The brief downturn in the Multifamily-for-Rent market outlook is clearly over as PSMJ’s forward-looking proposal activity metric reached its highest level for the sector in nearly two years. Proposal activity in the 4th Quarter, as measured by PSMJ’s Net Plus/Minus Index, climbed to 58% in the 4th Quarter, up from 40% in the 3rd Quarter. This is the sector’s highest NPMI since it hit 76% in the 1st Quarter of 2018, according to PSMJ Resources’ Quarterly Market Forecast (QMF). Multifamily had plummeted to -2% and +7%, respectively, in the first two quarters of 2020, coming off a 4th Quarter 2019 NPMI of 54%. Its 1st Quarter 2020 performance was its lowest in almost a decade.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the turnaround in the Multifamily-for-Rent and Condominium markets are part of an overall upward trend for all Housing markets. “The significant turnaround in both of these multifamily markets are attributable to an increase in personal savings resulting from the government’s stimulus checks as well as significant movement of many people from cities to suburbs – which is shifting the location of the demand,” he said. “So we believe the Multifamily market will continue to be strong into the foreseeable future.”

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the architecture and engineering (A/E) industry since its inception in 2003. A consistent group of over 300 A/E firm leaders participate regularly, with 132 contributing to the most recent survey.

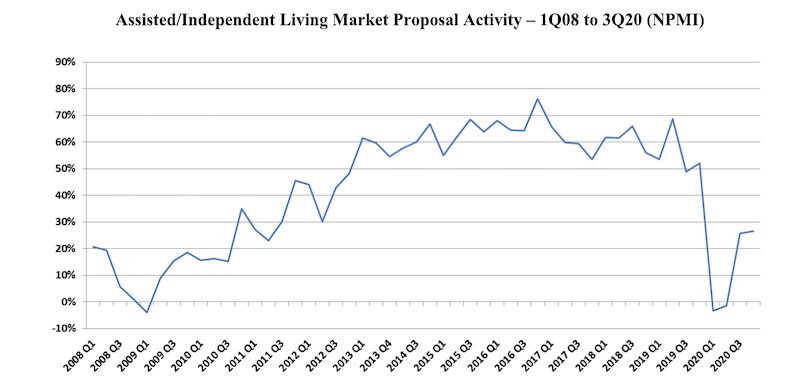

The Condominium and Assisted/Independent Living markets also continued their rebound. Condos’ NPMI crept up to 15% from 11% in the 3rd Quarter, off dismal results in the 1st (-28%) and 2nd (-26%) quarters. The 4th Quarter performance for Condos was still off from the 22% it recorded in the 4th Quarter of 2019. Similarly, Assisted/Independent Living showed minor improvement in the 4th Quarter (up from 26% to 27%, quarter over quarter) and down from the 52% the survey reported for the sector a year ago. It was also negative in the 1st (-3%) and 2nd (-1%) quarters of 2020.

The two other Housing markets measured in the PSMJ survey also show long-term promise for design and construction activity, according to the QMF. Single-Family Homes (59%) and Single-Family Subdivisions (51%) both reached their highest NPMI since PSMJ began collecting survey data for submarkets in 2006.

Among the 12 major markets surveyed, Energy/Utilities unseated Housing with an NPMI of 47%, though Housing’s runner-up NPMI of 43% was an improvement from 38% in the 3rd Quarter. Water/Wastewater, another stand-out during COVID, slipped to 6th among the 12 markets measured. Its NPMI of 23% is down from 37% the prior quarter. Healthcare’s outlook remained steady at 35% (up from 30%), as did Light Industry (35%, up from 27%). Heavy Industry had the greatest gain, rocketing to 32% from 0% due to strong scores in Product Manufacturing (40%) and Pharmaceutical Production (35%).

Proposal activity for Education projects trailed again at -29%, though it improved from -37%. Commercial Users (-29%, up from -31%) and Commercial Developers (-13% up from -23%) rounded out the dozen.

PSMJ Resources, a consulting and publishing company dedicated to the A/E industry, has conducted its Quarterly Market Forecast for more than 17 years. It includes data on 12 major markets and 58 submarkets served by A/E firms. For more information, go to https://www.psmj.com/surveys/quarterly-market-forecast-2.

Related Stories

Market Data | Jun 16, 2021

Construction input prices rise 4.6% in May; softwood lumber prices up 154% from a year ago

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span.

Market Data | Jun 16, 2021

Producer prices for construction materials and services jump 24% over 12 months

The 24.3% increase in prices for materials used in construction from May 2020 to last month was nearly twice as great as in any previous year

Market Data | Jun 15, 2021

ABC’s Construction Backlog inches higher in May

Materials and labor shortages suppress contractor confidence.

Market Data | Jun 11, 2021

The countries with the most green buildings

As the country that set up the LEED initiative, the US is a natural leader in constructing green buildings.

Market Data | Jun 7, 2021

Construction employment slips by 20,000 in May

Seasonally adjusted construction employment in May totaled 7,423,000.

Market Data | Jun 2, 2021

Construction employment in April lags pre-covid February 2020 level in 107 metro areas

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 14-month construction job losses.

Market Data | Jun 1, 2021

Nonresidential construction spending decreases 0.5% in April

Spending was down on a monthly basis in nine of 16 nonresidential subcategories.

Market Data | Jun 1, 2021

Nonresidential construction outlays drop in April to two-year low

Public and private work declines amid supply-chain woes, soaring costs.

Market Data | May 24, 2021

Construction employment in April remains below pre-pandemic peak in 36 states and D.C.

Texas and Louisiana have worst job losses since February 2020, while Utah and Idaho are the top gainers.

Market Data | May 19, 2021

Design activity strongly increases

Demand signals construction is recovering.