All leading indicators show that the multifamily sector is shrugging off rising interest rates, inflationary pressures and other economic challenges, and will continue to be a torrid market for design and construction firms for at least the rest of 2022.

CBRE reported that Multifamily remained the most preferred commercial real estate sector for investment in the 2nd Quarter, with a 32% year-over-year increase in volume to $78 billion, and the Federal Reserve reported strong multifamily results across all districts in its 2022 July Beige Book. At the same time, Rent.com reported that year-over-year rents grew 25.3% and 26.5% for one- and two-bedroom apartments, respectively, and the U.S. Census Department announced that apartment vacancy rates remained near record lows (5.6% in the 2nd Quarter of 2022).

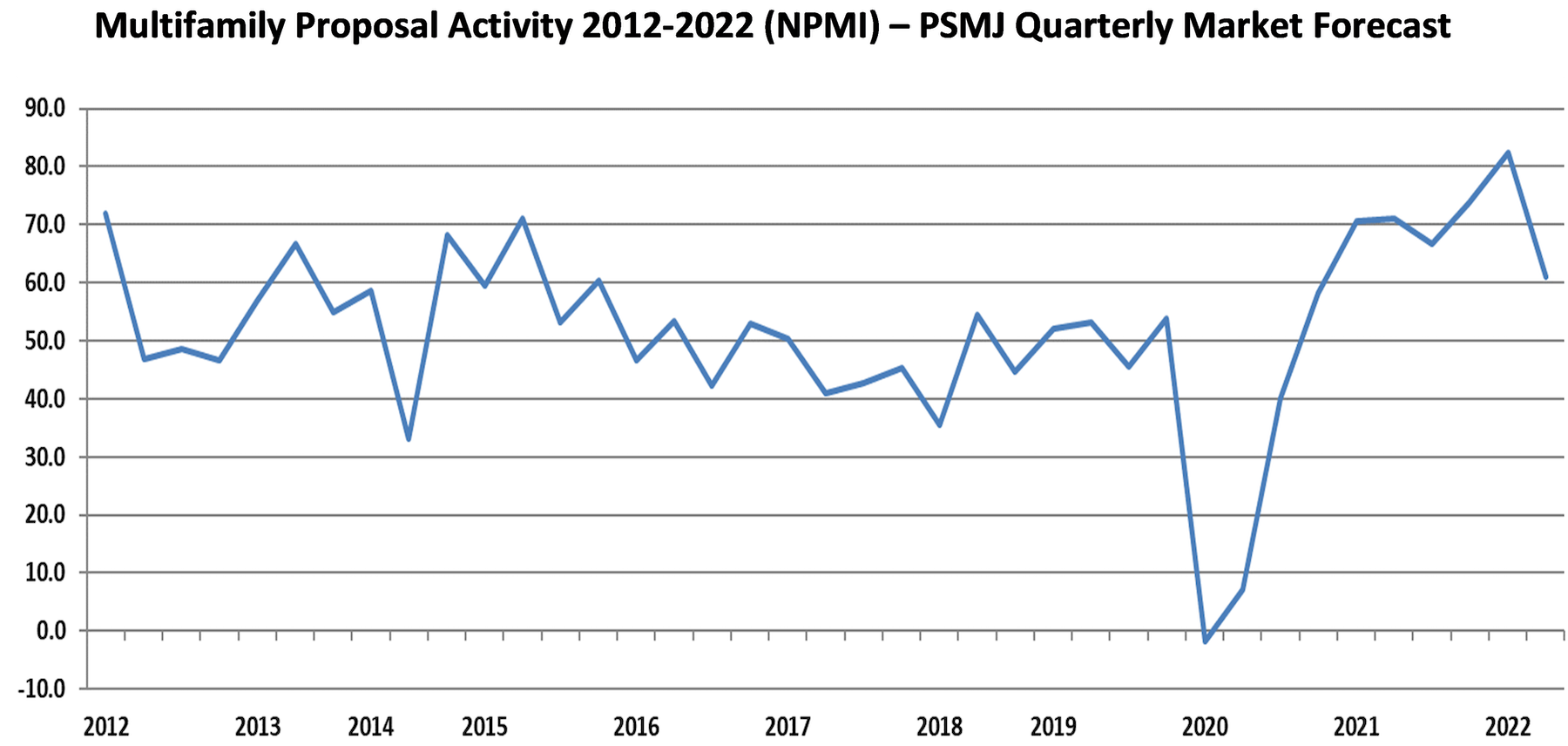

The PSMJ Resources Quarterly Market Forecast (QMF) survey of architects, engineers and contractors reinforces this view. While more than two-thirds (67.2%) of the firm leaders surveyed said that proposal activity in the multifamily market increased from the 1st Quarter of 2022, only 6.3% reported a decline. The resulting net plus/minus index (NPMI) of 60.9 – which is the delta between the percentage of respondents seeing a rise and fall in proposal activity – is down from the record-setting 1st Quarter NPMI of 82.4, but is still among the best quarters since PSMJ began measuring proposal opportunities in submarkets in 2006.

PSMJ Director and Senior Consultant David Burstein, PE, acknowledges the current strength of the entire housing market, but expects a turnaround in the not-too-distant future, albeit a minor to moderate one. “The housing market, including multifamily housing, has been red hot. But it may be on the verge of cooling off a bit,” he says. “A recent analysis by CNBC indicated that the average mortgage payments for a house purchased in 2019 was $1,192 per month. With the increase in home prices and interest rates, the mortgage on that same house is now $1,991 – an increase of almost $800 per month. Wages have gone up since 2019, but they haven’t gone up enough to account for that difference in mortgage costs. The net result will be fewer families able to afford a new home.”

This will have an impact on multifamily as well, adds Burstein. “The increase in interest rates also affects developers’ ability to finance new multifamily rental buildings. And the Fed has indicated that they aren’t close to topping out on their rate increases. So I expect the pace of new multifamily to slow significantly in the next few months. And those projects that do move forward will probably be for lower-cost properties.”

To Burstein’s point, the National Association of Home Builders (NAHB) Multifamily Market Survey weakened in the 1st Quarter of 2022 (the latest figures available), with confidence in market-rate rentals and for-sale apartments sliding. Only lower-rent properties supported by government programs showed a small increase in confidence among the builders responding to the survey.

Despite this caution, the forward-looking QMF survey also anticipates relatively healthy futures for two other multifamily submarkets it measures – condominiums and senior/assisted living.

Condominiums recorded an NPMI of 47.9 in the 2nd Quarter of 2022, its second-highest reading ever. Only the 2nd Quarter of 2021, when condos scored an NPMI of 59.2, was better. More than 54% of respondents working in the condo market saw higher proposal activity in the 1st Quarter, compared with about 6% that saw a decrease.

Proposal opportunities in senior/assisted living facilities also impressed, recording an NPMI of 58.8 – 62.7% saw an increase in activity, while only 3.9% reported a decline.

PSMJ has been conducting the Quarterly Market Forecast survey of its members since 2003. The A/E/C consulting and publishing company chose proposal activity as the basis for its QMF because it represents the earliest stage of the project lifecycle. For more information, go to https://www.psmj.com.

Related Stories

Adaptive Reuse | Mar 21, 2024

Massachusetts launches program to spur office-to-residential conversions statewide

Massachusetts Gov. Maura Healey recently launched a program to help cities across the state identify underused office buildings that are best suited for residential conversions.

Multifamily Housing | Mar 19, 2024

Jim Chapman Construction Group completes its second college town BTR community

JCCG's 200-unit Cottages at Lexington, in Athens, Ga., is fully leased.

Multifamily Housing | Mar 19, 2024

Two senior housing properties renovated with 608 replacement windows

Renovation of the two properties, with 200 apartments for seniors, was financed through a special public/private arrangement.

MFPRO+ New Projects | Mar 18, 2024

Luxury apartments in New York restore and renovate a century-old residential building

COOKFOX Architects has completed a luxury apartment building at 378 West End Avenue in New York City. The project restored and renovated the original residence built in 1915, while extending a new structure east on West 78th Street.

Multifamily Housing | Mar 18, 2024

YWCA building in Boston’s Back Bay converted into 210 affordable rental apartments

Renovation of YWCA at 140 Clarendon Street will serve 111 previously unhoused families and individuals.

Adaptive Reuse | Mar 15, 2024

San Francisco voters approve tax break for office-to-residential conversions

San Francisco voters recently approved a ballot measure to offer tax breaks to developers who convert commercial buildings to residential use. The tax break applies to conversions of up to 5 million sf of commercial space through 2030.

Apartments | Mar 13, 2024

A landscaped canyon runs through this luxury apartment development in Denver

Set to open in April, One River North is a 16-story, 187-unit luxury apartment building with private, open-air terraces located in Denver’s RiNo arts district. Biophilic design plays a central role throughout the building, allowing residents to connect with nature and providing a distinctive living experience.

Affordable Housing | Mar 12, 2024

An all-electric affordable housing project in Southern California offers 48 apartments plus community spaces

In Santa Monica, Calif., Brunson Terrace is an all-electric, 100% affordable housing project that’s over eight times more energy efficient than similar buildings, according to architect Brooks + Scarpa. Located across the street from Santa Monica College, the net zero building has been certified LEED Platinum.

MFPRO+ News | Mar 12, 2024

Multifamily housing starts and permitting activity drop 10% year-over-year

The past year saw over 1.4 million new homes added to the national housing inventory. Despite the 4% growth in units, both the number of new homes under construction and the number of permits dropped year-over-year.