All leading indicators show that the multifamily sector is shrugging off rising interest rates, inflationary pressures and other economic challenges, and will continue to be a torrid market for design and construction firms for at least the rest of 2022.

CBRE reported that Multifamily remained the most preferred commercial real estate sector for investment in the 2nd Quarter, with a 32% year-over-year increase in volume to $78 billion, and the Federal Reserve reported strong multifamily results across all districts in its 2022 July Beige Book. At the same time, Rent.com reported that year-over-year rents grew 25.3% and 26.5% for one- and two-bedroom apartments, respectively, and the U.S. Census Department announced that apartment vacancy rates remained near record lows (5.6% in the 2nd Quarter of 2022).

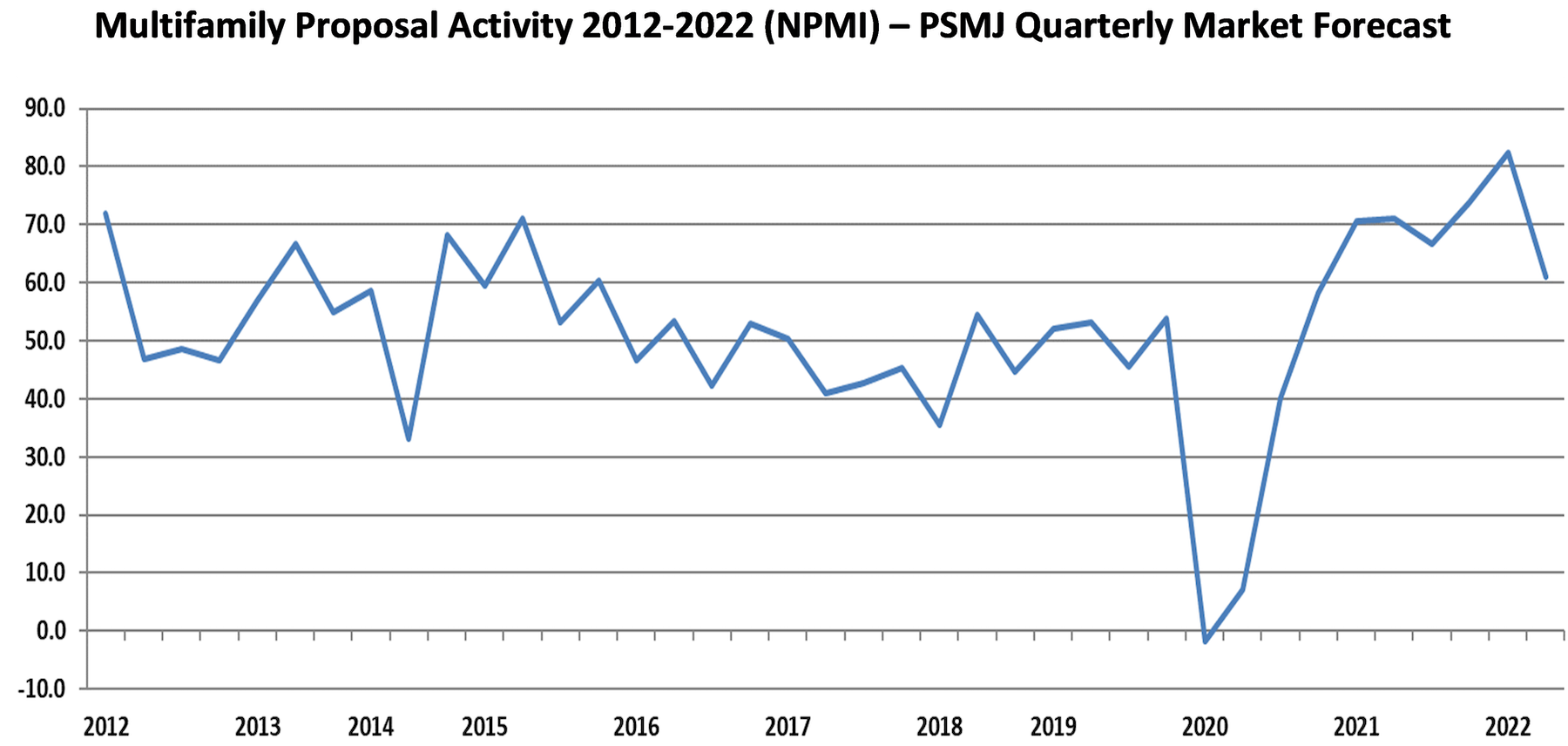

The PSMJ Resources Quarterly Market Forecast (QMF) survey of architects, engineers and contractors reinforces this view. While more than two-thirds (67.2%) of the firm leaders surveyed said that proposal activity in the multifamily market increased from the 1st Quarter of 2022, only 6.3% reported a decline. The resulting net plus/minus index (NPMI) of 60.9 – which is the delta between the percentage of respondents seeing a rise and fall in proposal activity – is down from the record-setting 1st Quarter NPMI of 82.4, but is still among the best quarters since PSMJ began measuring proposal opportunities in submarkets in 2006.

PSMJ Director and Senior Consultant David Burstein, PE, acknowledges the current strength of the entire housing market, but expects a turnaround in the not-too-distant future, albeit a minor to moderate one. “The housing market, including multifamily housing, has been red hot. But it may be on the verge of cooling off a bit,” he says. “A recent analysis by CNBC indicated that the average mortgage payments for a house purchased in 2019 was $1,192 per month. With the increase in home prices and interest rates, the mortgage on that same house is now $1,991 – an increase of almost $800 per month. Wages have gone up since 2019, but they haven’t gone up enough to account for that difference in mortgage costs. The net result will be fewer families able to afford a new home.”

This will have an impact on multifamily as well, adds Burstein. “The increase in interest rates also affects developers’ ability to finance new multifamily rental buildings. And the Fed has indicated that they aren’t close to topping out on their rate increases. So I expect the pace of new multifamily to slow significantly in the next few months. And those projects that do move forward will probably be for lower-cost properties.”

To Burstein’s point, the National Association of Home Builders (NAHB) Multifamily Market Survey weakened in the 1st Quarter of 2022 (the latest figures available), with confidence in market-rate rentals and for-sale apartments sliding. Only lower-rent properties supported by government programs showed a small increase in confidence among the builders responding to the survey.

Despite this caution, the forward-looking QMF survey also anticipates relatively healthy futures for two other multifamily submarkets it measures – condominiums and senior/assisted living.

Condominiums recorded an NPMI of 47.9 in the 2nd Quarter of 2022, its second-highest reading ever. Only the 2nd Quarter of 2021, when condos scored an NPMI of 59.2, was better. More than 54% of respondents working in the condo market saw higher proposal activity in the 1st Quarter, compared with about 6% that saw a decrease.

Proposal opportunities in senior/assisted living facilities also impressed, recording an NPMI of 58.8 – 62.7% saw an increase in activity, while only 3.9% reported a decline.

PSMJ has been conducting the Quarterly Market Forecast survey of its members since 2003. The A/E/C consulting and publishing company chose proposal activity as the basis for its QMF because it represents the earliest stage of the project lifecycle. For more information, go to https://www.psmj.com.

Related Stories

| Mar 22, 2011

Mayor Bloomberg unveils plans for New York City’s largest new affordable housing complex since the ’70s

Plans for Hunter’s Point South, the largest new affordable housing complex to be built in New York City since the 1970s, include new residences for 5,000 families, with more than 900 in this first phase. A development team consisting of Phipps Houses, Related Companies, and Monadnock Construction has been selected to build the residential portion of the first phase of the Queens waterfront complex, which includes two mixed-use buildings comprising more than 900 housing units and roughly 20,000 square feet of new retail space.

| Mar 17, 2011

Perkins Eastman launches The Green House prototype design package

Design and architecture firm Perkins Eastman is pleased to join The Green House project and NCB Capital Impact in announcing the launch of The Green House Prototype Design Package. The Prototype will help providers develop small home senior living communities with greater efficiency and cost savings—all to the standards of care developed by The Green House project.

| Mar 11, 2011

Renovation energizes retirement community in Massachusetts

The 12-year-old Edgewood Retirement Community in Andover, Mass., underwent a major 40,000-sf expansion and renovation that added 60 patient care beds in the long-term care unit, a new 17,000-sf, 40-bed cognitive impairment unit, and an 80-seat informal dining bistro.

| Mar 11, 2011

Mixed-income retirement community in Maryland based on holistic care

The Green House Residences at Stadium Place in Waverly, Md., is a five-story, 40,600-sf, mixed-income retirement community based on a holistic continuum of care concept developed by Dr. Bill Thomas. Each of the four residential floors houses a self-contained home for 12 residents that includes 12 bedrooms/baths organized around a common living/social area called the “hearth,” which includes a kitchen, living room with fireplace, and dining area.

| Mar 11, 2011

Texas A&M mixed-use community will focus on green living

HOK, Realty Appreciation, and Texas A&M University are working on the Urban Living Laboratory, a 1.2-million-sf mixed-use project owned by the university. The five-phase, live-work-play project will include offices, retail, multifamily apartments, and two hotels.

| Mar 1, 2011

How to make rentals more attractive as the American dream evolves, adapts

Roger K. Lewis, architect and professor emeritus of architecture at the University of Maryland, writes in the Washington Post about the rising market demand for rental housing and how Building Teams can make these properties a desirable choice for consumer, not just an economically prudent and necessary one.

| Feb 15, 2011

New Orleans' rebuilt public housing architecture gets mixed reviews

The architecture of New Orleans’ new public housing is awash with optimism about how urban-design will improve residents' lives—but the changes are based on the idealism of an earlier era that’s being erased and revised.

| Feb 11, 2011

Chicago high-rise mixes condos with classrooms for Art Institute students

The Legacy at Millennium Park is a 72-story, mixed-use complex that rises high above Chicago’s Michigan Avenue. The glass tower, designed by Solomon Cordwell Buenz, is mostly residential, but also includes 41,000 sf of classroom space for the School of the Art Institute of Chicago and another 7,400 sf of retail space. The building’s 355 one-, two-, three-, and four-bedroom condominiums range from 875 sf to 9,300 sf, and there are seven levels of parking. Sky patios on the 15th, 42nd, and 60th floors give owners outdoor access and views of Lake Michigan.

| Feb 11, 2011

Sustainable community center to serve Angelinos in need

Harbor Interfaith Services, a nonprofit serving the homeless and working poor in the Harbor Area and South Bay communities of Los Angeles, engaged Withee Malcolm Architects to design a new 15,000-sf family resource center. The architects, who are working pro bono for the initial phase, created a family-centered design that consolidates all programs into a single building. The new three-story space will house a resource center, food pantry, nursery and pre-school, and administrative offices, plus indoor and outdoor play spaces and underground parking. The building’s scale and setbacks will help it blend with its residential neighbors, while its low-flow fixtures, low-VOC and recycled materials, and energy-efficient mechanical equipment and appliances will help it earn LEED certification.

| Feb 11, 2011

Apartment complex caters to University of Minnesota students

Twin Cities firm Elness Swenson Graham Architects designed the new Stadium Village Flats, in the University of Minnesota’s East Bank Campus, with students in mind. The $30 million, six-story residential/retail complex will include 120 furnished apartments with fitness rooms and lounges on each floor. More than 5,000 sf of first-floor retail space and two levels of below-ground parking will complete the complex. Opus AE Group Inc., based in Minneapolis, will provide structural engineering services.