Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

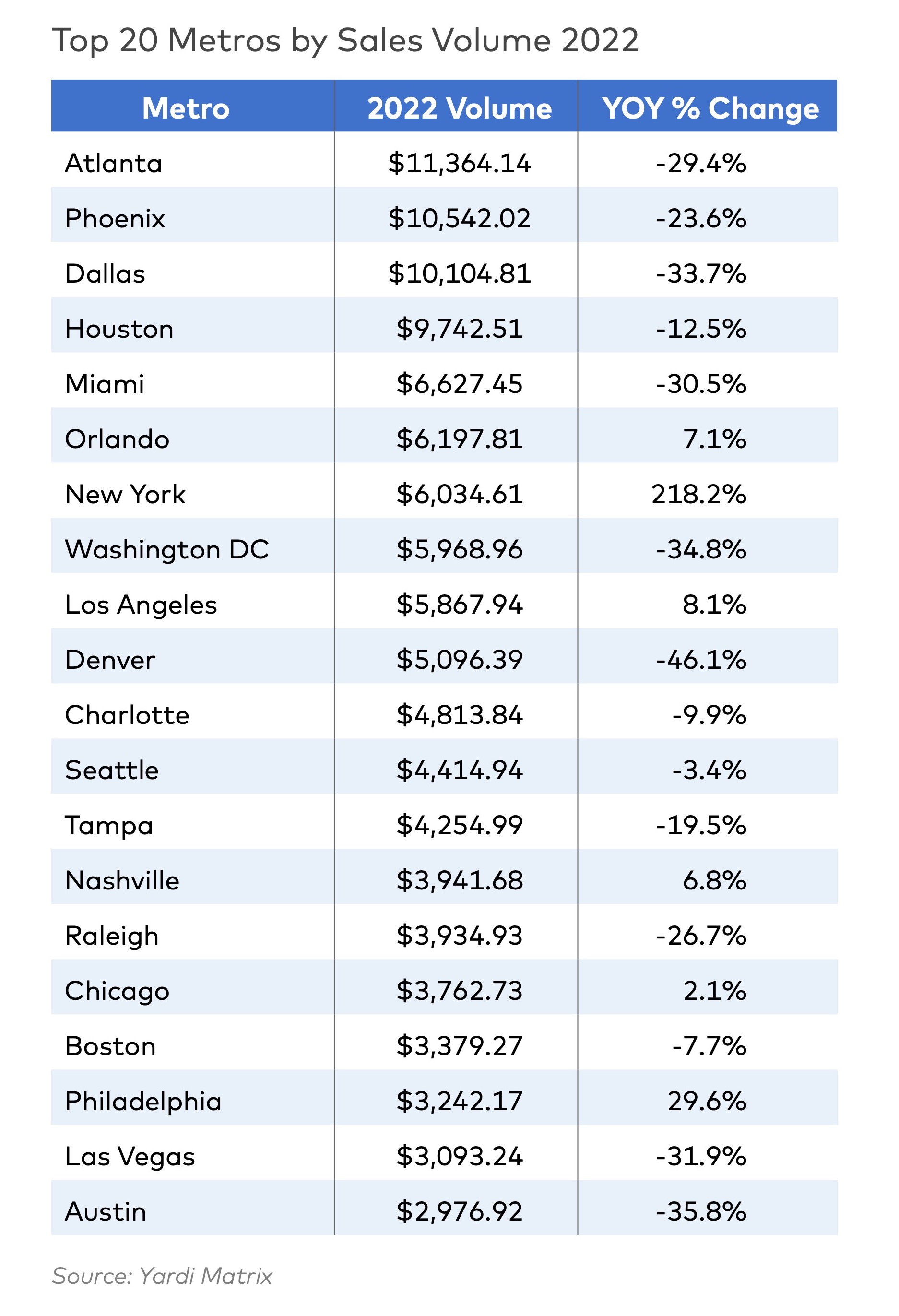

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.

Sponsored | BD+C University Course | Jan 17, 2024

Waterproofing deep foundations for new construction

This continuing education course, by Walter P Moore's Amos Chan, P.E., BECxP, CxA+BE, covers design considerations for below-grade waterproofing for new construction, the types of below-grade systems available, and specific concerns associated with waterproofing deep foundations.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Adaptive Reuse | Jan 12, 2024

Office-to-residential conversions put pressure on curbside management and parking

With many office and commercial buildings being converted to residential use, two important issues—curbside management and parking—are sometimes not given their due attention. Cities need to assess how vehicle storage, bike and bus lanes, and drop-off zones in front of buildings may need to change because of office-to-residential conversions.

MFPRO+ News | Jan 12, 2024

Detroit may tax land more than buildings to spur development of vacant sites

The City of Detroit is considering a revamp of how it taxes property to encourage development of more vacant lots. The land-value tax has rarely been tried in the U.S., but versions of it have been adopted in many other countries.

MFPRO+ News | Jan 12, 2024

As demand rises for EV chargers at multifamily housing properties, options and incentives multiply

As electric vehicle sales continue to increase, more renters are looking for apartments that offer charging options.

Sustainability | Jan 10, 2024

New passive house partnership allows lower cost financing for developers

The new partnership between PACE Equity and Phius allows commercial passive house projects to be automatically eligible for CIRRUS Low Carbon financing.

Giants 400 | Jan 8, 2024

Top 60 Senior Living Facility Construction Firms for 2023

Whiting-Turner, Ryan Companies US, Weis Builders, Suffolk Construction, and W.E. O'Neil Construction top BD+C's ranking of the nation's largest senior living facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 40 Senior Living Facility Engineering Firms for 2023

Kimley-Horn, Olsson, Tetra Tech, EXP, and IMEG head BD+C's ranking of the nation's largest senior living facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 80 Senior Living Facility Architecture Firms for 2023

Perkins Eastman, Hord Coplan Macht, Lantz-Boggio Architects, Ryan Companies US, and Moseley Architects top BD+C's ranking of the nation's largest senior living facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.