All leading indicators show that the multifamily sector is shrugging off rising interest rates, inflationary pressures and other economic challenges, and will continue to be a torrid market for design and construction firms for at least the rest of 2022.

CBRE reported that Multifamily remained the most preferred commercial real estate sector for investment in the 2nd Quarter, with a 32% year-over-year increase in volume to $78 billion, and the Federal Reserve reported strong multifamily results across all districts in its 2022 July Beige Book. At the same time, Rent.com reported that year-over-year rents grew 25.3% and 26.5% for one- and two-bedroom apartments, respectively, and the U.S. Census Department announced that apartment vacancy rates remained near record lows (5.6% in the 2nd Quarter of 2022).

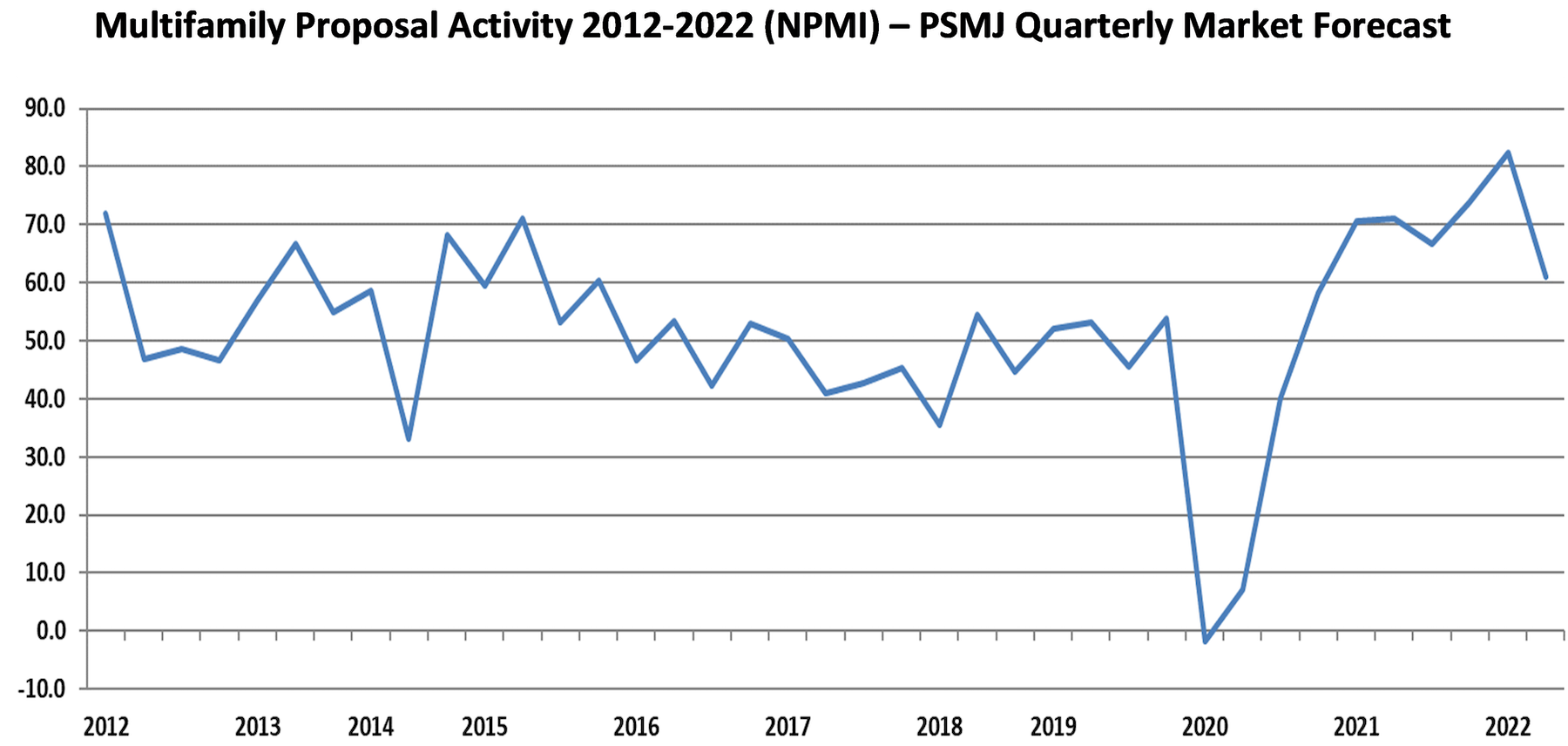

The PSMJ Resources Quarterly Market Forecast (QMF) survey of architects, engineers and contractors reinforces this view. While more than two-thirds (67.2%) of the firm leaders surveyed said that proposal activity in the multifamily market increased from the 1st Quarter of 2022, only 6.3% reported a decline. The resulting net plus/minus index (NPMI) of 60.9 – which is the delta between the percentage of respondents seeing a rise and fall in proposal activity – is down from the record-setting 1st Quarter NPMI of 82.4, but is still among the best quarters since PSMJ began measuring proposal opportunities in submarkets in 2006.

PSMJ Director and Senior Consultant David Burstein, PE, acknowledges the current strength of the entire housing market, but expects a turnaround in the not-too-distant future, albeit a minor to moderate one. “The housing market, including multifamily housing, has been red hot. But it may be on the verge of cooling off a bit,” he says. “A recent analysis by CNBC indicated that the average mortgage payments for a house purchased in 2019 was $1,192 per month. With the increase in home prices and interest rates, the mortgage on that same house is now $1,991 – an increase of almost $800 per month. Wages have gone up since 2019, but they haven’t gone up enough to account for that difference in mortgage costs. The net result will be fewer families able to afford a new home.”

This will have an impact on multifamily as well, adds Burstein. “The increase in interest rates also affects developers’ ability to finance new multifamily rental buildings. And the Fed has indicated that they aren’t close to topping out on their rate increases. So I expect the pace of new multifamily to slow significantly in the next few months. And those projects that do move forward will probably be for lower-cost properties.”

To Burstein’s point, the National Association of Home Builders (NAHB) Multifamily Market Survey weakened in the 1st Quarter of 2022 (the latest figures available), with confidence in market-rate rentals and for-sale apartments sliding. Only lower-rent properties supported by government programs showed a small increase in confidence among the builders responding to the survey.

Despite this caution, the forward-looking QMF survey also anticipates relatively healthy futures for two other multifamily submarkets it measures – condominiums and senior/assisted living.

Condominiums recorded an NPMI of 47.9 in the 2nd Quarter of 2022, its second-highest reading ever. Only the 2nd Quarter of 2021, when condos scored an NPMI of 59.2, was better. More than 54% of respondents working in the condo market saw higher proposal activity in the 1st Quarter, compared with about 6% that saw a decrease.

Proposal opportunities in senior/assisted living facilities also impressed, recording an NPMI of 58.8 – 62.7% saw an increase in activity, while only 3.9% reported a decline.

PSMJ has been conducting the Quarterly Market Forecast survey of its members since 2003. The A/E/C consulting and publishing company chose proposal activity as the basis for its QMF because it represents the earliest stage of the project lifecycle. For more information, go to https://www.psmj.com.

Related Stories

| Aug 11, 2010

10% of world's skyscraper construction on hold

Emporis, the largest provider of global building data worldwide, reported that 8.7% of all skyscrapers listed as "under construction" in its database had been put on hold. Most of these projects have been halted in the second half of 2008. According to Emporis statistics, the United States had been hit the worst: at the beginning of 2008, "Met 3" in Miami was the only U.S. skyscraper listed as being "on hold". In the second half of the year, 19 projects followed suit.

| Aug 11, 2010

Structure Tone, Turner among the nation's busiest reconstruction contractors, according to BD+C's Giants 300 report

A ranking of the Top 75 Reconstruction Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Skanska completes $74 million Harbor Towers project six months ahead of schedule

Skanska USA Building Inc. announced the completion of a $74 million rehabilitation project at Harbor Towers, a 40-story luxury condominium complex comprising two towers located on Boston’s waterfront. Skanska served as Program Manager and oversaw the repair and replacement work that dramatically enhanced the reliability, cost-effectiveness, and energy efficiency of the buildings’ MEP systems.

| Aug 11, 2010

Best AEC Firms of 2011/12

Later this year, we will launch Best AEC Firms 2012. We’re looking for firms that create truly positive workplaces for their AEC professionals and support staff. Keep an eye on this page for entry information. +

| Aug 11, 2010

Manitoba Hydro Place, Tornado Tower among world's 'best tall buildings,' according to the Council on Tall Buildings and Urban Habitat

The Council on Tall Buildings and Urban Habitat last week announced the winners of its annual “Best Tall Building” awards for 2009, recognizing one outstanding tall building from each of four geographical regions: Americas, Asia & Australia, Europe, and Middle East & Africa. This year’s winners are: Manitoba Hydro Place, Winnipeg, Canada; Linked Hybrid, Beijing, China; The Broadgate Tower, London, UK; Tornado Tower, Doha, Qatar.

| Aug 11, 2010

Call for entries: Building enclosure design awards

The Boston Society of Architects and the Boston chapter of the Building Enclosure Council (BEC-Boston) have announced a High Performance Building award that will assess building enclosure innovation through the demonstrated design, construction, and operation of the building enclosure.

| Aug 11, 2010

CampusBrands Inc., NYLO Hotels team to launch student housing franchise brand

Which would you choose: the cramped quarters, thin mattresses, and crowded communal bathrooms of dormitory life or a new type of student housing with comfortable couches, a game room, fitness center, Wi-Fi in every room, flat-screen televisions and maybe even a theater?

| Aug 11, 2010

Portland Cement Association offers blast resistant design guide for reinforced concrete structures

Developed for designers and engineers, "Blast Resistant Design Guide for Reinforced Concrete Structures" provides a practical treatment of the design of cast-in-place reinforced concrete structures to resist the effects of blast loads. It explains the principles of blast-resistant design, and how to determine the kind and degree of resistance a structure needs as well as how to specify the required materials and details.