Prices of construction materials jumped more than 20% from January 2021 to January 2022, according to an analysis by the Associated General Contractors of America of government data released today. The association recently posted a new edition of its Construction Inflation Alert, a report to inform project owners, officials, and others about the challenges volatile materials costs, supply chain disruptions, and labor shortages posed for construction firms.\

“Unfortunately, there has been no letup early this year in the extreme cost runup that contractors endured in 2021,” said Ken Simonson, the association’s chief economist. “They are apparently passing on more of those costs but will have a continuing challenge in getting timely deliveries and finding enough workers.”

The producer price index for inputs to new nonresidential construction—the prices charged by goods producers and service providers such as distributors and transportation firms—increased by 2.6% from December to January and 20.3% over the past 12 months. In comparison, the index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—climbed by 3.8% for the month and 16.5% from a year earlier.

A wide range of inputs contributed to the more than 20% jump in the cost index, Simonson noted. The price index for steel mill products soared 112.7% over 12 months despite declining 1.6% in January. The index for plastic construction products climbed 1.8% for the month and 35.0% over 12 months. The index for diesel fuel jumped 5.1% in January and 56.5% for the year. The index for aluminum mill shapes jumped 5.6% in January and 32.7% over 12 months, while the index for copper and brass mill shapes rose 4.1% in January and 24.8% over the year. Architectural coatings such as paint had an unusually large price gain of 9.0% in January and 24.3% over 12 months. The index for lumber and plywood leaped 15.4 for the month and 21.1% year-over-year. Other inputs with double-digit increases for the past 12 months include insulation, 19.2%; trucking, 18.3%; and construction machinery and equipment, 11.4%.

Association officials said construction firms are being squeezed by increases costs for materials and labor shortages. They urged federal officials to take additional steps to address supply chain disruptions and rising materials prices. These include continuing to remove costly tariffs on key construction components.

“Spiking materials prices are making it challenging for most firms to profit from any increases in demand for new construction projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Left unabated, these price increases will undermine the economic case for many development projects and limit the positive impacts of the new infrastructure bill.”

View producer price index data. View chart of gap between input costs and bid prices. View the February 2022 Construction Inflation Alert.

Related Stories

Market Data | Oct 14, 2021

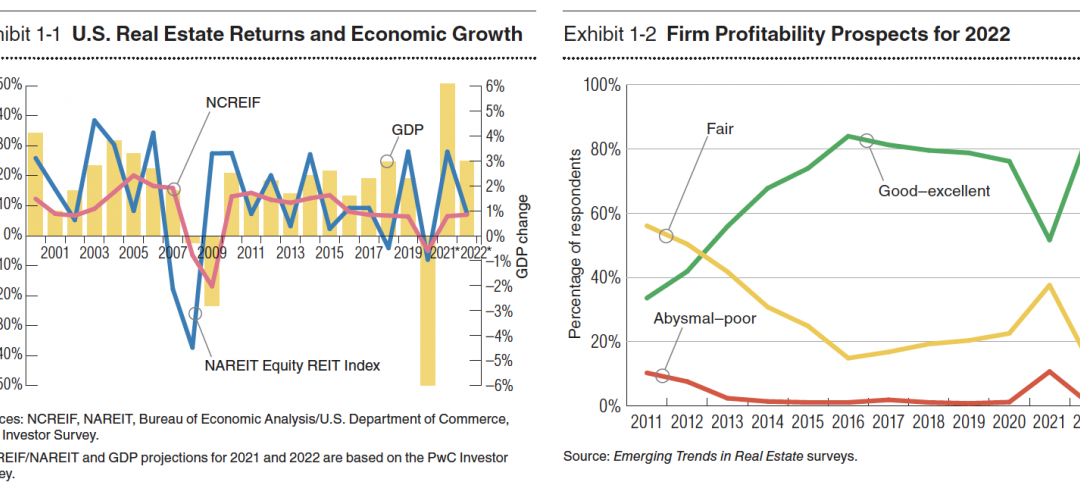

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 14, 2021

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

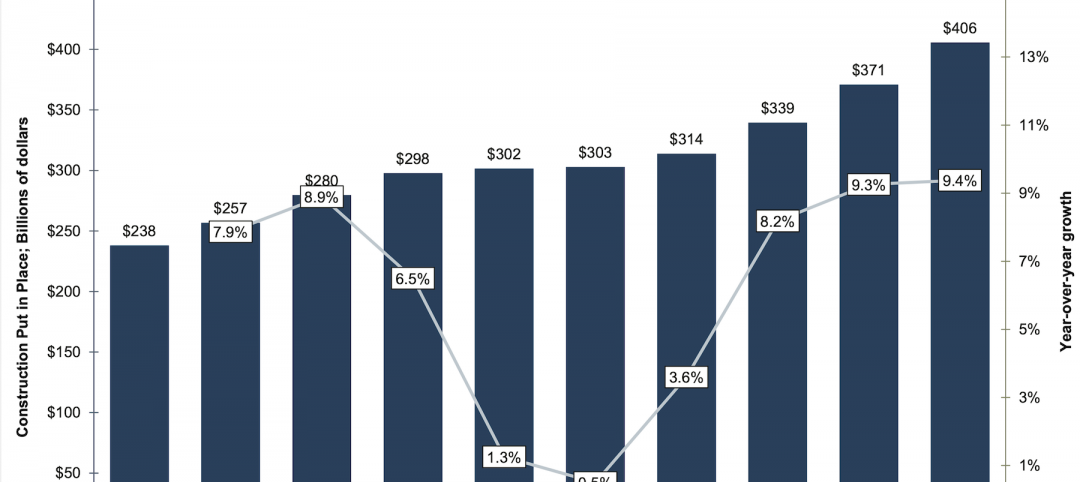

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.

Market Data | Sep 28, 2021

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.