In the recently released quarterly United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the franchise companies with the largest construction pipelines at the end of the second quarter of 2020 are Marriott International with 1,487 projects/195,952 rooms, followed by Hilton Worldwide with 1,395 projects/160,078 rooms, and InterContinental Hotels Group (IHG) with 920 projects/94,499 rooms. Combined these three companies account for 68% of the projects in the total pipeline; roughly the same percentage as the Q1’20 close.

Hilton’s Home2 Suites and IHG’s Holiday Inn Express continue to be the most prominent brands in the U.S. pipeline with 415 projects/43,336 rooms and 371 projects/35,539 rooms, respectively. Hampton by Hilton follows with 304 projects/31,365 rooms and then Marriott’s Fairfield Inn with 302 projects/29,251 rooms. These four brands combined represent an impressive 25% of the projects in the total pipeline.

Other notable brands in the pipeline for each of these franchise companies are Tru by Hilton with 298 projects/28,863 rooms; Marriott’s Residence Inn with 208 projects/25,520 rooms, SpringHill Suites with 184 projects/20,842 rooms, and TownePlace Suites with 207 projects/20,802 rooms; and then IHG’s Avid Hotel with 189 projects/17,090 rooms.

In the second quarter of 2020, LE recorded 580 conversion projects/66,852 rooms. Of these conversion totals, Best Western dominates with 150 conversion projects/13,482 rooms, alone claiming 25% of the conversion pipeline by projects. Following Best Western is Marriott with 79 projects/13,721 rooms, Hilton has 69 projects/11,279 rooms, and IHG recorded 50 projects/5,382 rooms. Best Western and these three franchise companies combined account for 66% of all the rooms in the conversion pipeline across the United States.

In the first half of 2020, 313 new hotels with 36,992 rooms opened across the United States. Of those openings, Marriott, Hilton and IHG collectively opened 69% of the hotels. Marriott opened 90 hotels 11,036 rooms, Hilton opened 82 hotels/8,728 rooms, and IHG opened 44 hotels/4,190 rooms.

Related Stories

Industry Research | Aug 29, 2019

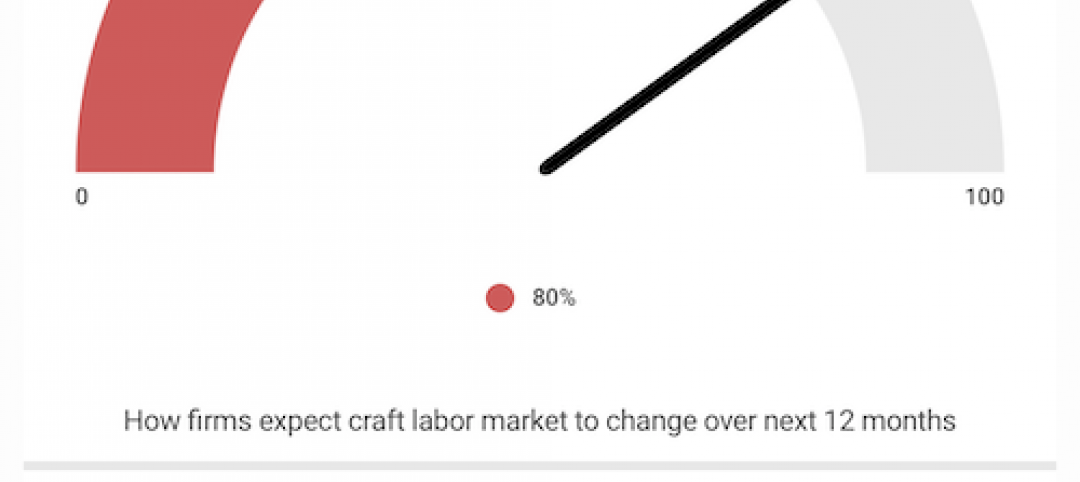

Construction firms expect labor shortages to worsen over the next year

A new AGC-Autodesk survey finds more companies turning to technology to support their jobsites.

Market Data | Aug 21, 2019

Architecture Billings Index continues its streak of soft readings

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Aug 19, 2019

Multifamily market sustains positive cycle

Year-over-year growth tops 3% for 13th month. Will the economy stifle momentum?

Market Data | Aug 16, 2019

Students say unclean restrooms impact their perception of the school

The findings are part of Bradley Corporation’s Healthy Hand Washing Survey.

Market Data | Aug 12, 2019

Mid-year economic outlook for nonresidential construction: Expansion continues, but vulnerabilities pile up

Emerging weakness in business investment has been hinting at softening outlays.

Market Data | Aug 7, 2019

National office vacancy holds steady at 9.7% in slowing but disciplined market

Average asking rental rate posts 4.2% annual growth.

Market Data | Aug 1, 2019

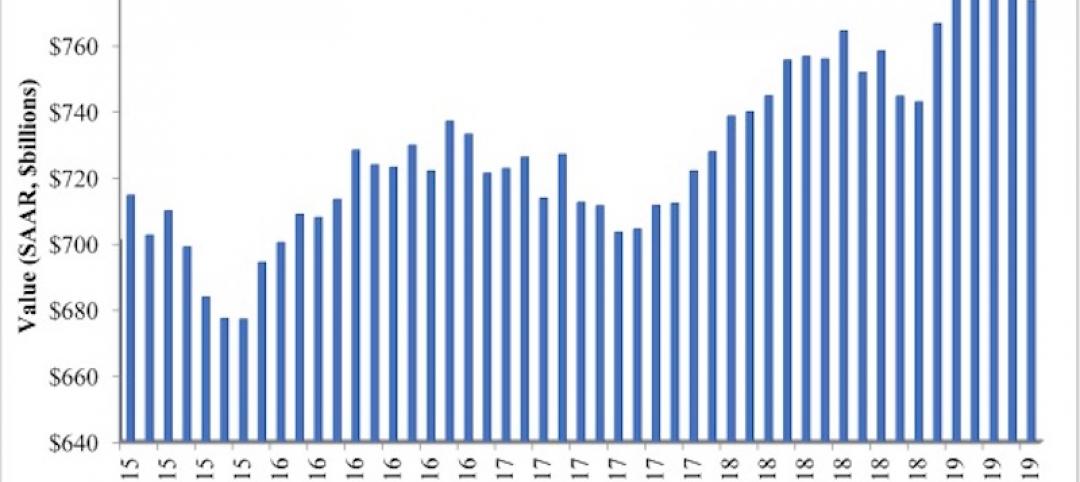

Nonresidential construction spending slows in June, remains elevated

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, seven experienced increases in monthly spending.

Market Data | Jul 31, 2019

For the second quarter of 2019, the U.S. hotel construction pipeline continued its year-over-year growth spurt

The growth spurt continued even as business investment declined for the first time since 2016.

Market Data | Jul 23, 2019

Despite signals of impending declines, continued growth in nonresidential construction is expected through 2020

AIA’s latest Consensus Construction Forecast predicts growth.

Market Data | Jul 20, 2019

Construction costs continued to rise in second quarter

Labor availability is a big factor in that inflation, according to Rider Levett Bucknall report.