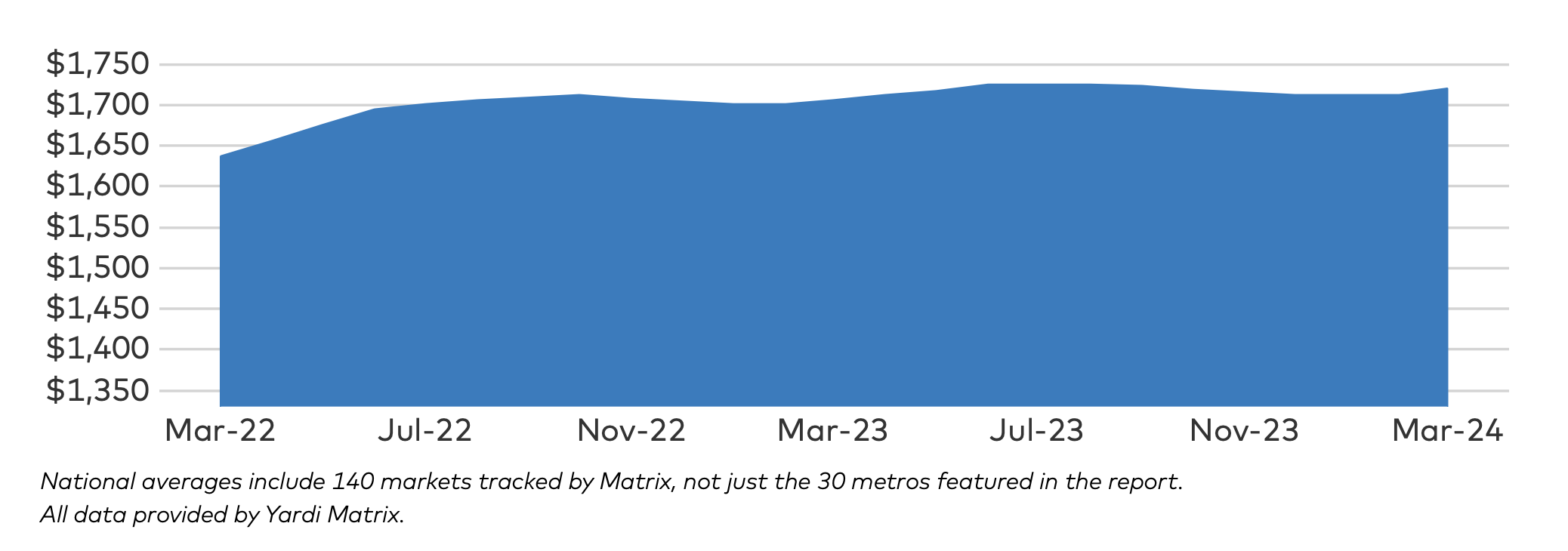

Multifamily rent growth reached a new record in March 2024, recording the largest gain in 20 months. Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

In the March 2024 National Multifamily Report, Matrix’s data provides “some level of comfort” for worried market observers. While 13 of the top metros had negative rent growth over the past year, only two metros reported negative growth in March.

Where is multifamily rent growth the highest?

As the economy continues to create jobs, with household growth boosted by immigration and wage growth, demand for multifamily units continues to rise. Markets in the midwest, such as Columbus, Ohio, Kansas City, Mo., and Indianapolis, Ind., have the highest multifamily rent growth. These metros trailed only New York City, N.Y., which topped the list with 5% year-over-year rent growth.

In March, San Francisco, Calif., was the only metropolitan city to report a growth in occupancy rate (0.1%) year-over-year. On the other hand, 21 metros have occupancy rates down by 0.5% or more, including Atlanta, Ga., and Indianapolis (both down 1.2%).

National Lease Renewals

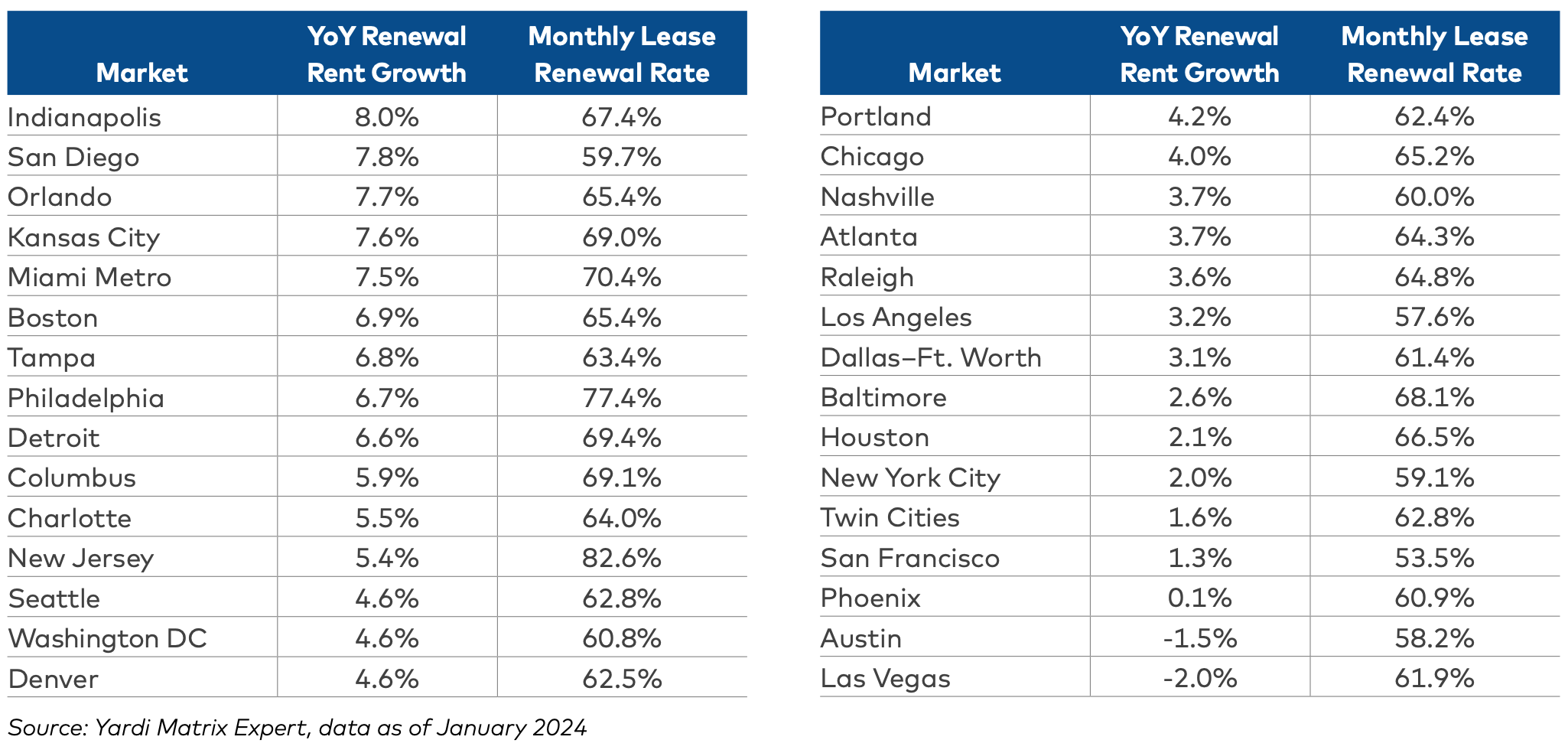

The national lease renewal rate averaged 64.8% at the beginning of 2024—the first time it’s dropped below 65% in more than two years.

Lease renewals were highest in metros like New Jersey (82.6%), Philadelphia, Pa. (77.4%), and Miami, Fla. (70.4%); renewals were lowest in San Francisco (53.5%), Los Angeles (57.6%), and Austin, Texas (58.2%).

Renewal Rent Growth

Year-over-year renewal rent growth—the change for residents that are rolling over existing leases—declined in January 2024 as well, to 4.6 percent.

According to the report, renewal rents have been down every month since May 2023. The metros with the highest year-over-year renewal rent growth include Indianapolis (8%), San Diego (7.8%), and Orlando (7.7%). Just two metros reported negative growth, with Las Vegas, Nev. (–2%) and Austin (–1.5%) at the end of the list.

RELATED

- Multifamily rent growth rate unchanged at 0.3%

- Expenses per multifamily unit reach $8,950 nationally

- Multifamily rents stable heading into spring 2024

Overall outlook for multifamily housing in 2024

From the December 2023 National Multifamily Report by Yardi Matrix:

- Expenses, income, deliveries, and interest rates pose key challenges for the multifamily industry this year

- Though the market is expected to deliver over 500,000 units this year, there is a dramatic decrease in starts

- Recent interest rate declines alleviate potential distress for multifamily owners, but long-term stability remains uncertain

Related Stories

Sponsored | BD+C University Course | May 10, 2022

6 steps to designing a modern wine display

Design-focused wine displays are becoming increasingly popular in amazing residential and commercial properties throughout the world. Top design/build professionals are using stylish wine racks and other premium materials to create wine cellars that are too beautiful to hide in out-of-the-way places like dusty basements. This course explains why wine cellars have become so popular and the key aspects of designing an appealing modern wine cellar, broken into six planning steps that should be considered during pre- or early-construction phases.

Multifamily Housing | May 10, 2022

Multifamily rents up 14.3% in 2022

The average U.S. asking rent for multifamily housing increased $15 in April to an all-time high of $1,659, according to Yardi Matrix.

Sponsored | Multifamily Housing | May 8, 2022

Choosing the right paver system for rooftop amenity spaces

This AIA course by Hoffmann Architects offers best practices for choosing the right paver system for rooftop amenity spaces in multifamily buildings.

Building Team | May 6, 2022

Atlanta’s largest adaptive reuse project features cross laminated timber

Global real estate investment and management firm Jamestown recently started construction on more than 700,000 sf of new live, work, and shop space at Ponce City Market.

Multifamily Housing | May 5, 2022

An Austin firm touts design and communal spaces in its student housing projects

Rhode Partners has multiple towers in various development stages.

Sponsored | BD+C University Course | May 3, 2022

For glass openings, how big is too big?

Advances in glazing materials and glass building systems offer a seemingly unlimited horizon for not only glass performance, but also for the size and extent of these light, transparent forms. Both for enclosures and for indoor environments, novel products and assemblies allow for more glass and less opaque structure—often in places that previously limited their use.

Multifamily Housing | May 3, 2022

Call for Kitchen+Bath projects and products – for next issue of "MULTIFAMILY Design+Construction" (no charge to participate!)

Multifamily AEC firms and developers and product manufacturers can submit Kitchen+Bath projects and products – for the next issue of "MULTIFAMILY Design+Construction."

Multifamily Housing | May 1, 2022

Kraus-Anderson helps fill void in tight Twin Cities housing market

One project just came online, and another apartment building should be completed this summer.

Multifamily Housing | Apr 26, 2022

Fitness centers for multifamily housing: Advice from 'Dr. Fitness,' Karl Smith

In this episode for HorizonTV, Cortland's Karl Smith shares best practices for designing, siting, and operating fitness centers in apartment communities.

Multifamily Housing | Apr 26, 2022

Investment firm Blackstone makes $13 billion acquisition in student-housing sector

Blackstone Inc., a New York-based investment firm, has agreed to buy student-housing owner American Campus Communities Inc.