The Marcum Commercial Construction Index highlights the continued spending weakness in nonresidential construction during the first nine months of the year and points to a significant anticipated change beginning in 2017. The change is being attributed to the major infrastructure-led stimulus package expected from the new Presidential administration. The national Construction Industry Practice group of Marcum LLP, a top national accounting and advisory firm, produces the quarterly index.

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier. Of the category’s 16 subsectors, bright spots included Office-related spending, which registered a whopping 23% gain to $70.7 billion; Lodging, up 20% year-over-year to $28.8 billion; Commercial construction, with a 6% gain to $71.7 billion; Amusement & Recreation, up 3.5% to $21.4 billion; and Educational construction, at $87.1 billion, a 3.3% percent increase.

The remaining 11 nonresidential subsectors all recorded fall-offs for the month, with the greatest declines in Sewage & Waste Disposal (-18.8%), Water Supply (-13.7%), Communication (-12.6%) and Transportation (-11.3%).

“Most construction firms report intense difficulty securing electricians, heating/cooling professionals, welders and carpenters, among others,” says Anirban Basu, Marcum’s Chief Construction Economist, in a press release. The construction worker unemployment rate in October was less than half of what it was five years ago, down to 5.7 % from 13.7 % in the same month of 2011. This compares to a national unemployment rate of 4.9% at the end of the 2016 third quarter.

Looking ahead, the Marcum report predicts that a stimulus package will put pressure on wages and inflation and lead to higher interest rates, which in turn will eventually hurt construction spending. “After a period of relatively intense construction spending due in part to a stimulus package, the nonresidential sector could face a sharp slowdown in construction spending thereafter,” it states.

For the complete Marcum Commercial Construction Index, visit www.marcumllp.com/industries/construction.

Related Stories

Market Data | Jun 12, 2019

Construction input prices see slight increase in May

Among the 11 subcategories, six saw prices fall last month, with the largest decreases in natural gas.

Market Data | Jun 3, 2019

Nonresidential construction spending up 6.4% year over year in April

Among the 16 sectors tracked by the U.S. Census Bureau, nine experienced an increase in monthly spending, led by water supply and highway and street.

Market Data | Jun 3, 2019

4.1% annual growth in office asking rents above five-year compound annual growth rate

Market has experienced no change in office vacancy rates in three quarters.

Market Data | May 30, 2019

Construction employment increases in 250 out of 358 metros from April 2018 to April 2019

Demand for work is outpacing the supply of workers.

Market Data | May 24, 2019

Construction contractors confidence remains high in March

More than 70% of contractors expect to increase staffing levels over the next six months.

Market Data | May 22, 2019

Slight rebound for architecture billings in April

AIA’s ABI score for April showed a small increase in design services at 50.5 in April.

Market Data | May 9, 2019

The U.S. hotel construction pipeline continues to grow in the first quarter as the economy shows surprising strength

Projects currently under construction stand at 1,709 projects/227,924 rooms.

Market Data | May 9, 2019

Construction input prices continue to rise

Nonresidential input prices rose 0.9% compared to March and are up 2.8% on an annual basis.

Market Data | May 7, 2019

Construction costs in major metros continued to climb last year

Latest Rider Levett Bucknall report estimates rise at more than double the rate of 2018 Growth Domestic Product.

Market Data | Apr 29, 2019

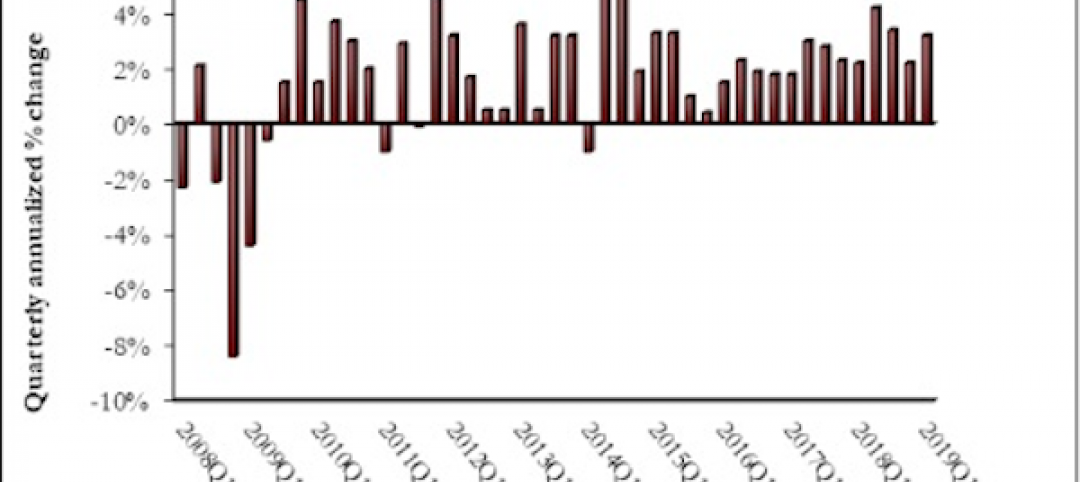

U.S. economic growth crosses 3% threshold to begin the year

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property.