Prices of construction materials jumped more than 20% from January 2021 to January 2022, according to an analysis by the Associated General Contractors of America of government data released today. The association recently posted a new edition of its Construction Inflation Alert, a report to inform project owners, officials, and others about the challenges volatile materials costs, supply chain disruptions, and labor shortages posed for construction firms.\

“Unfortunately, there has been no letup early this year in the extreme cost runup that contractors endured in 2021,” said Ken Simonson, the association’s chief economist. “They are apparently passing on more of those costs but will have a continuing challenge in getting timely deliveries and finding enough workers.”

The producer price index for inputs to new nonresidential construction—the prices charged by goods producers and service providers such as distributors and transportation firms—increased by 2.6% from December to January and 20.3% over the past 12 months. In comparison, the index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—climbed by 3.8% for the month and 16.5% from a year earlier.

A wide range of inputs contributed to the more than 20% jump in the cost index, Simonson noted. The price index for steel mill products soared 112.7% over 12 months despite declining 1.6% in January. The index for plastic construction products climbed 1.8% for the month and 35.0% over 12 months. The index for diesel fuel jumped 5.1% in January and 56.5% for the year. The index for aluminum mill shapes jumped 5.6% in January and 32.7% over 12 months, while the index for copper and brass mill shapes rose 4.1% in January and 24.8% over the year. Architectural coatings such as paint had an unusually large price gain of 9.0% in January and 24.3% over 12 months. The index for lumber and plywood leaped 15.4 for the month and 21.1% year-over-year. Other inputs with double-digit increases for the past 12 months include insulation, 19.2%; trucking, 18.3%; and construction machinery and equipment, 11.4%.

Association officials said construction firms are being squeezed by increases costs for materials and labor shortages. They urged federal officials to take additional steps to address supply chain disruptions and rising materials prices. These include continuing to remove costly tariffs on key construction components.

“Spiking materials prices are making it challenging for most firms to profit from any increases in demand for new construction projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Left unabated, these price increases will undermine the economic case for many development projects and limit the positive impacts of the new infrastructure bill.”

View producer price index data. View chart of gap between input costs and bid prices. View the February 2022 Construction Inflation Alert.

Related Stories

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.

Market Data | Sep 17, 2018

ABC’s Construction Backlog Indicator hits a new high in second quarter of 2018

Backlog is up 12.2% from the first quarter and 14% compared to the same time last year.

Market Data | Sep 12, 2018

Construction material prices fall in August

Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

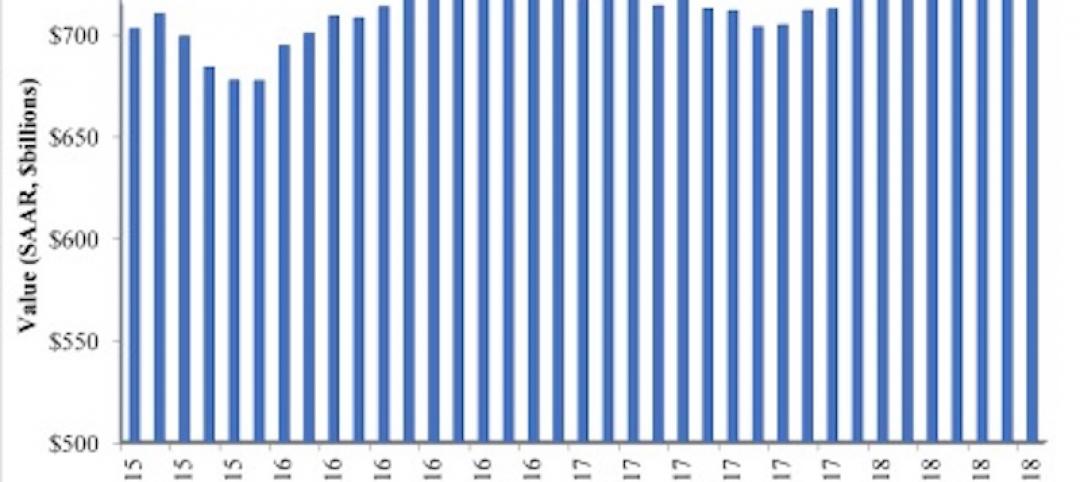

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.

Market Data | Aug 22, 2018

July architecture firm billings remain positive despite growth slowing

Architecture firms located in the South remain especially strong.

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.