Prices of construction materials jumped nearly 20% in 2021 despite moderating in December, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said contractors rate materials costs as a top concern for 2022, according to a survey predicting the industry’s outlook for the industry the association released yesterday.

“Costs may not rise as steeply in 2022 as they did last year but they are likely to remain volatile, with unpredictable prices and delivery dates for key materials,” said Ken Simonson, the association’s chief economist. “That volatility can be as hard to cope with as steadily rising prices and lead times.”

In the association’s 2022 Construction Hiring and Business Outlook Survey, material costs were listed as a top concern by 86% of contractors, more than any concern. Availability of materials and supply chain disruptions were the second most frequent concern, listed by 77% of the more than 1000 respondents.

The producer price index for inputs to new nonresidential construction—the prices charged by goods producers and service providers such as distributors and transportation firms—increased by 0.5% in December and 19.6% in 2021 as a whole. Those gains topped the rise in the index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings, Simonson noted. That index climbed by 0.3% for the month and 12.5% from a year earlier.

Prices moderated for some construction materials in December but still ended the year with large gains, Simonson observed. The price index for steel mill products rose 0.2% in December, its smallest rise in 15 months, but soared 127.2% over 12 months. The index for diesel fuel declined 5.3% for the month but increased 54.9% for the year. The index for aluminum mill shapes slid 4.9% in December but rose 29.8% over 12 months, while the index for copper and brass mill shapes fell 3.3% in December but rose 23.4% over the year.

Some prices accelerated in December. The index for plastic construction products climbed 1.3% for the month and 34.0% over 12 months. The index for lumber and plywood rose 12.7% and 17.6%.

Association officials said rising materials prices threaten to undermine what is otherwise a strong outlook for the construction industry in 2022. They urged the Biden administration to reconsider its plans to double tariffs on Canadian lumber and leave other trade barriers in place that artificially inflate the costs of key construction materials.

“Making lumber and other materials even more expensive will not tame inflation, boost supplies of affordable housing or help the economy grow,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead, the administration should be removing tariffs and beating inflation.”

View producer price index data. View chart of gap between input costs and bid prices. View the 2022 AGC/Sage Construction Hiring and Business Outlook Survey.

Related Stories

Apartments | Aug 22, 2023

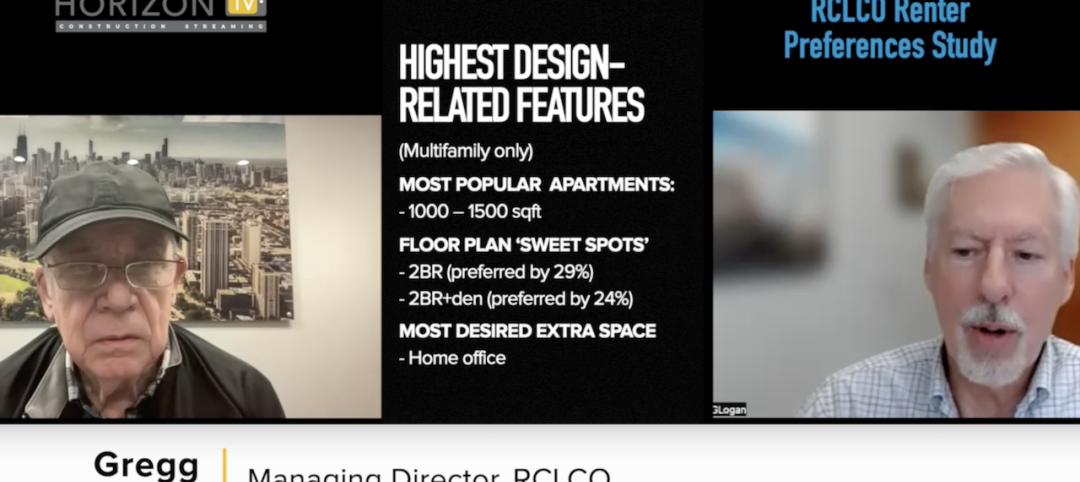

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

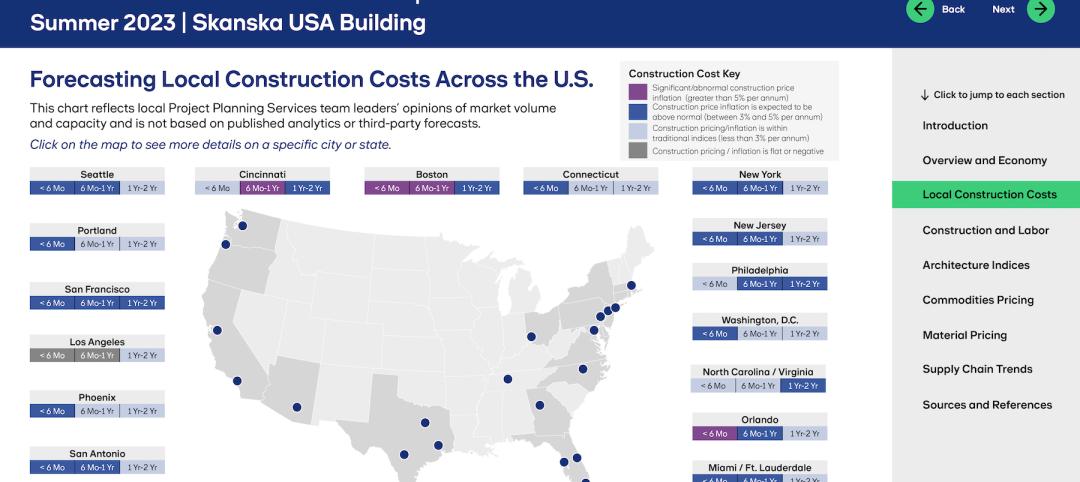

Market Data | Aug 18, 2023

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.