Commercial construction spending in the second quarter of 2017 increased 13% from the same period last year and office construction rose 11%, according to the latest Marcum Commercial Construction Index. However, these bright spots contrast with a decline of 3.1% in overall nonresidential construction spending in June year-over-year and a monthly drop of 2.0% from May 2017. The index is produced by the Construction Services Group of Marcum LLP, a national accounting and advisory firm.

Anirban Basu, the report’s author, attributes the relative strength of the commercial and office subsectors to the ecommerce boom. He also notes that June spending in communication construction increased 4.9% year-over-year and 2.8% from May 2017. The only other subsector to record a gain was health care, with a 2.8% annualized improvement, although monthly results in the sector declined 0.2% in June.

“With interest rates remaining near rock-bottom levels, investors have been chased up the risk spectrum, including into commercial real estate. That has helped to raise property values and prompt new construction. These dynamics have also helped lift industry backlog and supported reasonably solid profit margins,” Mr. Basu wrote.

Spending in all 12 of the remaining nonresidential construction subsectors retreated on both an annualized and monthly basis. The largest declines came in public sector spending, including conservation and development (-20.6% and -7.3%, respectively), sewage and waste disposal (-16.8% and -2.4%), and water supply (-16.4% and -3.7%).

“The infrastructure boom we have been waiting for has not arrived as of yet. Business attitudes and the business environment and confidence remain high for the moment. Backlogs in the private sector are healthy. Investment is robust. It’s my hope that we can turn some of this momentum towards infrastructure, sooner rather than later,” said Joseph Natarelli, national leader of Marcum’s Construction Services Group and an office managing partner in New Haven, Connecticut.

Current economic trends in the construction industry will be discussed in depth at the upcoming annual Marcum Construction Summits in Ft. Lauderdale, Fla., on September 7; New Haven, Conn., on September 27; and New York City on October 23.

For the complete Marcum Commercial Construction Index, visit www.marcumllp.com.

Related Stories

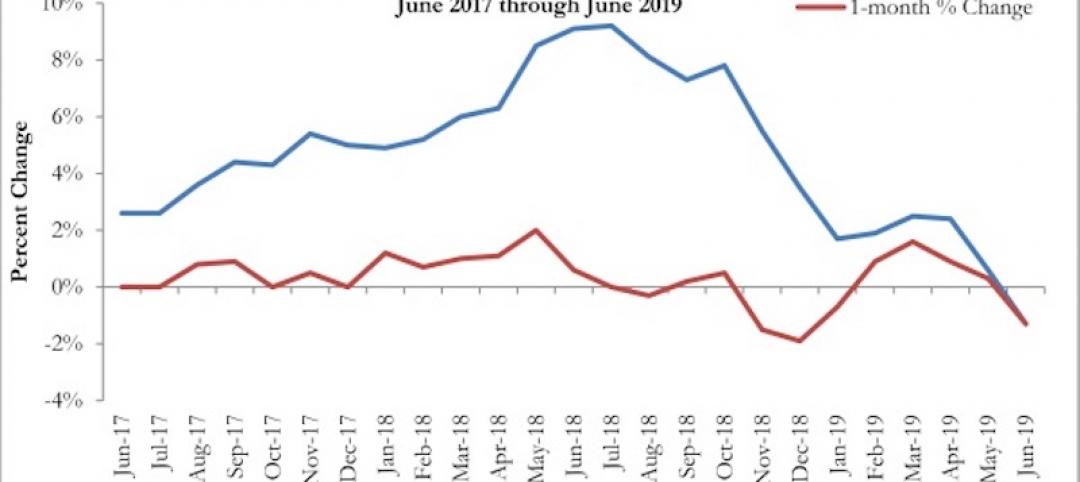

Market Data | Jul 20, 2019

Construction costs continued to rise in second quarter

Labor availability is a big factor in that inflation, according to Rider Levett Bucknall report.

Market Data | Jul 18, 2019

Construction contractors remain confident as summer begins

Contractors were slightly less upbeat regarding profit margins and staffing levels compared to April.

Market Data | Jul 17, 2019

Design services demand stalled in June

Project inquiry gains hit a 10-year low.

Market Data | Jul 16, 2019

ABC’s Construction Backlog Indicator increases modestly in May

The Construction Backlog Indicator expanded to 8.9 months in May 2019.

K-12 Schools | Jul 15, 2019

Summer assignments: 2019 K-12 school construction costs

Using RSMeans data from Gordian, here are the most recent costs per square foot for K-12 school buildings in 10 cities across the U.S.

Market Data | Jul 12, 2019

Construction input prices plummet in June

This is the first time in nearly three years that input prices have fallen on a year-over-year basis.

Market Data | Jul 1, 2019

Nonresidential construction spending slips modestly in May

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, five experienced increases in monthly spending.

Market Data | Jul 1, 2019

Almost 60% of the U.S. construction project pipeline value is concentrated in 10 major states

With a total of 1,302 projects worth $524.6 billion, California has both the largest number and value of projects in the U.S. construction project pipeline.

Market Data | Jun 21, 2019

Architecture billings remain flat

AIA’s Architecture Billings Index (ABI) score for May showed a small increase in design services at 50.2.

Market Data | Jun 19, 2019

Number of U.S. architects continues to rise

New data from NCARB reveals that the number of architects continues to increase.