The brief downturn in the Multifamily-for-Rent market outlook is clearly over as PSMJ’s forward-looking proposal activity metric reached its highest level for the sector in nearly two years. Proposal activity in the 4th Quarter, as measured by PSMJ’s Net Plus/Minus Index, climbed to 58% in the 4th Quarter, up from 40% in the 3rd Quarter. This is the sector’s highest NPMI since it hit 76% in the 1st Quarter of 2018, according to PSMJ Resources’ Quarterly Market Forecast (QMF). Multifamily had plummeted to -2% and +7%, respectively, in the first two quarters of 2020, coming off a 4th Quarter 2019 NPMI of 54%. Its 1st Quarter 2020 performance was its lowest in almost a decade.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the turnaround in the Multifamily-for-Rent and Condominium markets are part of an overall upward trend for all Housing markets. “The significant turnaround in both of these multifamily markets are attributable to an increase in personal savings resulting from the government’s stimulus checks as well as significant movement of many people from cities to suburbs – which is shifting the location of the demand,” he said. “So we believe the Multifamily market will continue to be strong into the foreseeable future.”

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the architecture and engineering (A/E) industry since its inception in 2003. A consistent group of over 300 A/E firm leaders participate regularly, with 132 contributing to the most recent survey.

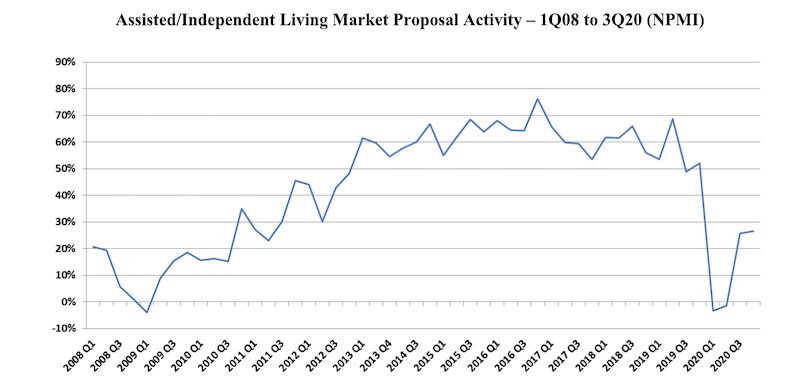

The Condominium and Assisted/Independent Living markets also continued their rebound. Condos’ NPMI crept up to 15% from 11% in the 3rd Quarter, off dismal results in the 1st (-28%) and 2nd (-26%) quarters. The 4th Quarter performance for Condos was still off from the 22% it recorded in the 4th Quarter of 2019. Similarly, Assisted/Independent Living showed minor improvement in the 4th Quarter (up from 26% to 27%, quarter over quarter) and down from the 52% the survey reported for the sector a year ago. It was also negative in the 1st (-3%) and 2nd (-1%) quarters of 2020.

The two other Housing markets measured in the PSMJ survey also show long-term promise for design and construction activity, according to the QMF. Single-Family Homes (59%) and Single-Family Subdivisions (51%) both reached their highest NPMI since PSMJ began collecting survey data for submarkets in 2006.

Among the 12 major markets surveyed, Energy/Utilities unseated Housing with an NPMI of 47%, though Housing’s runner-up NPMI of 43% was an improvement from 38% in the 3rd Quarter. Water/Wastewater, another stand-out during COVID, slipped to 6th among the 12 markets measured. Its NPMI of 23% is down from 37% the prior quarter. Healthcare’s outlook remained steady at 35% (up from 30%), as did Light Industry (35%, up from 27%). Heavy Industry had the greatest gain, rocketing to 32% from 0% due to strong scores in Product Manufacturing (40%) and Pharmaceutical Production (35%).

Proposal activity for Education projects trailed again at -29%, though it improved from -37%. Commercial Users (-29%, up from -31%) and Commercial Developers (-13% up from -23%) rounded out the dozen.

PSMJ Resources, a consulting and publishing company dedicated to the A/E industry, has conducted its Quarterly Market Forecast for more than 17 years. It includes data on 12 major markets and 58 submarkets served by A/E firms. For more information, go to https://www.psmj.com/surveys/quarterly-market-forecast-2.

Related Stories

Market Data | Nov 2, 2018

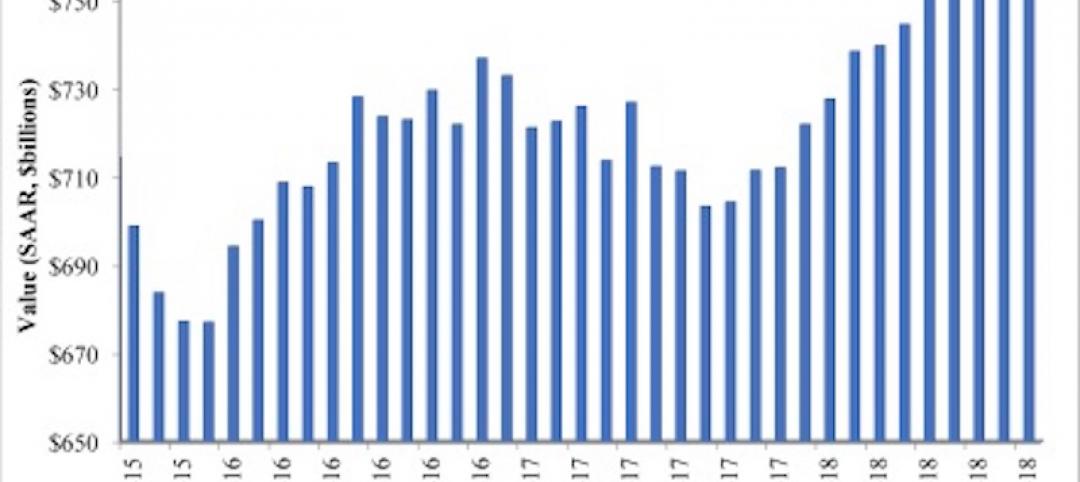

Nonresidential spending retains momentum in September, up 8.9% year over year

Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September.

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

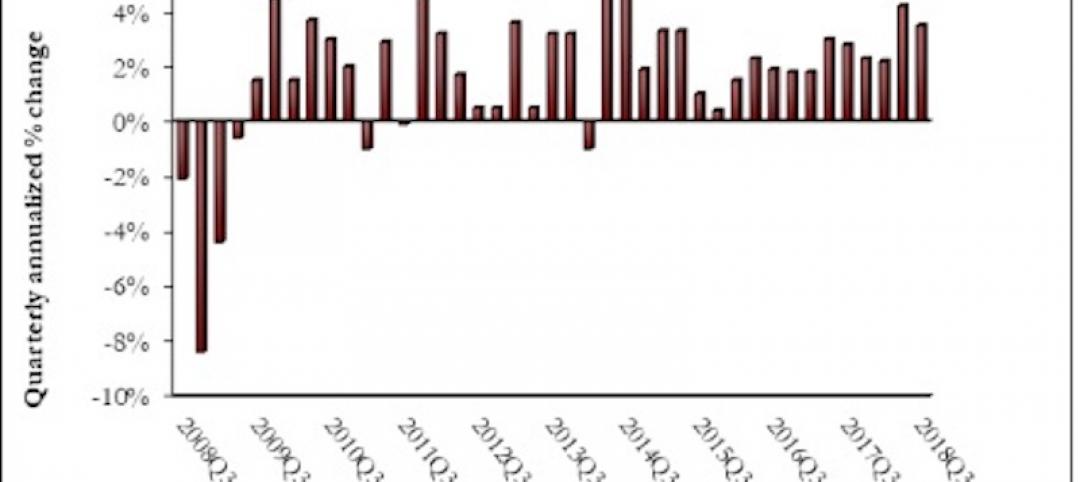

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

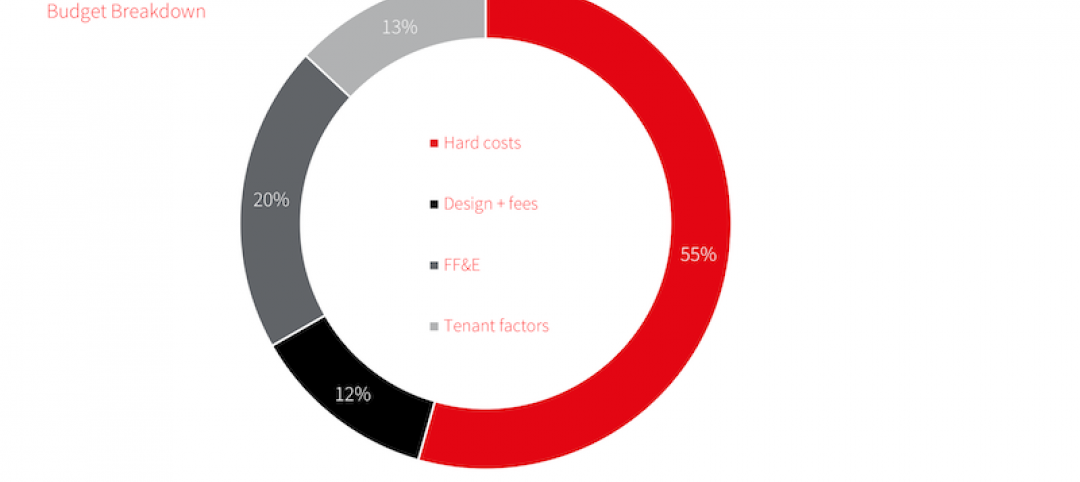

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.