In the recently released quarterly United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the franchise companies with the largest construction pipelines at the end of the second quarter of 2020 are Marriott International with 1,487 projects/195,952 rooms, followed by Hilton Worldwide with 1,395 projects/160,078 rooms, and InterContinental Hotels Group (IHG) with 920 projects/94,499 rooms. Combined these three companies account for 68% of the projects in the total pipeline; roughly the same percentage as the Q1’20 close.

Hilton’s Home2 Suites and IHG’s Holiday Inn Express continue to be the most prominent brands in the U.S. pipeline with 415 projects/43,336 rooms and 371 projects/35,539 rooms, respectively. Hampton by Hilton follows with 304 projects/31,365 rooms and then Marriott’s Fairfield Inn with 302 projects/29,251 rooms. These four brands combined represent an impressive 25% of the projects in the total pipeline.

Other notable brands in the pipeline for each of these franchise companies are Tru by Hilton with 298 projects/28,863 rooms; Marriott’s Residence Inn with 208 projects/25,520 rooms, SpringHill Suites with 184 projects/20,842 rooms, and TownePlace Suites with 207 projects/20,802 rooms; and then IHG’s Avid Hotel with 189 projects/17,090 rooms.

In the second quarter of 2020, LE recorded 580 conversion projects/66,852 rooms. Of these conversion totals, Best Western dominates with 150 conversion projects/13,482 rooms, alone claiming 25% of the conversion pipeline by projects. Following Best Western is Marriott with 79 projects/13,721 rooms, Hilton has 69 projects/11,279 rooms, and IHG recorded 50 projects/5,382 rooms. Best Western and these three franchise companies combined account for 66% of all the rooms in the conversion pipeline across the United States.

In the first half of 2020, 313 new hotels with 36,992 rooms opened across the United States. Of those openings, Marriott, Hilton and IHG collectively opened 69% of the hotels. Marriott opened 90 hotels 11,036 rooms, Hilton opened 82 hotels/8,728 rooms, and IHG opened 44 hotels/4,190 rooms.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

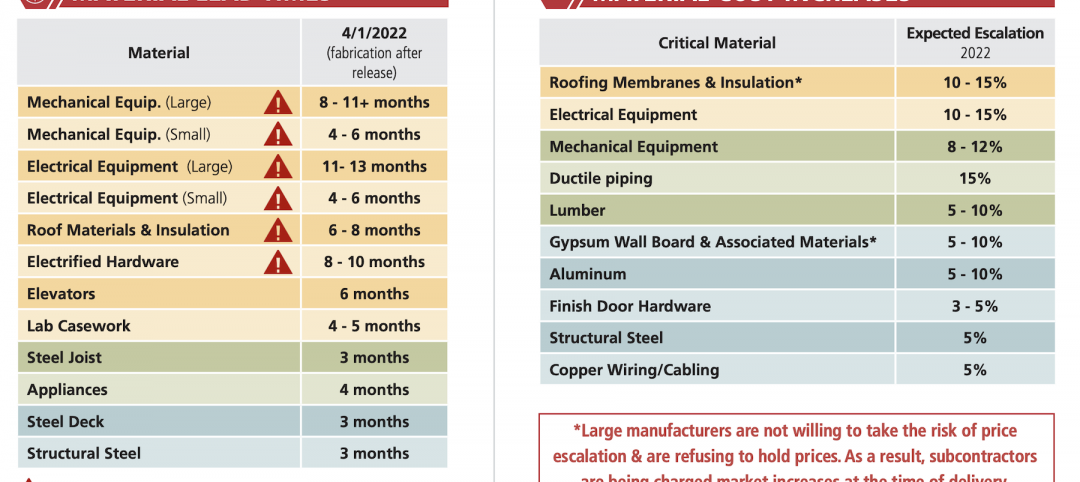

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment