In the recently released quarterly United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the franchise companies with the largest construction pipelines at the end of the second quarter of 2020 are Marriott International with 1,487 projects/195,952 rooms, followed by Hilton Worldwide with 1,395 projects/160,078 rooms, and InterContinental Hotels Group (IHG) with 920 projects/94,499 rooms. Combined these three companies account for 68% of the projects in the total pipeline; roughly the same percentage as the Q1’20 close.

Hilton’s Home2 Suites and IHG’s Holiday Inn Express continue to be the most prominent brands in the U.S. pipeline with 415 projects/43,336 rooms and 371 projects/35,539 rooms, respectively. Hampton by Hilton follows with 304 projects/31,365 rooms and then Marriott’s Fairfield Inn with 302 projects/29,251 rooms. These four brands combined represent an impressive 25% of the projects in the total pipeline.

Other notable brands in the pipeline for each of these franchise companies are Tru by Hilton with 298 projects/28,863 rooms; Marriott’s Residence Inn with 208 projects/25,520 rooms, SpringHill Suites with 184 projects/20,842 rooms, and TownePlace Suites with 207 projects/20,802 rooms; and then IHG’s Avid Hotel with 189 projects/17,090 rooms.

In the second quarter of 2020, LE recorded 580 conversion projects/66,852 rooms. Of these conversion totals, Best Western dominates with 150 conversion projects/13,482 rooms, alone claiming 25% of the conversion pipeline by projects. Following Best Western is Marriott with 79 projects/13,721 rooms, Hilton has 69 projects/11,279 rooms, and IHG recorded 50 projects/5,382 rooms. Best Western and these three franchise companies combined account for 66% of all the rooms in the conversion pipeline across the United States.

In the first half of 2020, 313 new hotels with 36,992 rooms opened across the United States. Of those openings, Marriott, Hilton and IHG collectively opened 69% of the hotels. Marriott opened 90 hotels 11,036 rooms, Hilton opened 82 hotels/8,728 rooms, and IHG opened 44 hotels/4,190 rooms.

Related Stories

Market Data | Nov 2, 2018

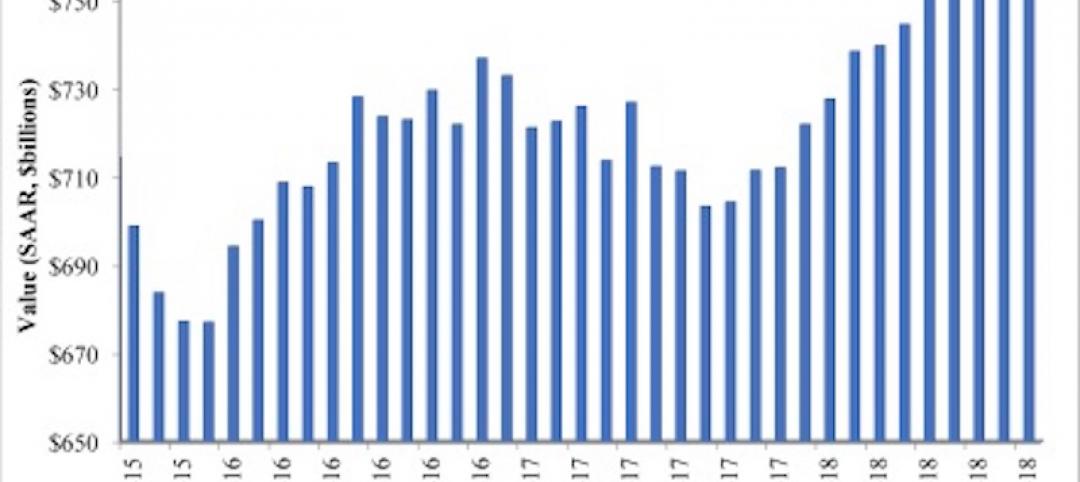

Nonresidential spending retains momentum in September, up 8.9% year over year

Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September.

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

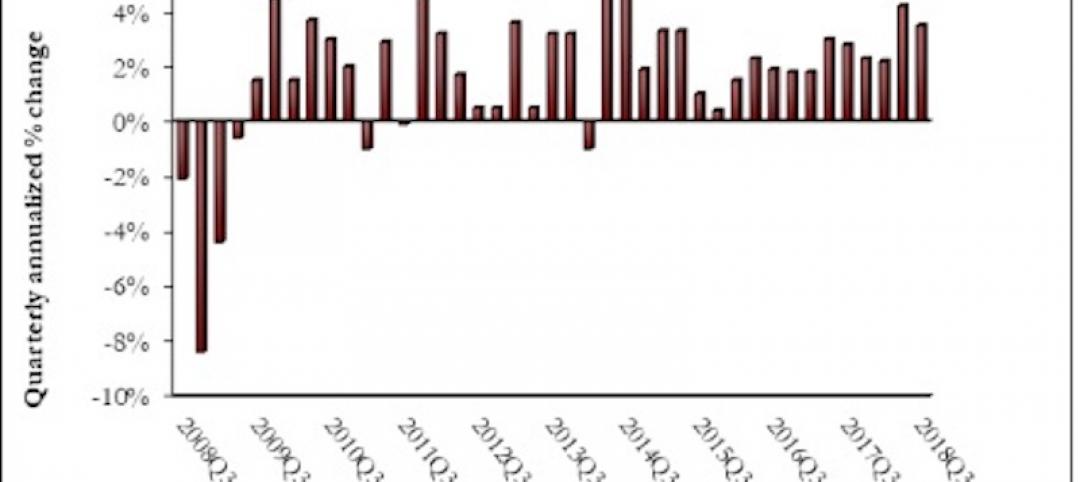

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

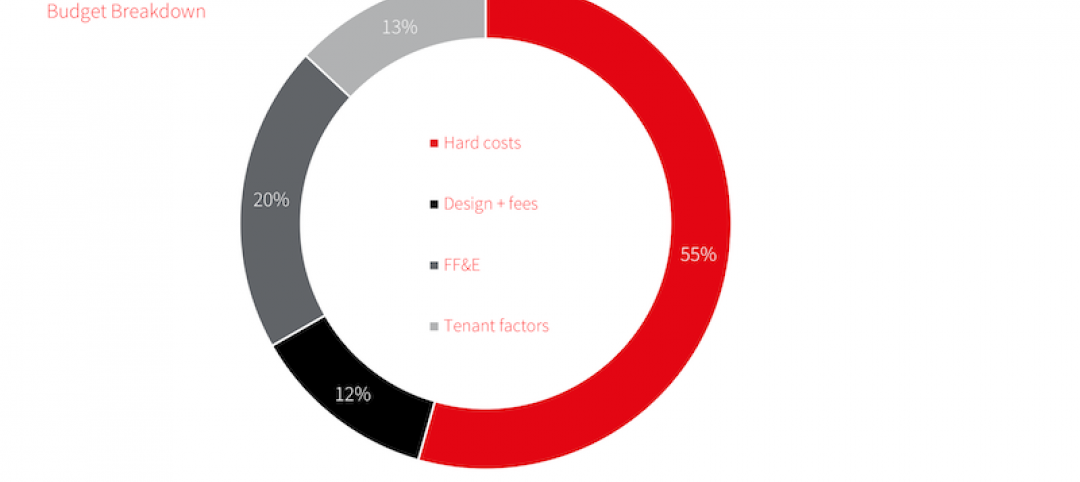

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.