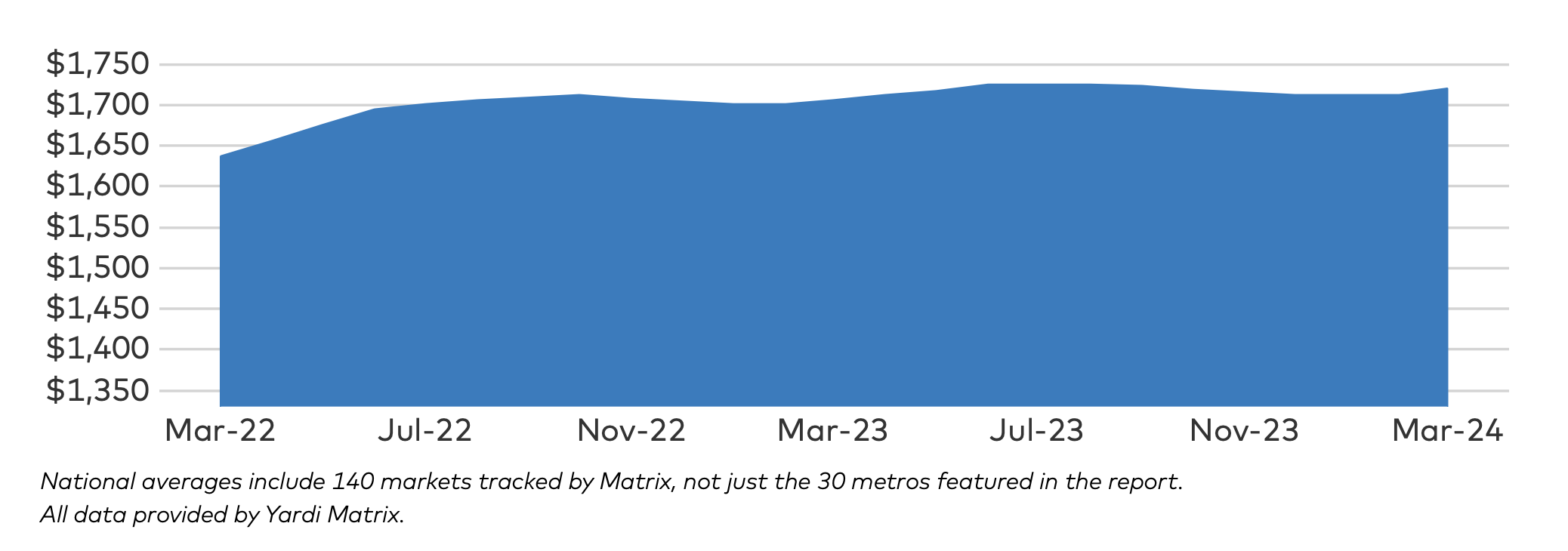

Multifamily rent growth reached a new record in March 2024, recording the largest gain in 20 months. Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

In the March 2024 National Multifamily Report, Matrix’s data provides “some level of comfort” for worried market observers. While 13 of the top metros had negative rent growth over the past year, only two metros reported negative growth in March.

Where is multifamily rent growth the highest?

As the economy continues to create jobs, with household growth boosted by immigration and wage growth, demand for multifamily units continues to rise. Markets in the midwest, such as Columbus, Ohio, Kansas City, Mo., and Indianapolis, Ind., have the highest multifamily rent growth. These metros trailed only New York City, N.Y., which topped the list with 5% year-over-year rent growth.

In March, San Francisco, Calif., was the only metropolitan city to report a growth in occupancy rate (0.1%) year-over-year. On the other hand, 21 metros have occupancy rates down by 0.5% or more, including Atlanta, Ga., and Indianapolis (both down 1.2%).

National Lease Renewals

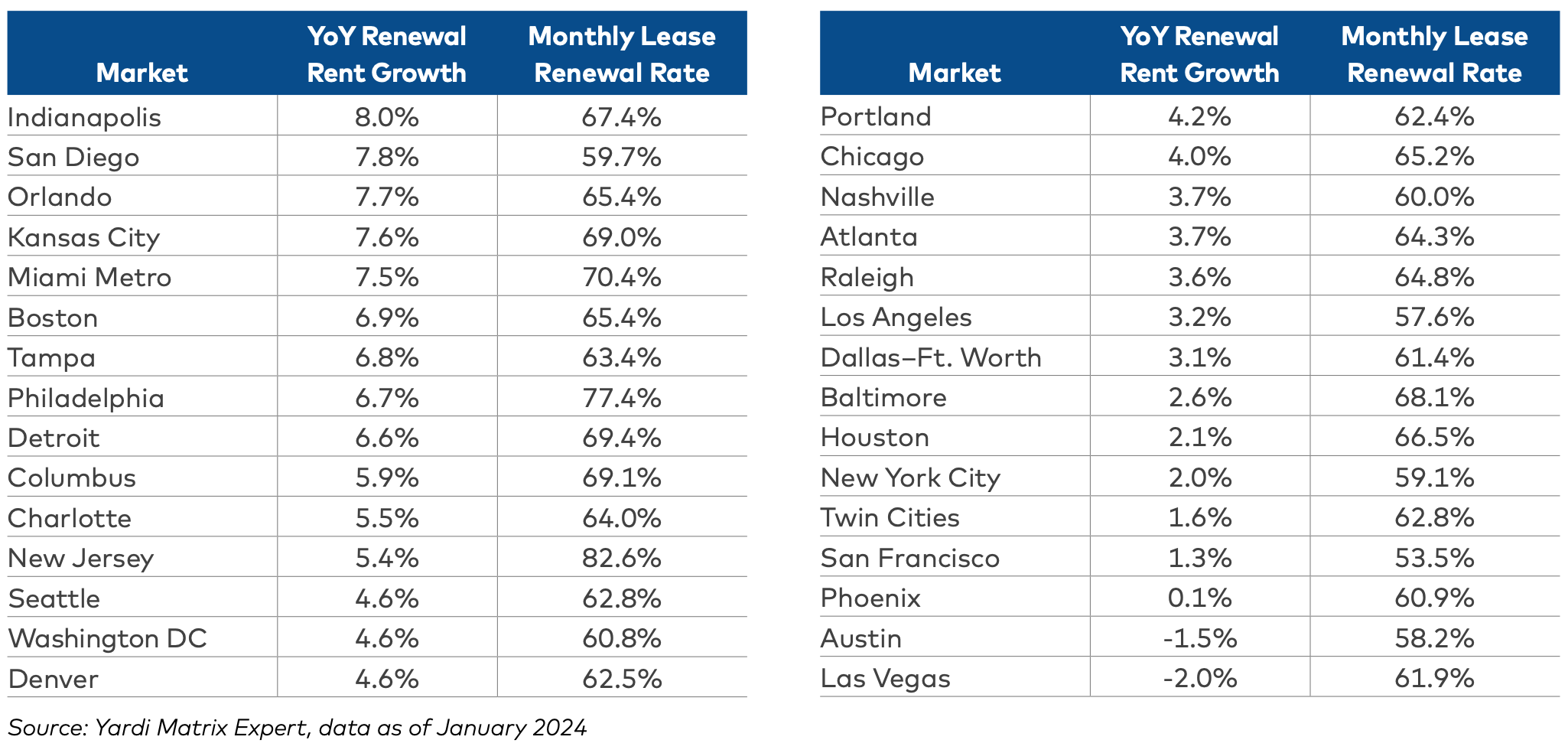

The national lease renewal rate averaged 64.8% at the beginning of 2024—the first time it’s dropped below 65% in more than two years.

Lease renewals were highest in metros like New Jersey (82.6%), Philadelphia, Pa. (77.4%), and Miami, Fla. (70.4%); renewals were lowest in San Francisco (53.5%), Los Angeles (57.6%), and Austin, Texas (58.2%).

Renewal Rent Growth

Year-over-year renewal rent growth—the change for residents that are rolling over existing leases—declined in January 2024 as well, to 4.6 percent.

According to the report, renewal rents have been down every month since May 2023. The metros with the highest year-over-year renewal rent growth include Indianapolis (8%), San Diego (7.8%), and Orlando (7.7%). Just two metros reported negative growth, with Las Vegas, Nev. (–2%) and Austin (–1.5%) at the end of the list.

RELATED

- Multifamily rent growth rate unchanged at 0.3%

- Expenses per multifamily unit reach $8,950 nationally

- Multifamily rents stable heading into spring 2024

Overall outlook for multifamily housing in 2024

From the December 2023 National Multifamily Report by Yardi Matrix:

- Expenses, income, deliveries, and interest rates pose key challenges for the multifamily industry this year

- Though the market is expected to deliver over 500,000 units this year, there is a dramatic decrease in starts

- Recent interest rate declines alleviate potential distress for multifamily owners, but long-term stability remains uncertain

Related Stories

Adaptive Reuse | Mar 21, 2024

Massachusetts launches program to spur office-to-residential conversions statewide

Massachusetts Gov. Maura Healey recently launched a program to help cities across the state identify underused office buildings that are best suited for residential conversions.

Multifamily Housing | Mar 19, 2024

Jim Chapman Construction Group completes its second college town BTR community

JCCG's 200-unit Cottages at Lexington, in Athens, Ga., is fully leased.

Multifamily Housing | Mar 19, 2024

Two senior housing properties renovated with 608 replacement windows

Renovation of the two properties, with 200 apartments for seniors, was financed through a special public/private arrangement.

MFPRO+ New Projects | Mar 18, 2024

Luxury apartments in New York restore and renovate a century-old residential building

COOKFOX Architects has completed a luxury apartment building at 378 West End Avenue in New York City. The project restored and renovated the original residence built in 1915, while extending a new structure east on West 78th Street.

Multifamily Housing | Mar 18, 2024

YWCA building in Boston’s Back Bay converted into 210 affordable rental apartments

Renovation of YWCA at 140 Clarendon Street will serve 111 previously unhoused families and individuals.

Adaptive Reuse | Mar 15, 2024

San Francisco voters approve tax break for office-to-residential conversions

San Francisco voters recently approved a ballot measure to offer tax breaks to developers who convert commercial buildings to residential use. The tax break applies to conversions of up to 5 million sf of commercial space through 2030.

Apartments | Mar 13, 2024

A landscaped canyon runs through this luxury apartment development in Denver

Set to open in April, One River North is a 16-story, 187-unit luxury apartment building with private, open-air terraces located in Denver’s RiNo arts district. Biophilic design plays a central role throughout the building, allowing residents to connect with nature and providing a distinctive living experience.

Affordable Housing | Mar 12, 2024

An all-electric affordable housing project in Southern California offers 48 apartments plus community spaces

In Santa Monica, Calif., Brunson Terrace is an all-electric, 100% affordable housing project that’s over eight times more energy efficient than similar buildings, according to architect Brooks + Scarpa. Located across the street from Santa Monica College, the net zero building has been certified LEED Platinum.

MFPRO+ News | Mar 12, 2024

Multifamily housing starts and permitting activity drop 10% year-over-year

The past year saw over 1.4 million new homes added to the national housing inventory. Despite the 4% growth in units, both the number of new homes under construction and the number of permits dropped year-over-year.

Affordable Housing | Mar 11, 2024

Los Angeles’s streamlined approval policies leading to boom in affordable housing plans

Since December 2022, Los Angeles’s planning department has received plans for more than 13,770 affordable units. The number of units put in the approval pipeline in roughly one year is just below the total number of affordable units approved in Los Angeles in 2020, 2021, and 2022 combined.