Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

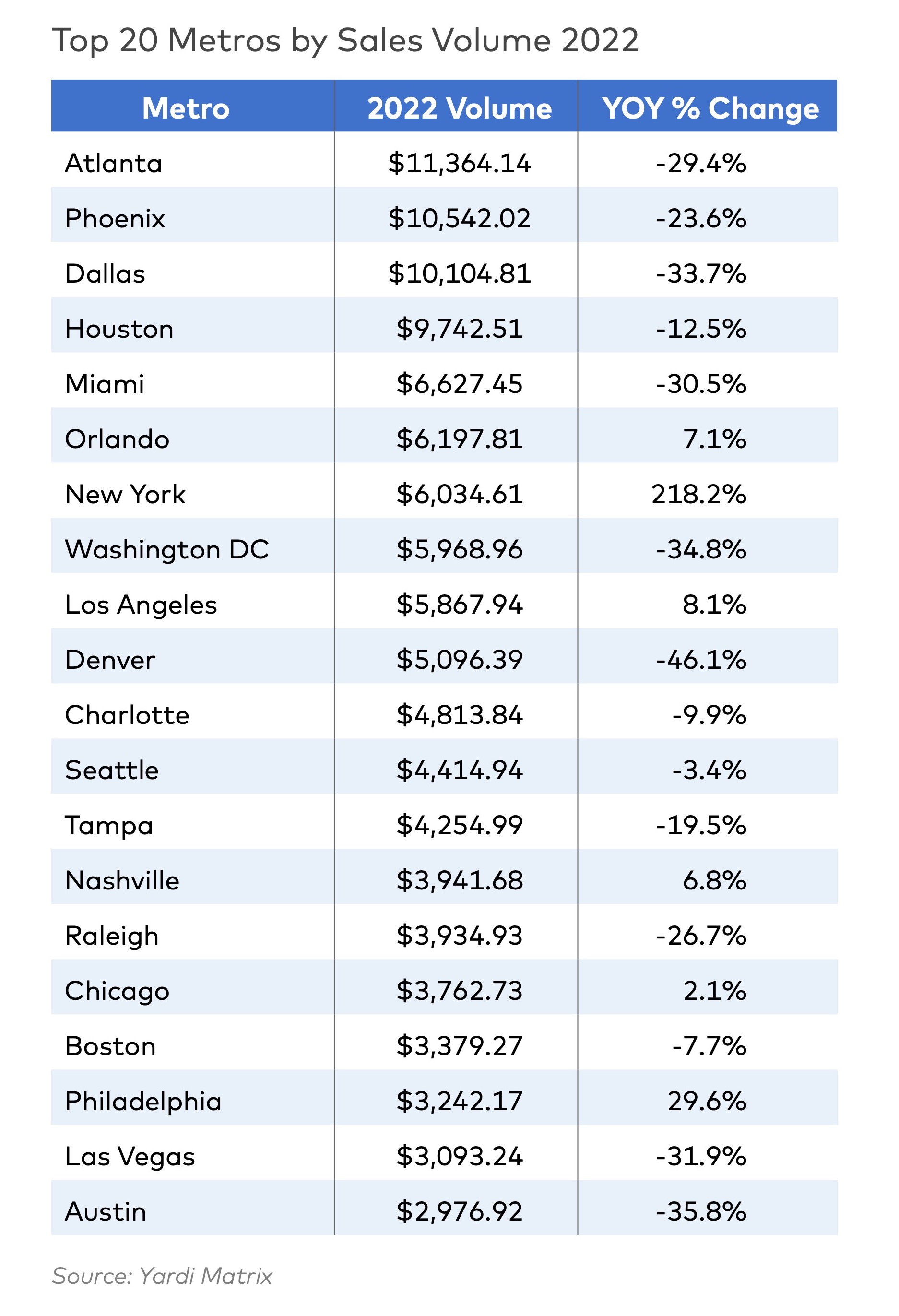

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Multifamily Housing | Dec 4, 2019

9 tips on creating places of respite and reflection

We talked to six veteran landscape architects about how to incorporate gardens and quiet spaces into multifamily communities.

| Nov 20, 2019

ClosetMaid to celebrate 55 years in business at the 2020 NAHB International Builders Show

Company to celebrate 55 years in storage and organization with a visit by celebrity guest Anthony Carrino.

Multifamily Housing | Nov 20, 2019

Over 400 micro units spread across two communities under development in Austin

Transwestern is developing the projects.

Multifamily Housing | Nov 14, 2019

U.S. multifamily market stays strong into 4th quarter 2019

October performance sets a record amid rising political pressure to cap rent growth, reports Yardi Matrix.

Multifamily Housing | Nov 8, 2019

The Peloton Wars, Part III - More alternatives for apartment building owners

ProForm Studio Bike Pro review.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

| Nov 6, 2019

Solomon Cordwell Buenz opens Seattle office, headed by Nolan Sit

National design firm brings residential high-rise expertise to the Pacific Northwest

| Nov 6, 2019

Passive House senior high-rise uses structural thermal breaks to insulate steel penetrations

Built to International Passive House standards, the Corona Senior Residence in Queens, N.Y., prevents thermal bridging between interior and exterior steel structures by insulating canopies and rooftop supports where they penetrate the building envelope.