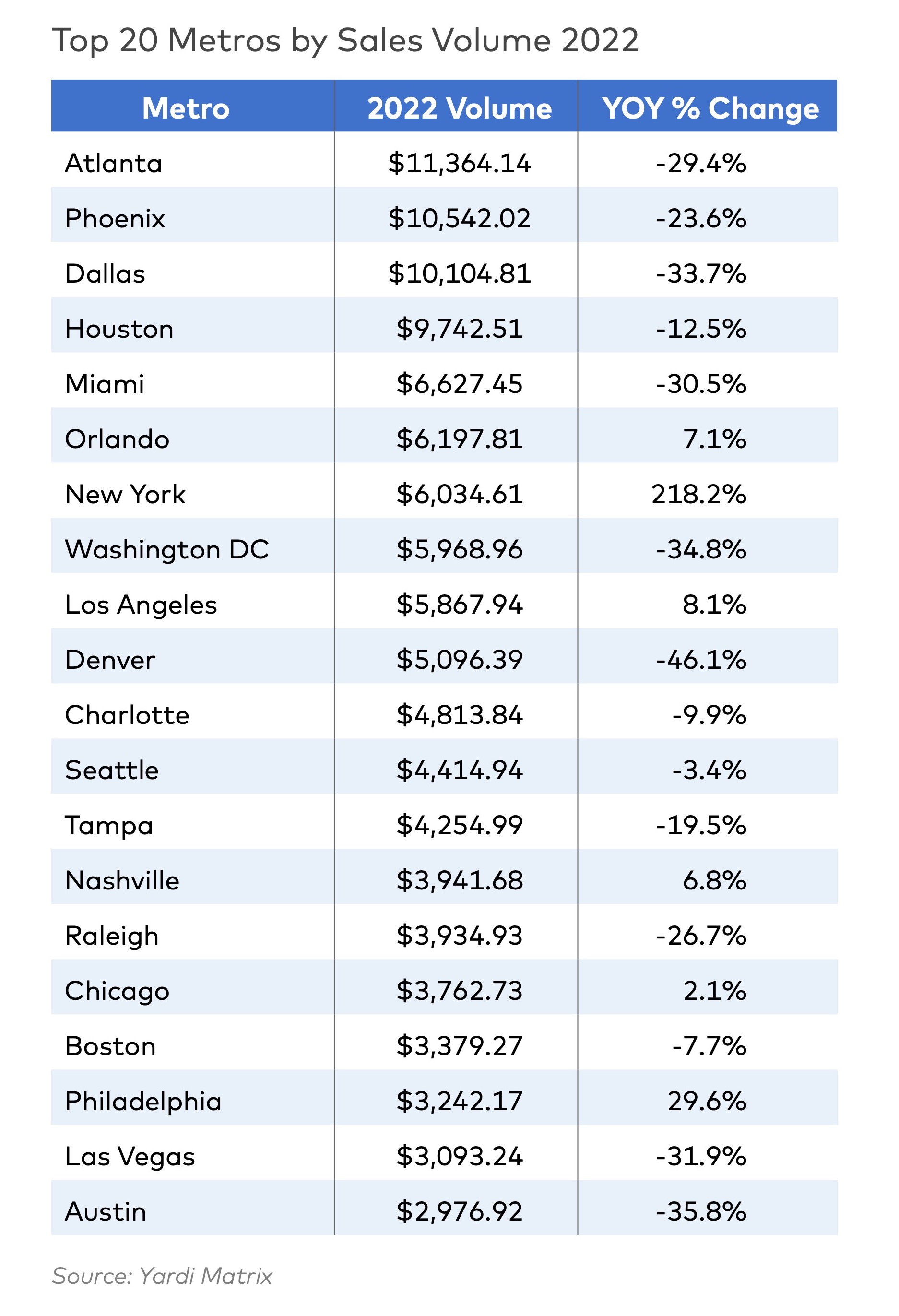

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

| May 27, 2014

America's oldest federal public housing development gets a facelift

First opened in 1940, South Boston's Old Colony housing project had become a symbol of poor housing conditions. Now the revamped neighborhood serves as a national model for sustainable, affordable multifamily design.

| May 23, 2014

Big design, small package: AIA Chicago names 2014 Small Project Awards winners

Winning projects include an events center for Mies van der Rohe's landmark Farnsworth House and a new boathouse along the Chicago river.

| May 22, 2014

No time for a trip to Dubai? Team BlackSheep's drone flyover gives a bird's eye view [video]

Team BlackSheep—devotees of filmmaking with drones—has posted a fun video that takes viewers high over the city for spectacular vistas of a modern architectural showcase.

| May 22, 2014

NYC's High Line connects string of high-profile condo projects

The High Line, New York City's elevated park created from a conversion of rail lines, is the organizing principle for a series of luxury condo buildings designed by big names in architecture.

| May 20, 2014

Kinetic Architecture: New book explores innovations in active façades

The book, co-authored by Arup's Russell Fortmeyer, illustrates the various ways architects, consultants, and engineers approach energy and comfort by manipulating air, water, and light through the layers of passive and active building envelope systems.

| May 20, 2014

World's best new skyscrapers: Renzo Piano's The Shard, China's 'doughnut hotel' voted to Emporis list

Eight other high-rise projects were named Emporis Skyscraper Award winners, including DC Tower 1 by Dominique Perrault Architecture and Tour Carpe Diem by Robert A.M. Stern.

| May 16, 2014

BoA, USGBC to offer $25,000 grants for green affordable housing projects

The Affordable Green Neighborhoods Grant Program will offer 14 grants to developers of affordable housing in North America who are committed to building sustainable communities through the LEED for Neighborhood Development program.

| May 13, 2014

19 industry groups team to promote resilient planning and building materials

The industry associations, with more than 700,000 members generating almost $1 trillion in GDP, have issued a joint statement on resilience, pushing design and building solutions for disaster mitigation.

| May 12, 2014

The best of affordable housing: 4 projects honored with 2014 AIA/HUD Secretary Awards [slideshow]

The winners include two dramatic conversions of historic YMCA buildings into modern, affordable multifamily complexes.

| May 11, 2014

Final call for entries: 2014 Giants 300 survey

BD+C's 2014 Giants 300 survey forms are due Wednesday, May 21. Survey results will be published in our July 2014 issue. The annual Giants 300 Report ranks the top AEC firms in commercial construction, by revenue.