Over the first half of 2017, the national median rent fluctuated, but it ended up exactly where it began: $1,016 for a one-bedroom. Prices fell from January to March, bottoming out at $1,003 before creeping back up in the spring. In all, the national median rent always stayed within 1.3% of its starting value.

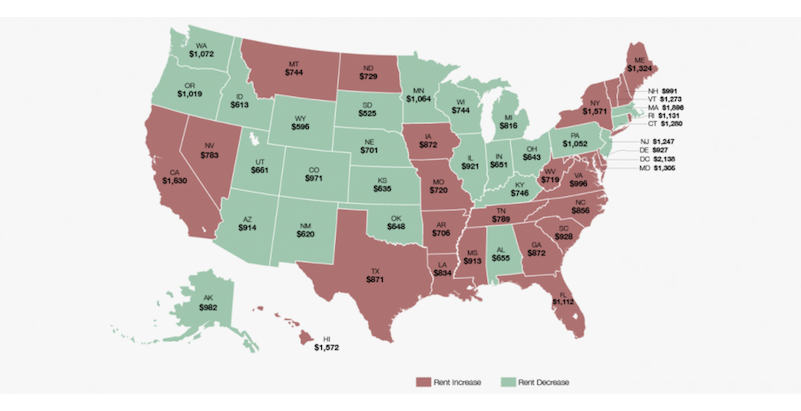

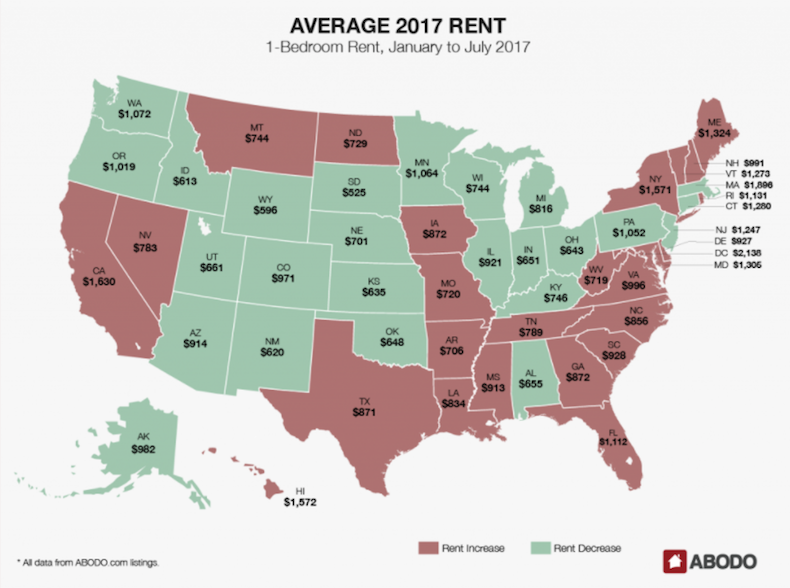

A slight majority of states (26, plus the District of Columbia) saw rental increases over the first six months of 2017, with the largest average percent changes coming in South Carolina (7.3%), Maine (7.3%), Vermont (7.2%), and Rhode Island (7.0%), Abodo's Midyear Rent Report reports. The greatest average decreases were significantly lower: Utah (-4.4%), Oklahoma (-3.3%), Pennsylvania (-2.7%), Connecticut (-2.3%).

The majority of states, 31, saw average changes in rent price of 1.3% or lower.

The states with the highest average rents will surprise no one. The District of Columbia had the highest average rent from January to July, with one-bedrooms going for $2,138 per month. Massachusetts ($1,896), California ($1,630), Hawaii ($1,572), and New York ($1,571) followed. The four states with the lowest average rents were all in the West or Southwest: South Dakota ($525), Wyoming ($596), Idaho ($613), and New Mexico ($620).

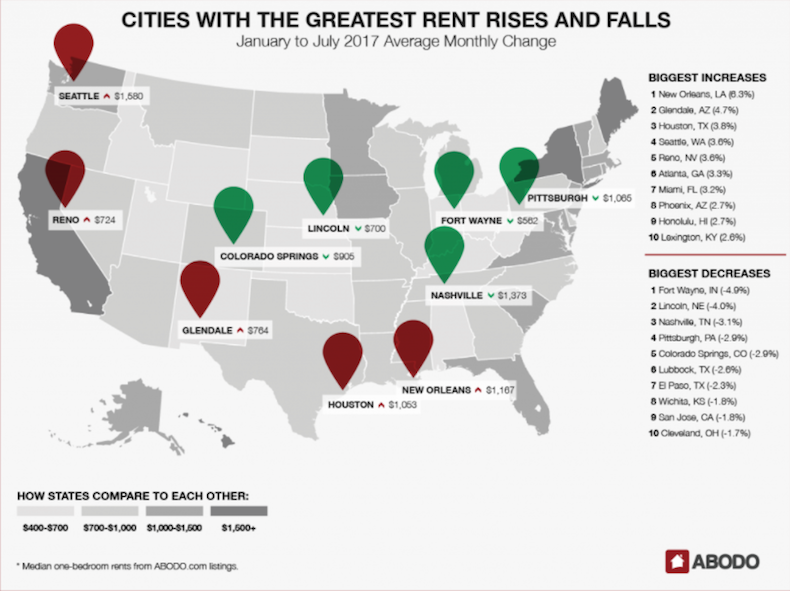

In December, our annual rent report noted that many of the cities with the fastest-growing rents were between the coasts. That trend continued in the first half of 2017: Eight of the top 10 cities for rental hikes were in the South or Southwest. New Orleans led the way, with an average monthly change of 6.3% and an average rent of $1,167. Glendale, Ariz. (4.7%, $764), and Houston (3.8%; $1,053), followed closely behind, with Reno, N.V., Atlanta, Miami, Phoenix, and Lexington, Ky., also making appearances.

The only geographic outliers were Seattle, which saw rents rise an average of 3.6% over the first half of the year, and Honolulu (2.6%).

The biggest drops in rent also continued to veer west and south. Fort Wayne, Ind., saw the largest rent drop, with an average decline of 4.9% per month and an average rent of $562. Lincoln, Neb., where the average rent is $700, experienced an average decline of 4% per month. And booming Nashville, Tenn., where the average one-bedroom rents for $1,373, saw an average drop of 3.1% per month.

From June to July, the biggest rental hike was in Newark, N.J., which saw its one-bedroom rent increase 10.2% to $1,120. Philadelphia (8.5%; $1,305) and Honolulu (8%; $1,654) rounded out the top three. In June, Reno saw its rent rise 6.7% to $832, and New Orleans jumped 5.8% to $1,397, continuing the months-long upward trend that landed them on the list for highest year-to-date change.

For the second month in a row, Buffalo, N.Y., and St. Paul, Minn., experienced the largest drops in rent in the country. This month, the order was reversed: St. Paul leads the way, with a 7.4% decrease to $1,233. Buffalo saw its rent drop 7.2% to $939. Glendale, which over the first six months of 2017 had the second-highest average monthly increase in rent, saw its median one-bedroom decrease 6.8% over the month of June, bottoming out at $833.

The cities with the highest rents are largely unchanged since last month’s report. San Francisco rents dropped $40 to $3,240, but that wasn’t enough to bump the city from its spot atop the rankings. As usual, New York City ($2,913) and San Jose ($2,378) rounded out the top three. The only real movement in the list of the country’s highest rents was near the bottom: Chicago ($1,861) superseded Miami ($1,855) for eighth place.

Nationally, rental prices were relatively stable through the first six months of 2017. Rent is rising in just over half of the nation’s states, and certain cities are seeing sustained increases in rent month to month. Cities where rent was already high—New York, D.C., Los Angeles—are still high, but the most notable rental increases are in growing markets in the South and Southwest, a continuation of a trend we noticed in our 2016 Annual Report.

In the next six months, rental prices in those markets will be a good barometer for how well new development is keeping up with what appears to be continued—and rising—demand for rentals.

Related Stories

Multifamily Housing | May 30, 2023

Milhaus, Gershman Partners, and Citimark close on $70 million multifamily development in Indy

Versa will bring 233 studio and one- and two-bedroom apartments to Indianapolis's $271 million, Class-A Broad Ripple Village development enterprise.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Multifamily Housing | May 19, 2023

Biden administration beefs up energy efficiency standards on new federally funded housing

The Biden Administration recently moved to require more stringent energy efficiency standards on federally funded housing projects. Developers building homes with taxpayer funds will have to construct to the International Energy Conservation Code (IECC) 2021 for low-density housing and American Society of Heating, Refrigerating and Air-Conditioning Engineers ASHRAE 90.1 for multi-family projects.

Sponsored | Multifamily Housing | May 19, 2023

Shear Wall Selection for Wood-Framed Buildings

From wall bracing to FTAO, there are many ways to secure the walls of a building. Learn how to evaluate which method is best for a project.

Sponsored | Multifamily Housing | May 17, 2023

The Key To Multifamily Access Control — Consistent Resident Experiences

Explore the challenges of multifamily access control and discover the key to consistent user experiences with a resident-first approach and open platforms.

Affordable Housing | May 17, 2023

Affordable housing advocates push for community-owned homes over investment properties

Panelists participating in a recent webinar hosted by the Urban Institute discussed various actions that could help alleviate the nation’s affordable housing crisis. Among the possible remedies: inclusionary zoning policies, various reforms to increase local affordable housing stock, and fees on new development to offset the impact on public infrastructure.

Multifamily Housing | May 16, 2023

Legislators aim to make office-to-housing conversions easier

Lawmakers around the country are looking for ways to spur conversions of office space to residential use.cSuch projects come with challenges such as inadequate plumbing, not enough exterior-facing windows, and footprints that don’t easily lend themselves to residential use. These conditions raise the cost for developers.

Multifamily Housing | May 12, 2023

An industrial ‘eyesore’ is getting new life as an apartment complex

The project, in Metuchen, N.J., includes significant improvements to a nearby wildlife preserve.

Senior Living Design | May 8, 2023

Seattle senior living community aims to be world’s first to achieve Living Building Challenge designation

Aegis Living Lake Union in Seattle is the world’s first assisted living community designed to meet the rigorous Living Building Challenge certification. Completed in 2022, the Ankrom Moisan-designed, 70,000 sf-building is fully electrified. All commercial dryers, domestic hot water, and kitchen equipment are powered by electricity in lieu of gas, which reduces the facility’s carbon footprint.