All leading indicators show that the multifamily sector is shrugging off rising interest rates, inflationary pressures and other economic challenges, and will continue to be a torrid market for design and construction firms for at least the rest of 2022.

CBRE reported that Multifamily remained the most preferred commercial real estate sector for investment in the 2nd Quarter, with a 32% year-over-year increase in volume to $78 billion, and the Federal Reserve reported strong multifamily results across all districts in its 2022 July Beige Book. At the same time, Rent.com reported that year-over-year rents grew 25.3% and 26.5% for one- and two-bedroom apartments, respectively, and the U.S. Census Department announced that apartment vacancy rates remained near record lows (5.6% in the 2nd Quarter of 2022).

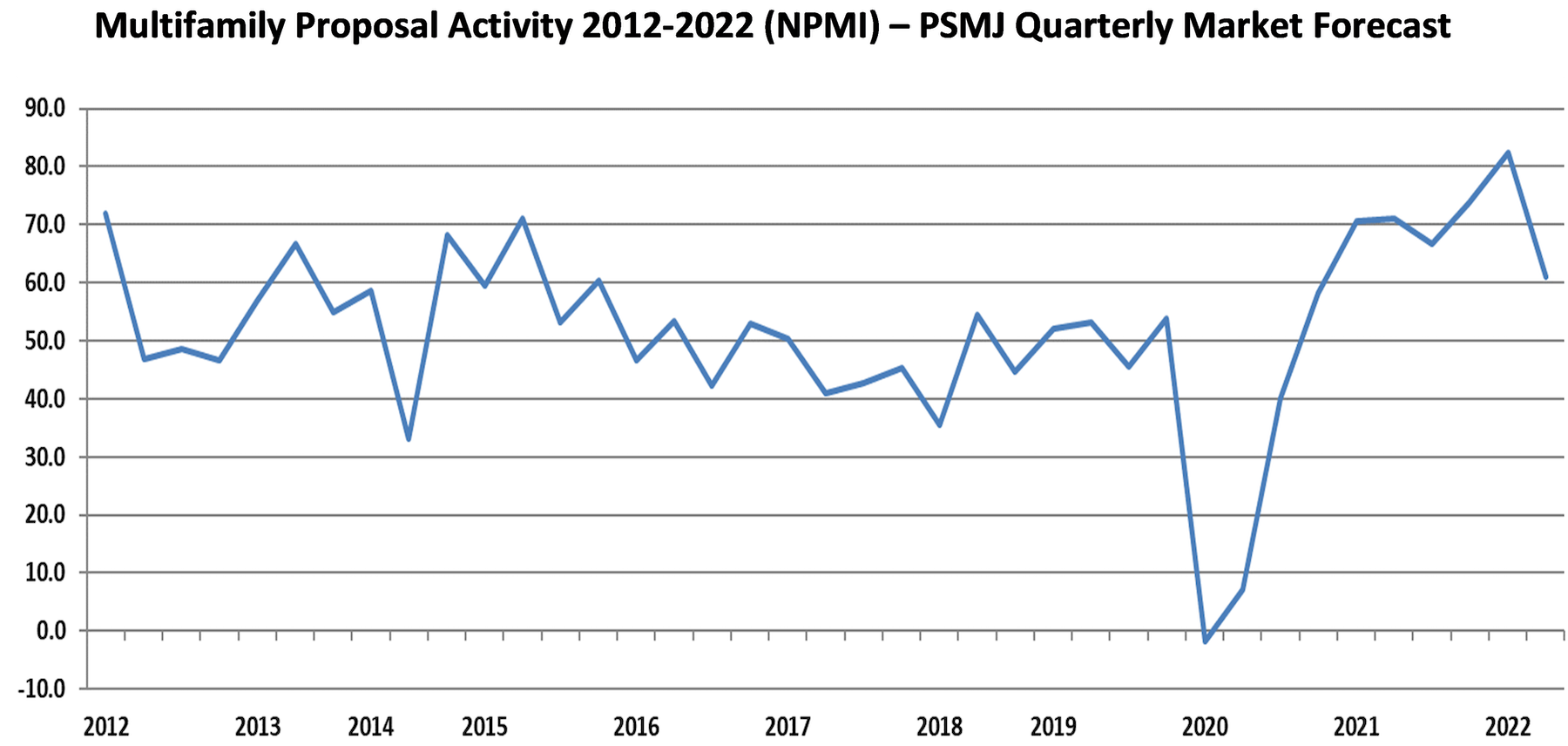

The PSMJ Resources Quarterly Market Forecast (QMF) survey of architects, engineers and contractors reinforces this view. While more than two-thirds (67.2%) of the firm leaders surveyed said that proposal activity in the multifamily market increased from the 1st Quarter of 2022, only 6.3% reported a decline. The resulting net plus/minus index (NPMI) of 60.9 – which is the delta between the percentage of respondents seeing a rise and fall in proposal activity – is down from the record-setting 1st Quarter NPMI of 82.4, but is still among the best quarters since PSMJ began measuring proposal opportunities in submarkets in 2006.

PSMJ Director and Senior Consultant David Burstein, PE, acknowledges the current strength of the entire housing market, but expects a turnaround in the not-too-distant future, albeit a minor to moderate one. “The housing market, including multifamily housing, has been red hot. But it may be on the verge of cooling off a bit,” he says. “A recent analysis by CNBC indicated that the average mortgage payments for a house purchased in 2019 was $1,192 per month. With the increase in home prices and interest rates, the mortgage on that same house is now $1,991 – an increase of almost $800 per month. Wages have gone up since 2019, but they haven’t gone up enough to account for that difference in mortgage costs. The net result will be fewer families able to afford a new home.”

This will have an impact on multifamily as well, adds Burstein. “The increase in interest rates also affects developers’ ability to finance new multifamily rental buildings. And the Fed has indicated that they aren’t close to topping out on their rate increases. So I expect the pace of new multifamily to slow significantly in the next few months. And those projects that do move forward will probably be for lower-cost properties.”

To Burstein’s point, the National Association of Home Builders (NAHB) Multifamily Market Survey weakened in the 1st Quarter of 2022 (the latest figures available), with confidence in market-rate rentals and for-sale apartments sliding. Only lower-rent properties supported by government programs showed a small increase in confidence among the builders responding to the survey.

Despite this caution, the forward-looking QMF survey also anticipates relatively healthy futures for two other multifamily submarkets it measures – condominiums and senior/assisted living.

Condominiums recorded an NPMI of 47.9 in the 2nd Quarter of 2022, its second-highest reading ever. Only the 2nd Quarter of 2021, when condos scored an NPMI of 59.2, was better. More than 54% of respondents working in the condo market saw higher proposal activity in the 1st Quarter, compared with about 6% that saw a decrease.

Proposal opportunities in senior/assisted living facilities also impressed, recording an NPMI of 58.8 – 62.7% saw an increase in activity, while only 3.9% reported a decline.

PSMJ has been conducting the Quarterly Market Forecast survey of its members since 2003. The A/E/C consulting and publishing company chose proposal activity as the basis for its QMF because it represents the earliest stage of the project lifecycle. For more information, go to https://www.psmj.com.

Related Stories

Modular Building | Jan 26, 2021

Offsite manufacturing startup iBUILT positions itself to reduce commercial developers’ risks

iBUILT plans to double its production capacity this year, and usher in more technology and automation to the delivery process.

Multifamily Housing | Jan 26, 2021

Merriman Anderson/Architects designs affordable housing complex out of shipping containers

The architect partnered with CitySquare Housing on the project.

Multifamily Housing | Jan 20, 2021

Abandoned Miami hospital gets third life as waterfront condo development

The 1920s King Cole Hotel becomes the Ritz-Carlton Residences Miami in the largest residential adaptive reuse project in South Florida.

Multifamily Housing | Jan 19, 2021

$100 million affordable housing development under construction in Santa Clara

KTGY Architecture + Planning is designing the project.

Multifamily Housing | Jan 14, 2021

The Weekly show, Jan 14, 2021: Passive House innovations, and launching a design studio during the pandemic

This week on The Weekly show, BD+C editors speak with AEC industry leaders about innovations in Passive House design, and the challenges of building a design team and opening a new design studio during a pandemic.

Multifamily Housing | Jan 11, 2021

McHugh Construction completes 5th-tallest all-residential building in the U.S.

McHugh Construction Completes Two Chicago Apartment Projects for Fifield Cos. and Crescent Heights, Including NEMA Chicago –Tallest All-Residential Building in Chicago and 5th Tallest in North Americ

Multifamily Housing | Jan 8, 2021

Student housing development in the time of COVID-19

Despite the coronavirus pandemic, many college and university residences were completed in time for classes, live or virtual. Here are 14 of the best.

Multifamily Housing | Dec 29, 2020

Sarah’s Circle supportive housing facility for women completes in Chicago

Perkins+Will designed the project.

Market Data | Dec 29, 2020

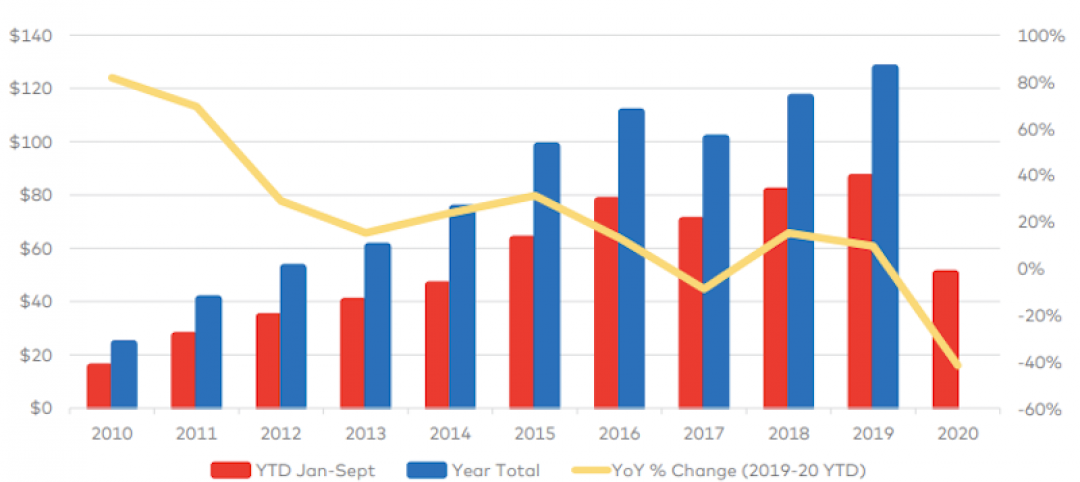

Multifamily transactions drop sharply in 2020, according to special report from Yardi Matrix

Sales completions at end of Q3 were down over 41 percent from the same period a year ago.