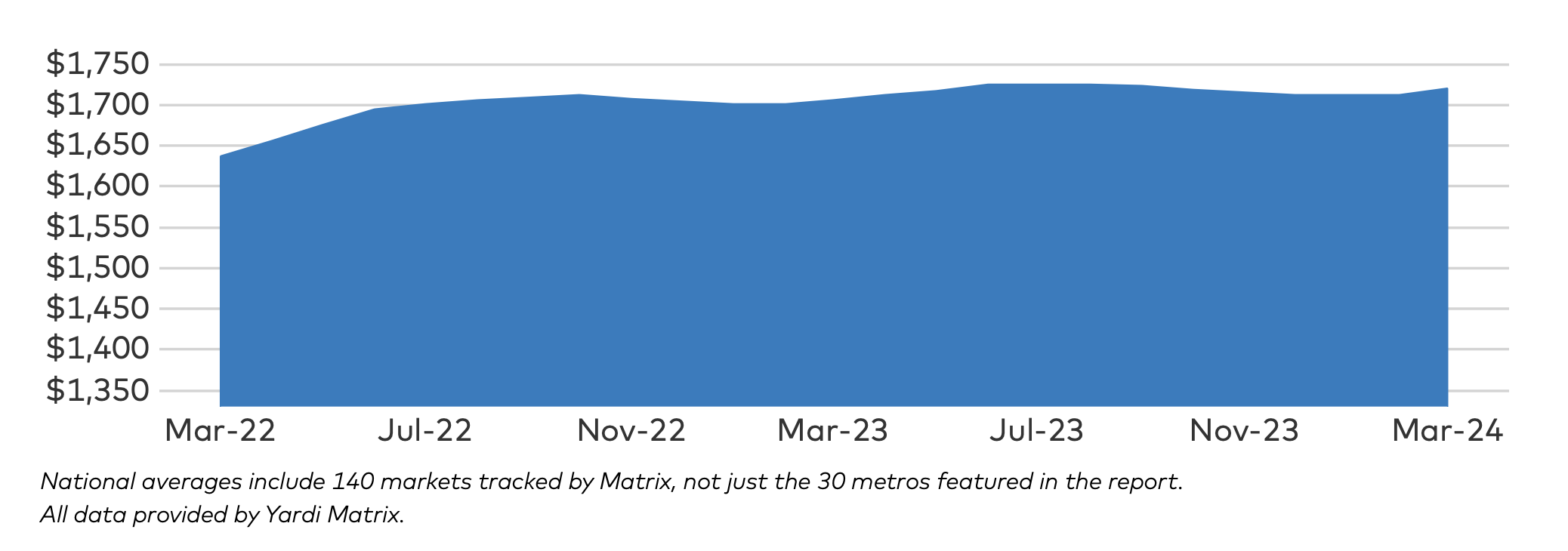

Multifamily rent growth reached a new record in March 2024, recording the largest gain in 20 months. Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

In the March 2024 National Multifamily Report, Matrix’s data provides “some level of comfort” for worried market observers. While 13 of the top metros had negative rent growth over the past year, only two metros reported negative growth in March.

Where is multifamily rent growth the highest?

As the economy continues to create jobs, with household growth boosted by immigration and wage growth, demand for multifamily units continues to rise. Markets in the midwest, such as Columbus, Ohio, Kansas City, Mo., and Indianapolis, Ind., have the highest multifamily rent growth. These metros trailed only New York City, N.Y., which topped the list with 5% year-over-year rent growth.

In March, San Francisco, Calif., was the only metropolitan city to report a growth in occupancy rate (0.1%) year-over-year. On the other hand, 21 metros have occupancy rates down by 0.5% or more, including Atlanta, Ga., and Indianapolis (both down 1.2%).

National Lease Renewals

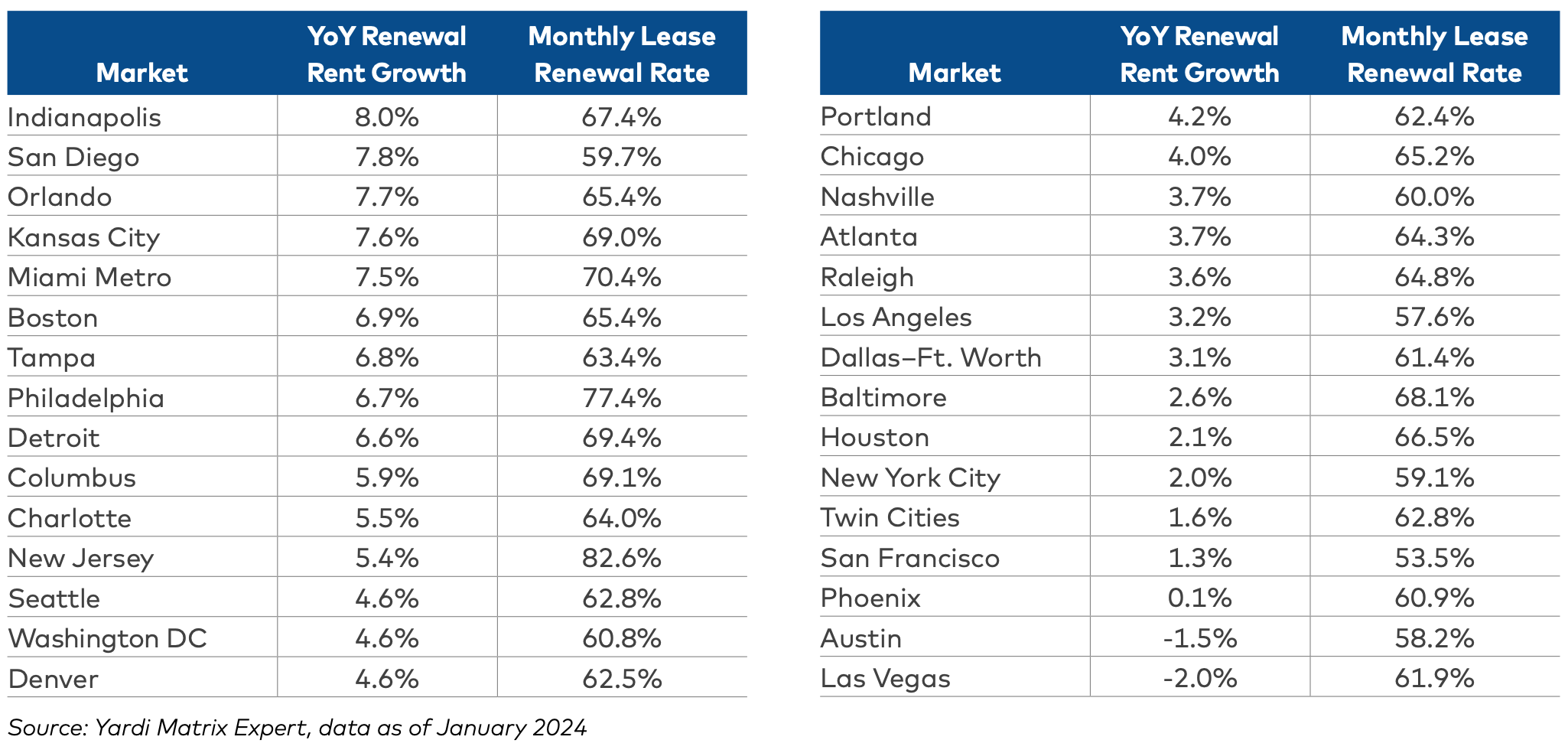

The national lease renewal rate averaged 64.8% at the beginning of 2024—the first time it’s dropped below 65% in more than two years.

Lease renewals were highest in metros like New Jersey (82.6%), Philadelphia, Pa. (77.4%), and Miami, Fla. (70.4%); renewals were lowest in San Francisco (53.5%), Los Angeles (57.6%), and Austin, Texas (58.2%).

Renewal Rent Growth

Year-over-year renewal rent growth—the change for residents that are rolling over existing leases—declined in January 2024 as well, to 4.6 percent.

According to the report, renewal rents have been down every month since May 2023. The metros with the highest year-over-year renewal rent growth include Indianapolis (8%), San Diego (7.8%), and Orlando (7.7%). Just two metros reported negative growth, with Las Vegas, Nev. (–2%) and Austin (–1.5%) at the end of the list.

RELATED

- Multifamily rent growth rate unchanged at 0.3%

- Expenses per multifamily unit reach $8,950 nationally

- Multifamily rents stable heading into spring 2024

Overall outlook for multifamily housing in 2024

From the December 2023 National Multifamily Report by Yardi Matrix:

- Expenses, income, deliveries, and interest rates pose key challenges for the multifamily industry this year

- Though the market is expected to deliver over 500,000 units this year, there is a dramatic decrease in starts

- Recent interest rate declines alleviate potential distress for multifamily owners, but long-term stability remains uncertain

Related Stories

| Sep 19, 2013

Roof renovation tips: Making the choice between overlayment and tear-off

When embarking upon a roofing renovation project, one of the first decisions for the Building Team is whether to tear off and replace the existing roof or to overlay the new roof right on top of the old one. Roofing experts offer guidance on making this assessment.

| Sep 16, 2013

Study analyzes effectiveness of reflective ceilings

Engineers at Brinjac quantify the illuminance and energy consumption levels achieved by increasing the ceiling’s light reflectance.

Smart Buildings | Sep 13, 2013

Chicago latest U.S. city to mandate building energy benchmarking

The Windy City is the latest U.S. city to enact legislation that mandates building energy benchmarking and disclosure for owners of large commercial and residential buildings.

| Sep 13, 2013

Chicago latest U.S. city to mandate building energy benchmarking

The Windy City is the latest U.S. city to enact legislation that mandates building energy benchmarking and disclosure for owners of large commercial and residential buildings.

| Sep 13, 2013

Video: Arup offers tour of world's first algae-powered building

Dubbed BIQ house, the building features a bright green façade consisting of hollow glass panels filled with algae and water.

| Sep 11, 2013

BUILDINGChicago eShow Daily – Day 3 coverage

Day 3 coverage of the BUILDINGChicago/Greening the Heartland conference and expo, taking place this week at the Holiday Inn Chicago Mart Plaza.

| Sep 10, 2013

BUILDINGChicago eShow Daily – Day 2 coverage

The BD+C editorial team brings you this real-time coverage of day 2 of the BUILDINGChicago/Greening the Heartland conference and expo taking place this week at the Holiday Inn Chicago Mart Plaza.

| Sep 4, 2013

Smart building technology: Talking results at the BUILDINGChicago/ Greening the Heartland show

Recent advancements in technology are allowing owners to connect with facilities as never before, leveraging existing automation systems to achieve cost-effective energy improvements. This BUILDINGChicago presentation will feature Procter & Gamble’s smart building management program.

| Sep 3, 2013

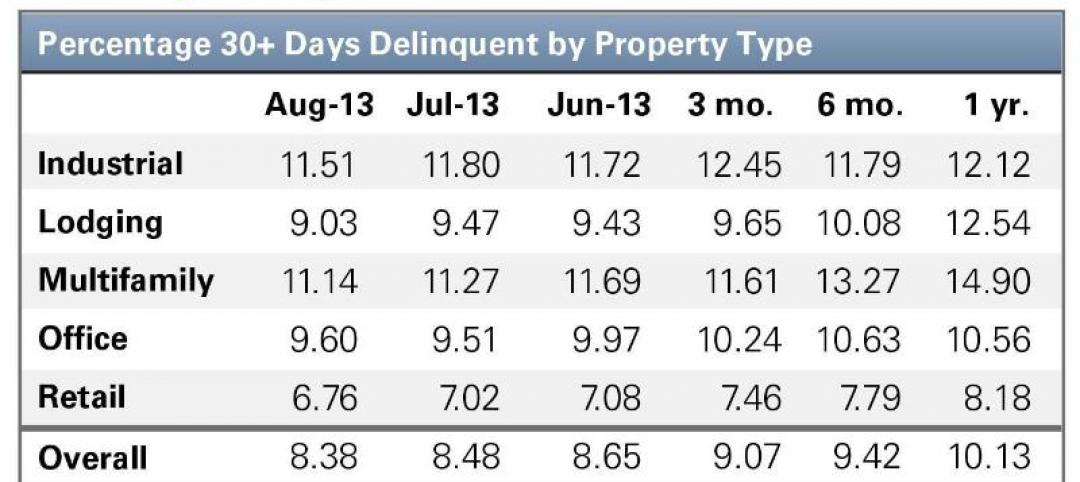

Delinquency rate for commercial real estate loans at lowest level in three years

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago.

| Aug 26, 2013

What you missed last week: Architecture billings up again; record year for hotel renovations; nation's most expensive real estate markets

BD+C's roundup of the top construction market news for the week of August 18 includes the latest architecture billings index from AIA and a BOMA study on the nation's most and least expensive commercial real estate markets.