% say they believe it may never reach pre-pandemic levels.

“While the survey respondents’ concerns about market viability and the health fears of the virus itself will remain in place for the duration of 2020 and into next year, contractors did report bright spots, such as a widespread adoption of technology after the outbreak of COVID-19,” said Lauren Pinch, editor-in-chief of CE. “That said, as the pandemic continues to change the landscape of the U.S. construction industry and state and local economies, contractors are continuously trying to assess the near- and long-term effects.”

While an uptick in office renovations to meet social distancing guidelines and to implement other COVID-19-related precautions was expected, more than three-quarters of respondents (76.12%) stated that they have not found this to be the case. Concerns over indoor air quality and proper ventilation may have also led people to believe there would also be a large increase in HVAC upgrade projects, but only 31.79% of respondents stated that this was the case.

Looking toward economic recovery, three-quarters of contractors believe that there will be more interest in construction education programs as people seek out new types of work. Specialty trades, apprenticeship programs, project management training and more tech-focused construction jobs were all listed as areas that contractors believe will see high levels of interest.

Read more about the survey results at ConstructionExec.com and subscribe to CE This Week for the latest news, market developments and business issues impacting the construction industry.

Related Stories

Market Data | Aug 12, 2021

Steep rise in producer prices for construction materials and services continues in July.

The producer price index for new nonresidential construction rose 4.4% over the past 12 months.

Market Data | Aug 6, 2021

Construction industry adds 11,000 jobs in July

Nonresidential sector trails overall recovery.

Market Data | Aug 2, 2021

Nonresidential construction spending falls again in June

The fall was driven by a big drop in funding for highway and street construction and other public work.

Market Data | Jul 29, 2021

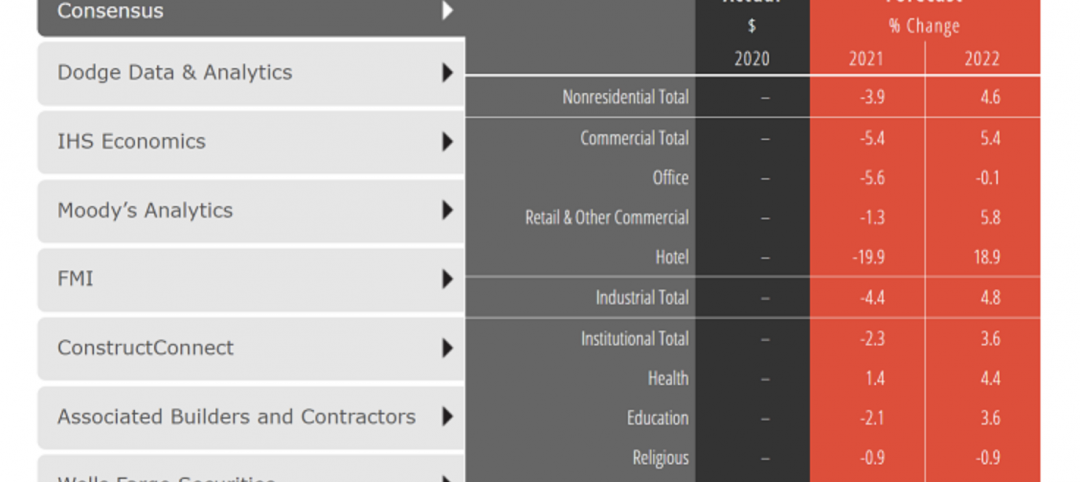

Outlook for construction spending improves with the upturn in the economy

The strongest design sector performers for the remainder of this year are expected to be health care facilities.

Market Data | Jul 29, 2021

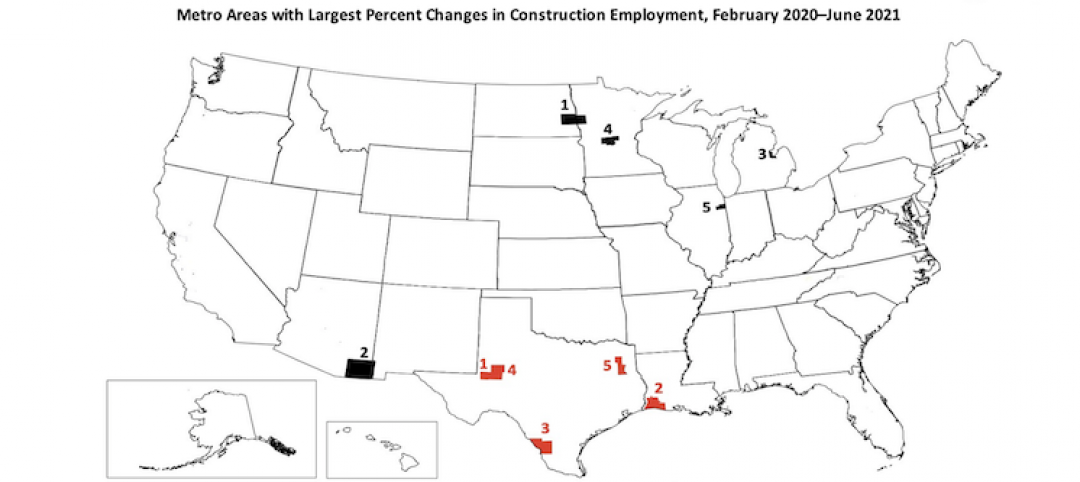

Construction employment lags or matches pre-pandemic level in 101 metro areas despite housing boom

Eighty metro areas had lower construction employment in June 2021 than February 2020.

Market Data | Jul 28, 2021

Marriott has the largest construction pipeline of U.S. franchise companies in Q2‘21

472 new hotels with 59,034 rooms opened across the United States during the first half of 2021.

Market Data | Jul 27, 2021

New York leads the U.S. hotel construction pipeline at the close of Q2‘21

Many hotel owners, developers, and management groups have used the operational downtime, caused by COVID-19’s impact on operating performance, as an opportunity to upgrade and renovate their hotels and/or redefine their hotels with a brand conversion.

Market Data | Jul 26, 2021

U.S. construction pipeline continues along the road to recovery

During the first and second quarters of 2021, the U.S. opened 472 new hotels with 59,034 rooms.

Market Data | Jul 21, 2021

Architecture Billings Index robust growth continues

AIA’s Architecture Billings Index (ABI) score for June remained at an elevated level of 57.1.

Market Data | Jul 20, 2021

Multifamily proposal activity maintains sizzling pace in Q2

Condos hit record high as all multifamily properties benefit from recovery.