Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

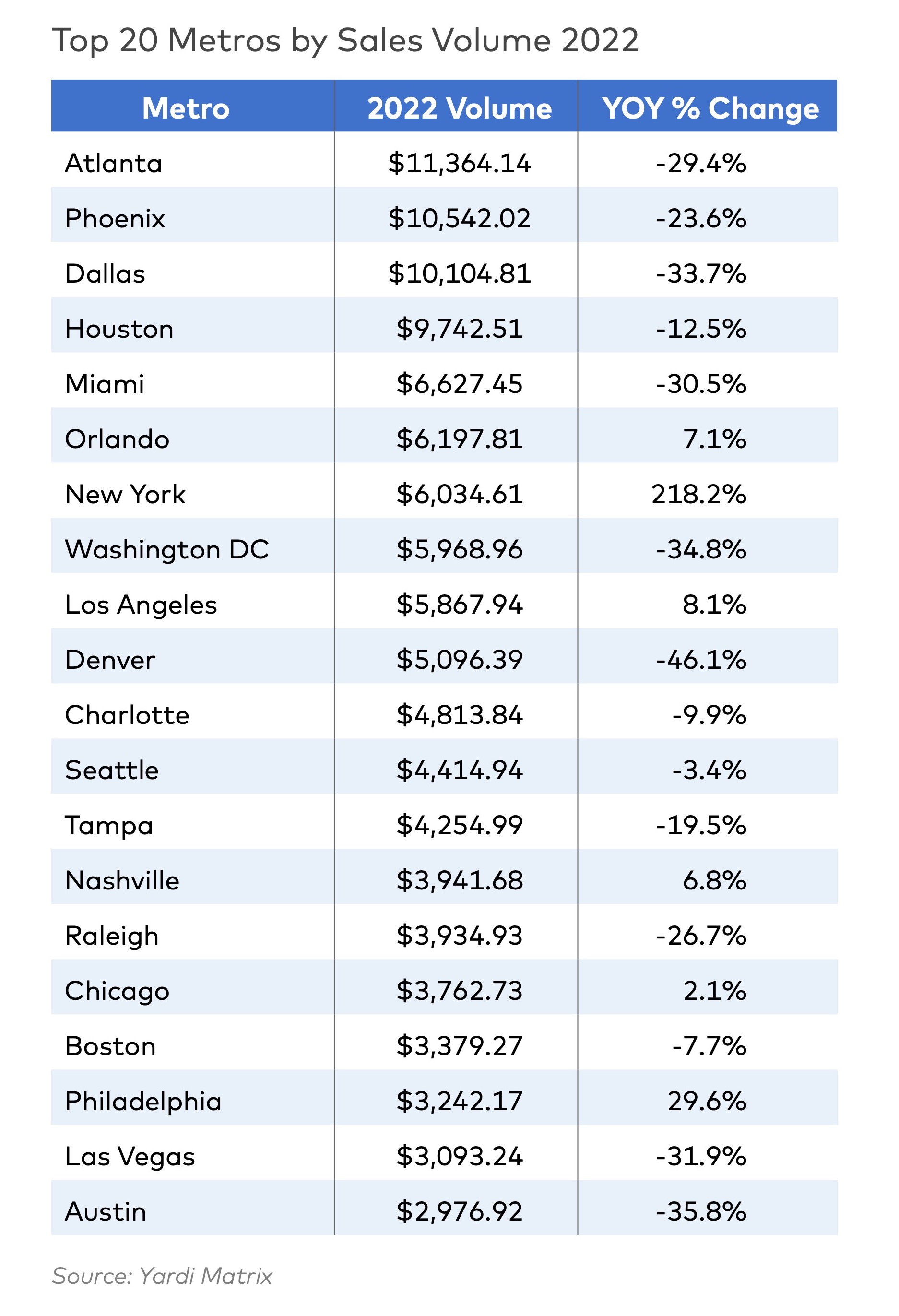

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Projects | Mar 18, 2022

Former department store transformed into 1 million sf mixed-use complex

Sibley Square, a giant mixed-use complex project that transformed a nearly derelict former department store was recently completed in Rochester, N.Y.

Multifamily Housing | Mar 15, 2022

Multifamily rents climbed 15.4 percent in one year

Multifamily asking rents picked up another $10 in February to reach a national average $1,628, and year-over-year growth recorded a 15.4 percent bump, according to the new Yardi Matrix Multifamily National Report.

Multifamily Housing | Mar 15, 2022

A 42-story tower envelops residents in Vancouver’s natural beauty

The city of Vancouver is world-renowned for the stunning nature that surrounds it: water, beaches, mountains. A 42-story tower, Fifteen Fifteen, will envelop residents in that natural beauty.

Multifamily Housing | Mar 15, 2022

Hermosa Village earns 2021 NAHB Best in American Living Award

Cadence McShane Construction Company received first place in this year's NAHB Best in American Living Award for its Hermosa Village project.

Projects | Mar 11, 2022

Suffolk completes construction of luxury condominium 2000 Ocean

The 38-story glass-encased tower along the beach on 1.3 acres is owned by KAR Properties and designed by TEN Arquitectos.

Projects | Mar 9, 2022

New 243-unit luxury apartment community opens in St. Paul, Minn.

Waterford Bay, a four-story, 243-unit luxury multifamily development recently opened in St. Paul, Minn.

Mass Timber | Mar 8, 2022

Heavy timber office and boutique residential building breaks ground in Austin

T3 Eastside, a heavy timber office and boutique residential building, recently broke ground in Austin, Texas.

Multifamily Housing | Mar 4, 2022

221,000 renters identify what they want in multifamily housing, post-Covid-19

Fresh data from the 2022 NMHC/Grace Hill Renter Preferences Survey shows how remote work is impacting renters' wants and needs in apartment developments.

Projects | Mar 2, 2022

Manufacturing plant gets second life as a mixed-use development

Wire Park, a mixed-use development being built near Athens, Ga., will feature 130 residential units plus 225,000 square feet of commercial, office, and retail space. About an hour east of downtown Atlanta, the 66-acre development also will boast expansive public greenspace.

Multifamily Housing | Feb 25, 2022

First set of multifamily properties achieve BREEAM certification in the U.S.

WashREIT says it has achieved certification on eight multifamily assets under BREEAM’s In-Use certification standard.